We’ve been credit carding it up (yep, it’s a verb) lately and as a result, Americans have collected more credit card debt than we had a year ago during the same time period, according to new figures from a credit reporting agency. But while we’re spending more, we’re not being so good at actually paying off that debt — which makes for a particularly unwinning economic combination. [More]

credit cards

Don’t Get Sucked Into Retailers’ Deferred Interest Trap

You’re probably familiar with “same as cash” credit offers from retail stores, where you aren’t charged any interest so long as the entire purchase is paid off within a given period of time (usually 6 or 12 months). But what many of those stores don’t put in the bold type is what happens if you don’t pay by the deadline. [More]

US Bank Scores Twice In Roundup Of Worst Credit Cards

It’s probably not a banner day for some folks at US Bank, after two of the bank’s credit cards landed top (dis)honors in a roundup of worst credit cards of 2012. [More]

Having Separate Credit Card Accounts From Your Spouse Can Keep You From Being Stranded Abroad

While many couples consolidate their bank and credit card accounts, there is at least one situation where having a separate account from your spouse can save you some huge headaches. [More]

Data Shows Bank Of America Is Also Bad At Dealing With Credit Card Complaints

Earlier this year, the Consumer Financial Protection Bureau launched a complaint portal for people with credit card-related issues. Banks and card companies are not obliged to provide a happy ending to the complainant, but they are obliged to reply in a timely manner. And even with the bar lowered that much, Bank of America still manages to disappoint. [More]

Americans Are More Responsible With Credit Cards Than We’ve Been In A Decade

Times may have been tough on our wallets over the years, but somehow despite a recession and its ensuing after-effects, Americans have become a lot better at making their credit card payments on time. The amount of delinquencies on credit cards issued by banks is at its lowest level since 2001, according to a new report from a banking group. [More]

American Express To Pay Out $85 Million To Customers For Variety Of Consumer Violations

American Express is feeling the sting of an $112.5 million spanking from the Consumer Financial Protection Bureau, following an investigation that found that three subsidiaries of the credit card company had violated several consumer rights, from misleading ads to age discrimination to unlawful late fees. [More]

Survey Says: We Apparently Can Get Some Satisfaction From Credit Cards

Despite the horror stories and the trials and tribulations we endure every day with banks, consumers are still getting some satisfaction (as opposed to no, get it) from our credit cards. In fact, we’re more well pleased with our cards than we have been at any time in the last six years. This sense of contentment seems simply to stem from the fact that banks have settled on terms for the cards stopped hitching up fees. [More]

How Capital One Didn't Send One Bill And Cost Me Thousands Of Dollars

Alyssa had a perfect credit score. Once. Not too long ago. Before Capital One. She has a card for her small business, and made a small charge around the time that her baby was born. She didn’t receive a statement from Capital One, didn’t remember that there was a charge in the fog of new-mom hormones and things to do, and didn’t pay the nonexistent bill. Months of unpaid bills caused a 200-point drop in her credit score, just as she happened to be applying for a mortgage. Now that one unpaid bill she never got will cost her thousands of dollars. [More]

Credit Card Companies Increasingly Using Robo Testimony, Erroneous Documents To Go After Customers In Court

We’ve all learned to fear the robo-signing reaper in home foreclosures, but now that same tactic of providing generic evidence of debt is sweeping the credit card collections world. Judges are calling out credit card issuers on this so-called “robo-testimony” tactic, but if a consumer doesn’t fight back, those robots might win by default. [More]

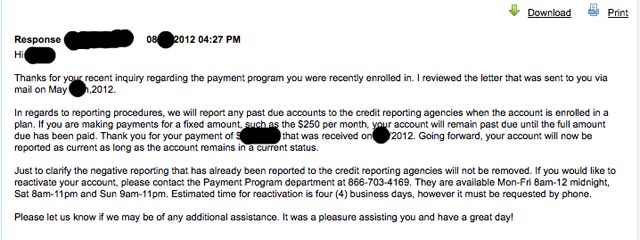

American Express Payment Plans Won't Do Your Credit Any Favors

Ryan was in a tight spot, and late with the payment on his American Express account. The problem didn’t seem as scary as it could have been, though. The company’s Web interface offered him the opportunity to sign up for a payment plan, so he could pay down the outstanding balance over a period of as long as twelve months. Neat! But the plan didn’t quite have the credit-saving effects that he expected. He was reported to credit bureaus as delinquent during the entire repayment period. That’s how the plan works. [More]

HSBC Really Wants Your Cellphone Number To Alert You To Suspicious Activity (Oh, And Also To Make Collections Calls)

According to this post from yesterday, the folks at HSBC’s collections dept. have such a trigger finger on the redial button that they made a list of most-blocked phone numbers. And now we have a pretty good idea where HSBC is getting permission to call up customers’ cellphones. [More]

Chase Ordered To Pay $100M To Credit Card Customers For Boosting Minimum Payments

JPMorgan Chase hit up its customers for some additional cash back in 2008 and 2009 when it raised minimum monthly payments on many of its credit cards from 2% to 5%, and now it seems the tables have turned. As part of a class-action settlement over litigation brought by customers, the bank has agreed to pay $100 million to its cardholders for improperly boosting payments in order to generate higher fees. [More]

Signing Up For Square Is An Eternal Binding Covenant

Zack was interested in the Square mobile credit card reader, which has a wonderfully simple and easy signup process. Much less wonderful is the company’s user agreement, which he didn’t read closely until he had already begun the process of registering for an account. While Square has brought easy credit card payments to the masses, it has also brought a long list of rules that your average craft show vendor or flute teacher isn’t really used to. Uninterested in allowing the company the right to come inspect his business at any time, Zack decided that Square isn’t for him. That’s when he learned about another provision of the user agreement: Square will close your account, but won’t delete it. [More]

Man Sues Strip Club Over Mysterious $50,000 Credit Card Bill

Strip clubs can be an alternate dimension where money vanishes at a faster rate than it does in the outside world. Or so we’ve been told… Ahem… Regardless, a man in Florida says there is no way he spent $50,000 on lap dances and warm cans of beer, and he’s willing to go to court to prove it. [More]

Get Ready To Pay Surcharge Every Time You Pay With Credit Card

Visa and MasterCard know there is nothing that American consumers love more than fees and surcharges. That’s why the credit card companies are reportedly looking to do away with longstanding rules that prohibit merchants from adding on extra costs to customers who pay with credit. [More]

Look, Don’t Post Instagram Photos Of Your Credit Card

If you’ve found your way to this site, you’re probably savvy enough to know that it’s a very, very poor idea to snap cell phone pics of your debit card and post them to the public photo-sharing service Instagram. We would have thought that would be common sense for anyone intelligent enough to own both money and a functioning smartphone. We were wrong. You see, the NeedADebitCard Twitter bot retweets photos that people post publicly online of their credit and debit cards, often with the numbers in full view. It always seems to have fresh material, but those featured do often take their photos down. The rest remain, with names and numbers in full view. [More]