Three years ago, the Consumer Financial Protection Bureau warned consumers that some credit card companies weren’t clearly disclosing the risks of promotions, including deferred-interest offers that promise not to charge interest on purchases as long as the balance is paid off by a certain date. However, if that doesn’t happen customers can find their bill nearly doubled thanks to retroactive interest charges. Now the agency is setting its sights on retailers, urging them consider more transparent promotions for store-branded credit cards. [More]

credit

Surprise Charges: Feds Advise Retailers To Make “No Interest” Store Credit Offers More Transparent

Kohl’s Appears To Break Own Policy By Not Refunding $1,500 Credit Card Overpayment

When you overpay your credit card, should you be able to get a refund? One Arizona family accidentally paid their Kohl’s credit card bill twice, but the retailer refused to refund their $1,500, even though Kohl’s policies and federal regulations require it. [More]

Feds Order MasterCard, RushCard Owner To Pay $13M Over Oct. 2015 Outages

Nearly 15 months after tens of thousands of users of the prepaid RushCard were cut off from their funds because of an apparent technical glitch, the company behind the card, UniRush and its payment processor MasterCard have been ordered to pay $13 million in refunds and penalties. [More]

Tostitos ‘Party Safe’ Bags Will Detect If You’ve Been Drinking; Help You Call Uber

On Super Bowl Sunday, many of us will enjoy an adult beverage. Some of us may overindulge to the point where it’s unsafe to drive home. Now there are tortilla chips that can both detect if you’ve been drinking, and help you call for a ride home. [More]

Costco Credit Card Switch Came With Unexpected Side Effect: Lost Insurance

When Costco announced it was ditching its exclusive co-branded American Express card in favor of a Citibank-issued Visa card, customers worried about the various ways this switch could affect their finances and credit, but one family says the change in card networks resulted in them losing an insurance policy. [More]

New Prepaid Debit Card Rules Add Protections, Improve Transparency; Take Effect Oct. 2017

Two years after the Consumer Financial Protection Bureau first proposed rules aimed at making prepaid cards safer and less costly for the 24 million unbanked consumers who make use of these sometimes costly and fee-laden financial products, the agency is releasing the final version of the rules that will kick in a year from now. [More]

Wells Fargo Employee: I Tried Talking Friends & Family Into Opening Accounts To Meet Sales Quotas

Yet another former Wells Fargo employee has come forward to talk about the high-pressure atmosphere created by the bank, where she says there were only two types of employees: those who sold customers on products they didn’t want, and those that were shown the door. [More]

Banks Trying To Attract Customers With Products To Reduce, Repay Student Loans

With student loan debt in the U.S. now well beyond $1 trillion, everyone seems eager to get into the debt-reduction business. Some cities will pay down your debt if you move there, while a growing number of employers are making loan payment contributions part of the benefits package. Now some financial institutions are dangling the debt-reduction carrot in front of potential customers — but should you bite? [More]

Aldi Will Accept Credit Cards Nationwide Starting Today

There are many things missing from Aldi that American shoppers expect to find in grocery stores. They don’t have free plastic bags, for example, or candy at the checkout, or items containing added MSG or hydrogenated oils. Another familiar missing item was credit cards: cash, debit cards, SNAP, and EBT cards were accepted, but not credit cards with their higher fees. As of today, though, that changes nationwide. [More]

Apple Now Offering Its Own Program To Buy iPhone On Installments

With the release of the latest version of the iPhone last fall, Apple introduced a program that follows current trends in the mobile phone industry. Like some mobile carriers, they’ll rent you a phone, letting you trade it in every year if you want. Now they’re also offering a program where you can pay in installments and keep the phone rather than leasing. [More]

