Many Americans are carrying more than $10,000 in revolving credit card debt, some with an APR of over 20%. But while the idea of putting a more reasonable ceiling on these rates might seem like a way to help get these folks out of debt and back in the black, some say it would likely have no positive effect on the economy at large. [More]

credit cards

American Shoppers Are Back To Using Their Credit Cards

When the economy jumped head-first into a drained pool in 2008, many American shoppers turned away from using their credit cards to make purchases, instead opting to use debit cards and cash. But during the last six months, the numbers show that we’ve returned to pressing the “credit” button at the checkout line. [More]

Banks Pull Credit Card Tricks To Lure Consumers Back Into Spending More Money

Now that recession-weary consumers have been shedding debt, banks are doing their best to convince you to get that spending back up. Somewhat tricky moves from various credit card companies could result in a high balance if you’re not careful. [More]

Visa Launching PayPal-Like V.me Service Next Year

Visa will roll out its V.me online payment service early next year. The company, which announced plans for the service in March, has also launched a developer program to help merchants incorporate its payment systems into their web sites and other products. [More]

Wells Fargo Tries To Predict The Future, Sucks At It

A few months before her wedding, Megan bought her bridesmaids’ dresses at J. Crew, and opened a store credit card account to get 20% off. She scheduled a payment through her bank, Wells Fargo, to pay off the balance, then panicked weeks later when she saw a large chunk of money leaving her bank account that she didn’t remember authorizing. She called to cancel, remembered what the payment was for, then canceled the cancellation. This led Wells Fargo’s fraud-flagging systems to believe that the next time Megan opened a store credit card and paid the bill, they should just go ahead and cancel the payment. [More]

Salvation Army Bell Ringers Will Accept Credit Card Payments With Their Smart Phones

The Salvation Army has announced that they are testing Square, a service that allows a smart phone to accept credit card payments. The test will take place at 40 locations in Dallas, San Francisco, Chicago and New York. Previous attempts at accepting credit cards weren’t successful, but the Army is feeling optimistic that consumers will adopt this new way of paying. [More]

Steam Database Hacked

The popular online video game distribution system Steam was hacked and a database containing user names, passwords, user credit card information was compromised. [More]

BofA Charges Man $39.23 On A $0 Balance

Bank of America charged Roger $39.23 in interest on his credit card, even though he had a zero balance. How could that be? [More]

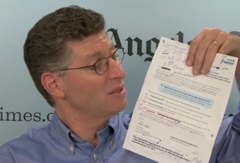

Proponent Of Costing Banks More Money By Mailing Back Weighted Business Reply Envelopes Defends His Cause

Earlier this week I wrote about a viral video that promised you could “Keep Wall Street Occupied” by sending back credit card business reply envelopes stuffed with anti-corporate messages and wooden shims. The video said this would increase mailing costs for the banks and force them to engage in a dialogue with their customers. Responding to my review where I called this idea “terrible,” the video’s maker sent me a note defending his campaign. [More]

Credit Card Bumper Crop Boasts Low Teaser Rates, New Snags

After being such prudes for so long, credit card companies are raising their hemlines and lowering their standards. They’re actively deluging customers with credit card offers and using low teaser rates as a crooked finger. However, they’re also coming with new hidden baggage you need to watch out for, like cash back rewards that are high, but have to be opted in again every few months. [More]

Sending Back Protest Messages In Pre-Paid Credit Card Envelopes Isn't Going To Occupy Wall Street One Bit

A YouTube video has racked up over 300,000 hits promoting the idea that you can really mess with the banks by sending back activist messages in those pre-paid response envelopes that come with the credit card junk mail. The theory is that if enough people do it, it will force people in the bank mailrooms to have a meeting about all these Occupy Wall Street slogans showing up in their mail, and making banks engage in a dialogue with their customers, revolutionizing how they operate to a way that’s more responsive to the common good. This is a terrible idea and a waste of time. [More]

Banana Republic Clerk Misled Me Into Opening Another Credit Card

When Jessica went shopping at Banana Republic last month, she forgot her store credit card. That was OK, the sales clerk assured her: she just needed Jessica’s Social Security number and for her to sign off on the transaction in order to access her existing card data in the system. Most people are so used to having our forgotten store loyalty cards looked up using our phone numbers that this seems natural enough. Only it wasn’t – by providing her SSN and signature, Jessica was actually applying for a Banana Republic Visa card. [More]

What You Need To Know When Transferring Credit Card Balances

Credit card companies like to lure in new customers with impressive-sounding balance transfer officers, but they don’t just do that to be nice. There are usually fine-print catches associated with the deals, and they’ll bite you if you overlook them. [More]

Top 10 States With Highest Debt Per Capita

Are you in a state that has saddled its citizens with a big debt load per person? This list tells you. It may surprise you that the state with the highest debt per capita is also the one with the most penny loafers per capita. [More]

Thief Uses Woman's Credit Card To Rack Up $717 At Same Burger King

It’s not unusual for a credit card thief to charge some outlandish amount to the victim’s card, hoping to score big before setting off alarm bells. But police in Boca Raton, FL, say they are trying to hunt down a criminal who only charged about $14 at Burger King, ever day… for more than 50 days. [More]

People Are Back To Making Late Payments On Their Credit Cards

Two months ago, the number of people making late credit card payments was at its lowest since Justin Bieber was a twinkle in his parents’ eyes. Of course, when you reach a low like that, there is often nowhere to go but up. [More]

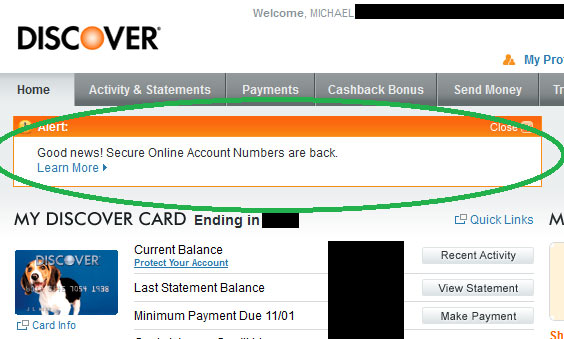

Discover Brings Back Disposable Account Numbers

Without explanation as to why, Discover card is telling customers that they’re bringing back the disposable account numbers they got rid of at the end of August. [More]