Check your statements. Fraudulent charges of $429 for “ID Safe” are showing up on some people’s credit card bills. Which is odd, because usually these places use tiny charges so they’re more likely to go unnoticed. If you see a suspicious charge on your credit card, call your card company immediately to check it out and get it reversed if need be. On the credit card statement, the phone number listed for ID safe is 888-261-6045. After the jump, what happened to one consumer when he called the number and got through to the mastermind, who sounded like she was banging pots around in her kitchen…

complaints

Get Countrywide To Remove Your PMI With An 80% LTV

Is Countrywide telling you your Loan-to-Value (LTV) ratio needs to have reached 75%, not 80%, in order to get the private mortgage insurance (PMI) removed? Throw the book at them: tell them they’re in violation of the Homeowners Protection Act of 1998. The law clearly states that PMI is to be removed after 80%:

Cancellation date.–The term “cancellation date” means…the date on which the principal balance of the mortgage…is first scheduled to reach 80 percent of the original value of the property securing the loan.

One reader (different from the guy we posted about before) says he was having trouble getting Countrywide to remove the PMI. They twice told him in writing that he needed a LTV of 75%. Then on the phone with them he mentioned the Homeowner’s Protection Act and then all of a sudden they were magically able to remove the PMI.

Top 20 Consumer Fraud Complaints Of 2007

The FTC today released its top consumer fraud complaints of 2007. Based on complaints filed by consumers, identity theft is the number one complaint by a very wide margin, taking 32% of all complaints. The next closest complaint category was Shop-at-Home/Catalog Sales, which only took 8% of the complaints. Here’s how the bastards break down:

Countrywide Says "Our Investors Require" Us To Rip You Off

3. PMI [Ed. A type of insurance a borrower pays to the lender to protect the lender in case the borrower defaults. It is typically required when putting down less than 20%]. Because this was our first home loan, and it was considered a “jumbo” (I hate that term), they required us to have PMI (despite having put down 20%). During the summer of 2005, we were nearing the magic 80/20 Loan-to-Value ratio, which I believed to be sufficient to have them remove our PMI…

Woman Sues Best Buy For $54 Million Over Lost Laptop

Raelyn Campbell is suing Best Buy for $54 million for losing her laptop and lying to her for months about it. She bought a laptop from Best Buy with an extended warranty, it broke, she sent it in for repairs, months later she didn’t have her laptop and after getting the runaround the store finally said it had lost her laptop and offered her a $900 gift card. She paid over $1,100 for the laptop, she paid for software on it, and it had irreplaceable photos, music, and personal information, including her tax returns. She freely admits she chose the high figure to attract media attention. She tells the Red Tape Chronicles “I can’t help but wonder how many other people have had their computer stolen (or) lost by Best Buy and then been bullied into accepting lowball compensation offers for replacement expenses and no compensation for identity theft protection expenses.” She also has a blog.

Seller Gets Scammed On eBay Despite Doing Everything Right

Read the tragic tale of this screwed eBay seller over on Metafilter. He did everything Paypal told him to do to avoid being scammed when he sold a cellphone, including, when the buyer returned the item, opening it in front of a police officer. Problem was, the buyer/scammer sent back a smashed gold cellphone instead of nice $500+ cellphone that was sold. Seller protection policy should apply, right? Nope, it doesn’t cover “items not as described.” Failure.

"HughesNet is Absolutely, Without A Doubt, The Worst Company I Have Ever Had The Misfortune of Relying On"

Reader Jeff isn’t pleased with HughesNet and has cc’d us on his email so that we can listen in. It’s more of a warning than a specific complaint that can be resolved:

I would just like to take this opportunity to reiterate, for the hundredth time, how much I loathe HughesNet. I have just been FAPed again. No one here is downloading any movies, music, books, or much of anything — just using the Internet. I have a guest visiting, and I’m assuming their additional drain on the ridiculously small 375 MB cap we’re afforded is what’s knocked us over the limit…so now I’m stuck at sub-dialup speeds for the next 24 hours.

