Last December, the Consumer Financial Protection Bureau filed a lawsuit against Student Loan Processing.US, a debt relief operation, that allegedly reaped millions of dollars from thousands of consumer by promising to provide repayment benefits that come free of charge with federal student loans. Today, the agency took steps to put an end to the organization once and for all. [More]

consumer financial protection bureau

Student Loan Companies Could Face Enforcement Actions Over Automatic Defaults

In recent years, countless private student loan borrowers have found themselves placed in automatic default – even if they were up-to-date on payments – when their co-signer died or filed for bankruptcy. Federal regulators now appear poised to rein in this often devastating practice, warning student loan lenders and servicers that they could soon face enforcement action if they continue the practice. [More]

Banks Turned Account Overdraft Fees Into $11.16B In Revenue Last Year

Banks with more than $1 billion in assets now need to report on how much revenue they bring in from overdraft fees and other charges. The first report on those numbers shows that banks made $11.6 billion last year from customers who overdrew their accounts.

[More]

Bank-Backed Lawmakers Accuse CFPB Of Hurting Consumers By Trying To Regulate Payday Loans

It’s never a good sign for the Consumer Financial Protection Bureau when it’s called to testify at a Congressional subcommittee hearing subtitled “The CFPB’s Assault on Access to Credit and Trampling of State and Tribal Sovereignty.” And so it should come as little surprise that bank-backed members of the House Financial Services Committee is trying to paint the agency’s efforts to rein in predatory lending as an attack on the very people the CFPB is trying to protect. [More]

Toyota Must Pay $22M For Charging Higher Interest To Non-White Borrowers

Under the Equal Credit Opportunity Act, creditors are prohibited from discriminating against loan applicants based on race or national origin. But that was a rule Toyota’s financing unit allegedly violated, resulting in thousands of African-American, Asian and Pacific Islander borrowers paying higher interest rates than their white counterparts. Now, in an effort to resolve charges filed by the Consumer Financial Protection Bureau, Toyota Motor Credit Corporation must pay $21.9 million to wronged consumers. [More]

“Buy Here, Pay Here” Dealer To Return $700K To Consumers Over Deceptive Lending Practices

Federal regulators continued their crackdown on not-so-upfront “buy-here, pay-here” auto dealers today, ordering a Colorado-based dealer to pay nearly $1 million in restitution and fines for operating an abusive financing scheme. [More]

Verizon, Sprint Customers Have Until Dec. 31 To Claim A Piece Of The $158M Cramming Settlement Pie

The holidays can be a tiring, stressful time, full of never-ending checklists. While you might have checked off plenty of your to-do items, if you’re a Verizon or Sprint customer, you’ll want to make sure you add “check to see if I’m eligible for a bill-cramming refund,” to the top of your list. [More]

CarHop Must Pay $6.4 Million In Penalties For Jeopardizing Consumers’ Credit With Inaccurate Reports

CarHop, one of the country’s largest “buy-here, pay-here” auto dealers, promotes itself as a company that offers fast approval for “just about anyone, despite bad or no credit.” While the company prides itself on the ability to help consumers, federal regulators say the dealer and its financing arm often did more harm than good when it came to reporting on customers’ credit behavior. To that end, CarHop must pay $6.4 million in penalties for providing damaging, inaccurate consumer information to credit reporting agencies (CRAs). [More]

Consumer Advocates Ask Regulators To Investigate T-Mobile Over Advertising, Debt Collection Practices

Those two-year mobile phone contracts we all signed for so long became a relic of the past pretty quickly over the last two years, with national providers all abandoning ship. T-Mobile moved to “contract freedom” almost two years ago now, and has since then continued to make a big deal over the fact that their users are neither locked into time-locked agreements nor face old-school high data overage fees. [More]

Debt Collector Must Pay $2.5M In Refunds, Penalties For Illegally Collecting Consumers’ Old AT&T Debt

Federal regulators continued their fight against unscrupulous debt collectors today, ordering a Massachusetts organization to pay $2.5 million in refunds and penalties for illegally collecting unverified debt and providing inaccurate information to national credit reporting agencies. [More]

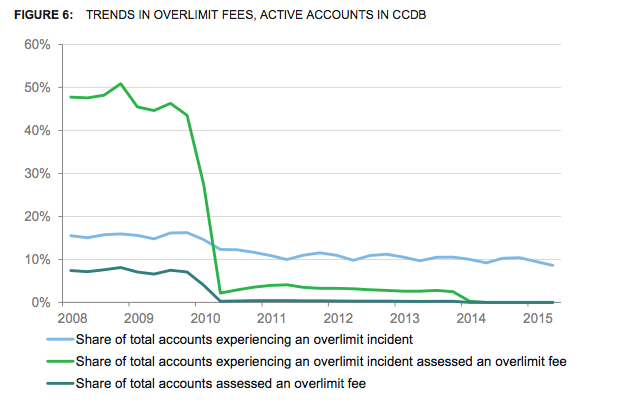

Report: Credit Card Reforms Saved Consumers $16B In Six Years

In 2009, lawmakers passed a massive set of reforms for the credit card industry – known as the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) — aimed at protecting consumers though transparency, fairness, accountability and better access to an array of financial products. A new report from the agency tasked with enforcing these rules, finds that nearly six years after implementation, consumers have saved nearly $16 billion in fees. [More]

Regulators Take Action Against Online Lender For Deceiving Borrowers On Default Charges

When a company’s name has the word “integrity” in it, you may assume it’s a wholesome, truthful operation forthcoming with information that its customers would find beneficial. That apparently wasn’t the case with Integrity Advance, as federal regulators accused the short-term online lender of deceiving borrowers about the true cost of its loans. [More]

Federal Inquiry Probes TCF Bank’s Overdraft Practices

Overdraft fees cost consumers an average of $32 billion each year. The hefty fees and their often less-than-transparent policies, which vary greatly between banks and financial products, have long garnered the ire of consumer advocates and federal regulators. Case in point: a Minnesota-based bank is now under investigation for possibly unfair and deceptive practices related to its overdraft program. [More]

Feds Sue Scammers Who Charged For Bogus Student Financial Aid Assistance

Paying for college out of pocket is nearly impossible for millions of prospective students. Instead, these individuals turn to scholarships, grants, and student loans, often relying on financial service programs to assist them in obtaining the funds. But not all of the companies promising a helping hand are looking out for your best interests. That was apparently the case for a California company accused of ripping off tens of thousands of victims in a nationwide financial aid scam. [More]