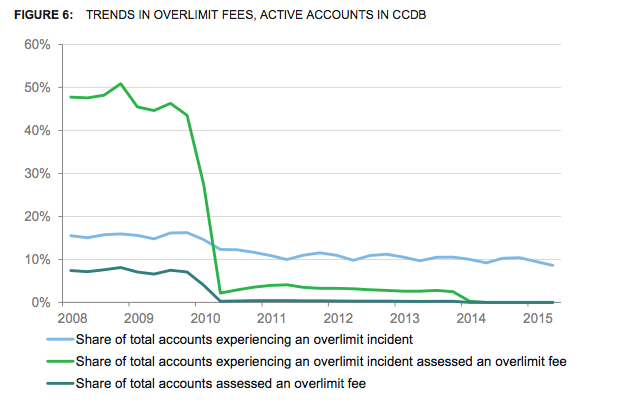

Report: Credit Card Reforms Saved Consumers $16B In Six Years

In 2009, lawmakers passed a massive set of reforms for the credit card industry – known as the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) — aimed at protecting consumers though transparency, fairness, accountability and better access to an array of financial products. A new report from the agency tasked with enforcing these rules, finds that nearly six years after implementation, consumers have saved nearly $16 billion in fees. [More]

Lending Startups Use Borrowers’ Smartphone Behavior To Decide If They Are Creditworthy

The wallet-sized – or larger – smartphone constantly tethered to your hand may often be seen as your connection to the outside world. Each time you surf the web, connect with friends, make purchases and check your bank account, it’s collecting mountains of data about you. And that data could soon be analyzed to determine if you’re creditworthy. [More]

Sprint To Pay $2.95M Over Claims It Violated The Fair Credit Reporting Act

Under the Federal Trade Commission’s Fair Credit Reporting Act, companies are required to inform consumers when they are offered services with less favorable terms than those offered to consumers with better credit standing. That apparently wasn’t the case for Sprint. [More]

Sam’s Club Expands To Accept American Express Cards Starting Oct. 1

Back in February, American Express and Costco announced that they’re breaking up in 2016. That means AmEx, including the Costco co-branded cards, will be useless at the warehouse store. Now, seven months later, the credit card company reveals its entering into a relationship with Costco rival Sam’s Club, allowing shoppers at that warehouse store to use AmEx cards at the register for the first time. [More]

I Can’t Buy A Car Because Acura Thinks I’m Dead

Dead people do not need cars, and they also have trouble making the payments. That’s probably why one woman’s credit score plummeted to zero when a lender accidentally put her down as dead. It was due to human error, but she’ll need to wait 30 days to move on with her new car purchase because someone at Acura Financial Services picked the wrong thing in a drop-down menu. [More]

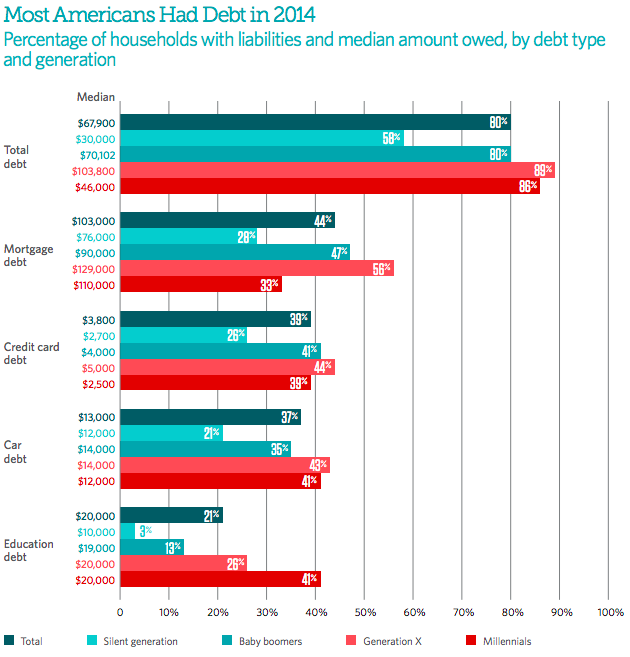

Nearly 80% Of Americans Hold Some Form Of Debt, But It Isn’t Always Bad

When most people think of debt, they probably conjure up a vision of consumers struggling to make ends meet after making unwise financial decisions. But that actually isn’t the case for most Americans. In fact, like other things, debt in moderation is actually a good thing. [More]