It’s been less than a week since WhatsApp announced it would start sharing some user data with parent company Facebook, but in that short time, app users and privacy advocates alike have raised a ruckus over what they see as a broken promise. Now, some consumer privacy watchdog groups have filed a formal complaint with the FTC, asking them to look into it. [More]

complaints

Amazon Angers Smaller Sellers With Suspensions

The pages of Amazon are full of third-party sellers using the e-tail giant as a storefront, but a number of small-scale sellers say there’s a growing rift between themselves and Amazon over accounts that the sellers claim are being suspended with little notice and few options for recourse. [More]

What You Should Know About The Confusing Gear Shift In Jeep, Dodge, & Chrysler Vehicles

For years, the gearshift in a vehicle has followed roughly the same design: a user guides the stick to a designated slot corresponding to the desired gear selection. That has changed in recent years, as some carmakers have opted for sleeker, tech-savvy electronic shifters. However, these components have proven to be confusing, leading to some vehicles — thought to have been in “park” — rolling away, injuring some owners. [More]

Jeep Recalled For Gear Shift Issue Linked To Star Trek Actor’s Death

When Fiat Chrysler (FCA) recalled 811,000 Dodge Charger, Chrysler 300, and Jeep Grand Cherokee vehicles in April over concerns about the cars’ confusing electronic gear shifter, the carmaker said it was aware of more than 100 crashes, including 41 injuries, resulting from drivers inadvertently leaving their vehicles in gear with the engine running. The issue is now being linked to the death of a young actor over the weekend. [More]

Companies Agree To Stop Promoting Beauty Products With Synthetic Ingredients As “All Natural”

One would assume when buying a product marketed as “all-natural” or “100% natural” that said product wouldn’t contain synthetic ingredients like phenoxyethanol or polyethylene, right? Wrong. At least, that’s the cases for five companies facing action by federal regulators for allegedly making false claims about their products’ ingredients.

Cancer Charities That Scammed $75M From Donors Must Shut Down, Issue Refunds

Last May, an investigation involving federal regulators and prosecutors from all 50 states led to four national cancer charities being charged with swindling consumers out of $187 million in charitable donations. Today, two of those bogus charities — responsible for $75 million in bilked donations — have agreed to close up shop and provide refunds to donors.

Servicemembers Twice As Likely To Submit Complaints About Unsavory Debt Collection Practices

While millions of Americans are no strangers to questionable debt-collection practices, a new report from the Consumer Financial Protection Bureau shows that the men and women in the armed forces are twice as likely than their civilian counterparts to file a complaint when a collector crosses the line.

[More]

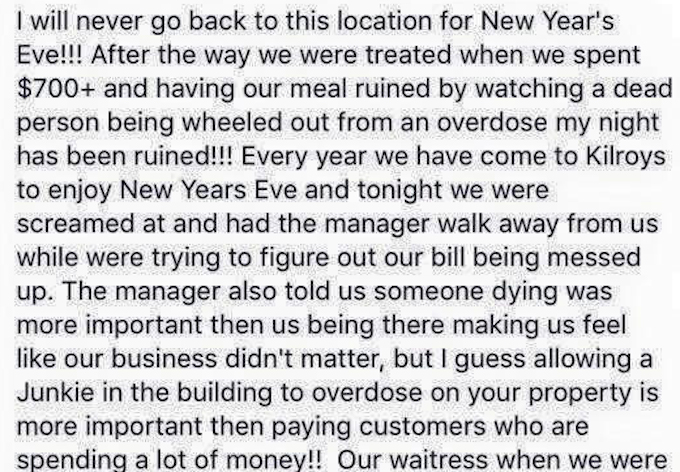

The 8.5 Steps To Making An Effective Complaint That Gets A Solution

Millions upon millions of seamless commercial transactions — interactions between consumers and business — take place every day. But sometimes, something goes wrong. Your package arrived broken. You’ve been billed for a service you cancelled three months ago. You were called something rude by an employee. Whatever it is, it’s a problem, and you need to complain about it. [More]

Traveler Complaints About Airlines Increased Nearly 30% Last Year

While airlines might not be leaping at the chance to tell customers how to file complaints about their service, that hasn’t stopped more travelers from sharing their tales of woe with the Department of Transportation. In fact, the number of complaints filed by beleaguered passengers increased by nearly 30% last year. [More]

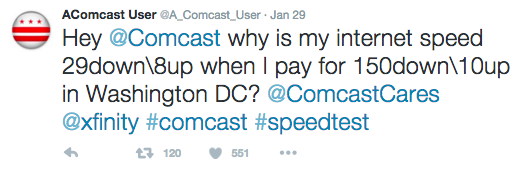

Comcast User’s Bot Tweets At Comcast Whenever His Internet Speed Gets Too Slow

Just because you pay for a certain internet speed doesn’t mean you get it all the time. That’s just a sad fact of life: those speeds are an “up to” promise, not a “minimum guarantee” promise. But just how often is a lapse below a certain threshold acceptable? And given that internet speeds are variable, how would you make sure your provider knows? [More]

