Bob Sullivan at MSNBC—who coincidentally was one of the speakers at our event last night—has published a list of myths and facts about the new credit card bill. His article dispels some of the misinformation that’s out there right now about just what the act does, and what card companies are going to do in retaliation.

credit card reform

Consumerist Interviews Goolsbee On Credit Card Reform: Part 4 of 4

The final installment of our 4-part interview on credit card reform with Austan Goolsbee, President Obama’s senior economic adviser. In this one we say, hey, what about mandatory binding arbitration?

Credit Card Reform Bill Passes With Guts Intact

NYT: It sounds like most of the good stuff stayed in the Senate Credit Card Reform bill:

Senate Passes Credit Card Reform Bill

Hooray! 90-5, the Senate has passed the Credit Card Reform bill. The job now is to iron out the differences between it and the slightly weaker House bill, or for the House to approve the Senate bill. Either way, Obama has asked for legislators to send him a bill by Memorial Day. [Washington Post] (Photo: afagen)

Consumerist Interviews Goolsbee On Credit Card Reform: Part 3 of 4

Are credit cards set up like a horrible game of Chutes & Ladders that plays for keeps? In the 3nd of our 4-part interview series with President Obama’s Senior Economic Adviser, Austan Goolsbee, on credit card reform, we ask why credit card companies can raise the APR on stuff you already charged, and go into some of the credit card companies’ anti-consumer tricks like liquid and fickle terms and conditions, penalty fees that aren’t trying to discourage behavior anymore, they’re just pure profit, and teeny-tiny contracts written in “Bank-o-nese.”

Consumerist Interviews Goolsbee On Credit Card Reform: Part 2 of 4

In the 2nd of our 4-part interview series with President Obama’s Senior Economic Adviser, Austan Goolsbee, on credit card reform, we ask, what about the kids? Specifically, what is this bill going to do about those guys giving away shirts on campus in exchange for signing up for credit cards? Because these seems a really great service for college students, who, as we know, frequently go shirtless. Also, how one side of the debate on credit cards is essentially arguing that if you didn’t want to get carjacked you should have taken the bus… because an honest business model and a profitable one needn’t be mutually exclusive.

Goolsbee Video Fixed

If you had problems viewing the Goolsbee interview, this here video should work for you now. [Consumerist]

Consumerist Interviews Goolsbee On Credit Card Reform: Part 1 of 4

We took your credit card reform questions to DC yesterday and interviewed Austan Goolsbee, senior economic adviser to President Obama. In part 1 of our 4-part series, we ask how are banks getting billions in bailouts and can turn around and cut off millions of credit cards and raise rates? How does it make sense that credit card companies can raise the interest rate on an existing balance? And, most importantly, why don’t we treat credit cards more like Canadians do cigarettes?

Consumerist Interviews Goolsbee About Credit Card Reform: Part 1 of 4

We took your credit card reform questions to DC yesterday and interviewed Austan Goolsbee, senior economic adviser to President Obama. In part 1 of our 4-part series, we ask how are banks getting billions in bailouts and can turn around and cut off millions of credit cards and raise rates? How does it make sense that credit card companies can raise the interest rate on an existing balance? And, most importantly, why don’t we treat credit cards more like Canadians do cigarettes?

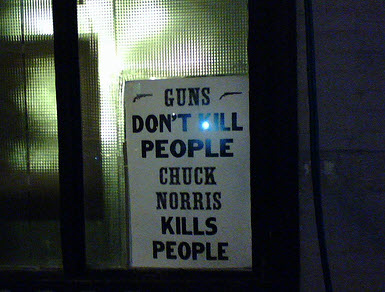

Credit Card Reform And Guns Are The New Peanut Butter And Jelly

If the government decides to reform the credit card industry, you may be able to celebrate by bringing a gun into Yellowstone National Park and firing some celebratory shots into the air.

Your Visa Gift Card Will Self-Destruct If Used Within 24 Hours

Stephanie bought a $100 Vanilla Visa gift card at her local CVS in Richmond, VA. She went right home and tried to use it to make some purchases online. When the card was declined, she studied the fine print that came with the card: “Funds may not be available for 24 hours after purchase.” So she waited the 24 hours and tried it again the next day. Still no luck. When she called the customer service number she was told to go back to CVS. At CVS, a manager told Stephanie (and apparently many others before her) that by using the card within 24 hours she had rendered her card agreement invalid. Bang, there goes $100.

Liveblog Transcript From Obama's Credit Card Reform Town Hall

Our fearless co-leader Ben just sent us this link from the Consumerist Washington delegation. The New Mexico Independent sent a reporter to liveblog today’s credit card reform town hall meeting at a high school in Rio Rancho, NM. The transcript includes comments and questions from readers, and also comments from national and regional consumer advocates.

Credit Card Reform Act Could Let You Pay Less If You Use Cash Or Debit

A Wall Street Journal story highlights one potential amendment to credit card reform legislation, which could allow vendors to charge different prices depending on how you make your purchase. Under the Durbin-Bond amendment, if you pay with a credit card, you’ll also have to fork over the fee the business will have to pay for accepting your transaction that way. Pay by cash or debit card and you’d get a discount.

../../../..//2009/05/13/senator-bernie-sanderss-i-vt-attempt/

Senator Bernie Sanders’s (I-VT) attempt to amend the credit card bill to impose a national usury limit of 15% (the same rate applied to credit unions) just failed by a large margin. This isn’t the Senate’s only attempt to cap interest rates, though. (Photo: BinaryApe)

Bankers' Letter To Senate Against Credit Card Reform

The American Bankers Association sent a letter to Senators yesterday to voice their opposition to the credit card reform act. Their big thing is they say the bill will make it so there’s less credit available, and it will cost consumers more. Definitely something worth bringing up when we interview Austan Goolsbee, senior economic adviser to Obama, in DC tomorrow. Here’s the letter:

Bankers Say "Whoa There" To Credit Card Reform

Credit card reform is bad, says the American Bankers Association, an industry trade group. The ABA sent a letter around to Senators on Tuesday warning against credit card reform. They say that new regulation will mean credit card companies will have to cut off credit to some consumers completely “when they need it most.”

Credit Card Company Threats Don't Scare Consumerist Readers

When we wrote earlier about credit card companies’ threats to treat customers even worse in light of Congress passing credit card reform legislation, it ignited a righteous firestorm of consumer rage in the comments. Inside, our favorites.