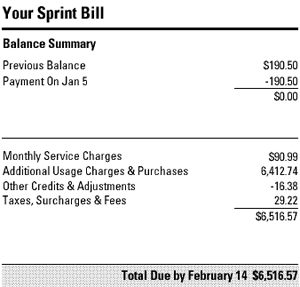

The $6,516.67 Sprint Bill

JD writes:

My device was stolen in Mexico. I reported it. The Sprint rep. suspended the WRONG line. My bill comes a few weeks ago: $6,000+. My Sprint bill was $6,000 this month and two calls to Fraud Prevention/2 tickets/and my bill is almost due (with no response or adjustment, was was promised within 2 business days, twice). I don’t know what to do at this point…

It appears your claim has gotten lost somewhere within the deep dark bowels of Sprint’s billing system. The best thing we can suggest at this point is to call the Sprint Executive Customer Service line at 703-433-4401 and get your claim expedited. Oh, and happy Valentine’s Day.

Dear Sur La Table: It Has Been 42 Days Since You Stole $100 From My Bank Account

Rachel used a $100 gift card to pay for her Christmas gifts, but Sur La Table decided to take the funds directly from her debit card. Sur La Table apologized for the error, but instead of overnighting Rachel a refund check as promised, they inexplicably charged her an additional $31.89. Now Rachel is angry and wants an explanation.

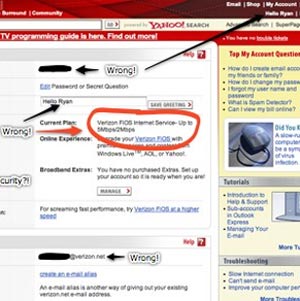

55 Support Tickets Later And Your Verizon FiOS TV Service Still Doesn't Work

Andrew writes: “I had been a satisfied customer of Verizon for several years – I have had phone service with them since the days of Bell Atlantic and have had their fiber-optic internet service (FiOS) since March 2005. In March 2007, I decided to switch cable providers and signed up for Verizon’s FiOS TV service as it was cheaper than Comcast and supposedly provided superior picture quality. As the saying goes, “you get what you pay for.”

Dinged For Enterprise Car Rental Dent

Shawn writes:

About 3 weeks ago I had a job interview in California- I currently live in Philadelphia. The employer reserved a rental car for me with enterprise so I could get around town, with his credit card. I had a long flight with a lay over, and didn’t arrive at Enterprise until about 2 o clock Philadelphia time. There was a long line, and after about a half hour I was taken back and shown a Chevy Aveo. She handed me papers to sign saying there was no damage to the car, and that I would pay an additional 10$ a day for being 23 years old. I walked around the car, and didn’t see anything. I was eager to get to my hotel and go to bed, so I signed the papers and left.

Woman Threatens To Sue Salon Over Horrible Haircut

The photo at left is an actual photo of the damage done to this lady’s hair and head. Lane writes:

I’m sure you get hundreds of complaints about salons, but have any of the salon owners in question put a lien on the car of the injured party? Mine has.

New iPhone, New 2-Year AT&T Contract

Some iPhone users are being told that they have to sign up for a new 2-year contract if they upgrade from the 8gb iPhone to the 16gb iPhone. Even though Apple’s website and AT&T’s internal official policy says this is not the case, some AT&T reps are insisting that customers have to extend their contract. Fortunately, they are completely misinformed. You just get your new iPhone, update your account through iTunes, and boom, you’re good to go, no contract extension.

Why Everyone At Verizon Online Is Utterly Useless

Faith writes:

It began the beginning of Oct. 2007. My credit card expired, and I contacted all of my utilities to update my credit card information. It was an annoying process, but it went smoothly. That is, until the notices started coming.

6 Worst Travel Agents Of 2007

According to the Department of Transportation’s Air Travel Consumer Report the top 6 most complained about travel agents for 2007 are:

Your Account Is Never Really Closed At Bank Of America

Paul writes, “Did you know a “closed” checking account is never really closed? Today I walked to the local BofA for the third time to close a checking account that every month seems to magically re-open with a $5.95 account fee. What the manager told me was quite shocking.”