Some GM SUV Owners Say Their Vehicles Are Making Them Sick

From time to time you might feel a bit nauseated while driving (or riding) from point A to point B, and that’s pretty normal. But it appears that some General Motors SUV owners are having a bit more than just a little bout of carsickness while trolling around in their vehicles. [More]

1.5M Bottles Of Sweet Leaf Tea Recalled Over Glass Fragments

Some days you just don’t want water or a soda to go with your lunch, so instead you pick up a bottle of something a little sweeter. But if that something else happens to be Sweet Leaf Tea, it might contain an extra ingredient: glass fragments. [More]

UPDATE: For-Profit Education Company EDMC Agrees To Pay $95.5M To Settle Fraud, Recruitment Violations

UPDATE: Education Management Corporation, the operator of for-profit college chains such as Brown Mackie College, Argosy University and the Art Institutes, will pay $95.5 million to settle claims it violated state and federal False Claims Act (FCA) provisions regarding its recruiting practices. [More]

Wells Fargo Reportedly Under Federal Investigation Related To Student Loan Servicing

According to a new report, Wells Fargo is the latest big-name bank to be scrutinized as part of the Consumer Financial Protection Bureau’s ongoing investigation into student loan servicing practices.

[More]

Regulators Halt Alleged Energy Drink Pyramid Scheme That Targeted College Students, Other Young Adults

Federal regulators continued their crackdown on supposedly deceptive dietary supplement companies this week by temporarily shutting down an Arizona-based company that allegedly ran a pyramid scheme promising college students they would rake in the big bucks by selling energy drinks. [More]

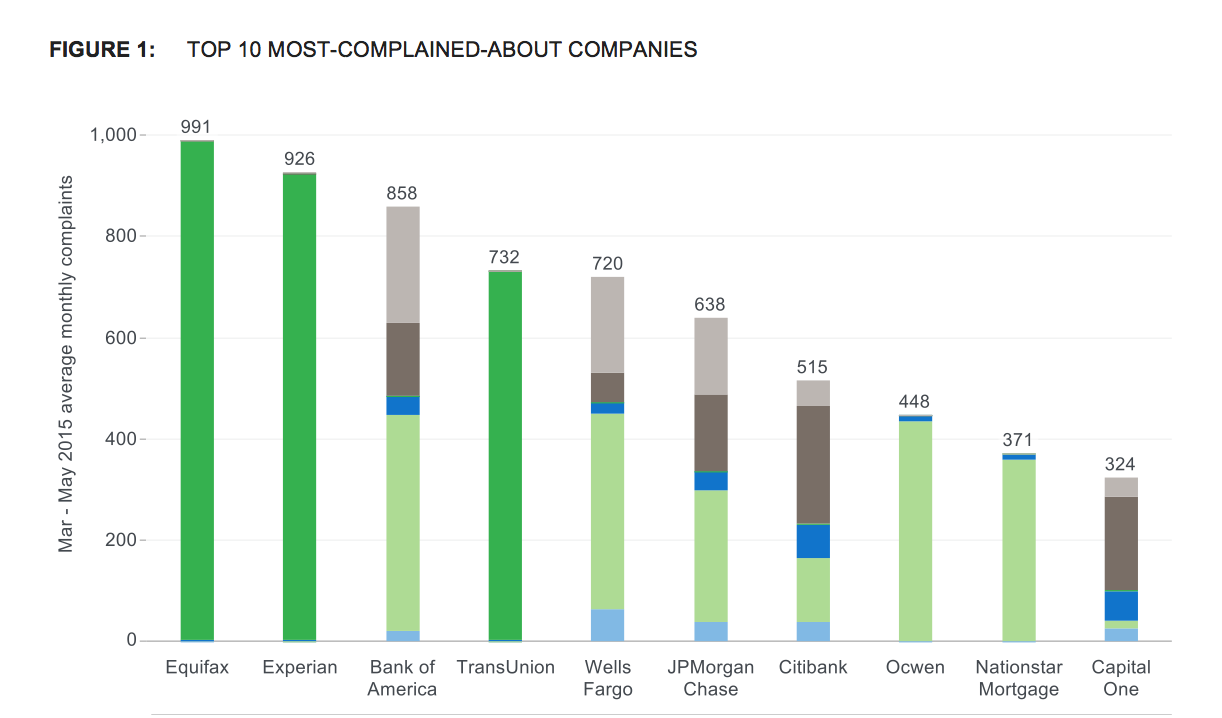

Credit Bureaus, Bank Of America, Wells Fargo Top List Of Most Complained-About Financial Companies

The Consumer Financial Protection Bureau has released its latest report on the various complaints the agency has received about banks, lenders, debt collectors, and other financial services. Amid a sudden increase in the number of complaints involving credit report errors, the country’s largest credit bureaus now dominate the top of the CFPB’s list of most complained-about companies. [More]