For decades, retailers have had charity donation jars at checkout points, giving customers the option to quickly support a helpful organization with the change from their purchase. Now Lyft is looking to apply that same model to ridesharing, by letting passengers round up their fares with the extra money going to non-profit groups. [More]

charitable donations

Lyft Adding Option To Let Passengers Round Up Their Fares For Charity Donations

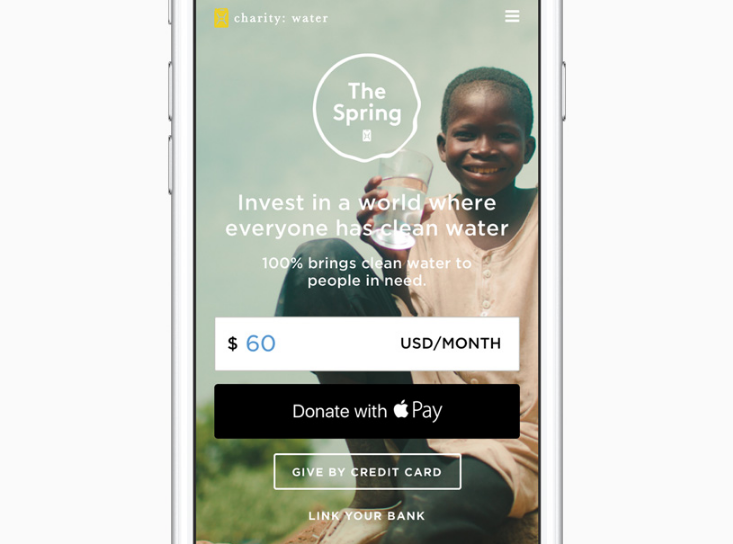

Apple Pay Will Now Let Users Donate To Charitable Organizations

As we head into the holidays, giving to charitable organizations might be something you’re thinking about. You’ll have another option for how you can do that, with Apple announcing today that Apple Pay now supports donations to non-profits. [More]

Group Must Pay $700K Penalty For Allegedly Profiting From ‘Charity’ Donation Bins

How do you turn a charitable donation into a scam? Take the donated item and sell it for a profit, instead of giving it to the needy. New York Attorney General Eric Schneiderman said his office has reached a settlement with a for-profit company accused of doing just that, by way of more than 1,100 clothing donation bins scattered throughout the New York City area. [More]

H&R Block Screwup Costs You $10,000

Last year H&R Block told the IRS that reader Tuyen made $33,000 in charitable donations. Tuyen, who earns $60,000 per year, collected a huge rebate, but when he returned to H&R Block this year, he learned that thanks to the screwup he now owes the IRS $10,000 in back taxes.

Charitable Cash Donation Deductions Now Require Proof

Blueprint for Financial Prosperity scrutinized the new IRS rules about charitable donations and found an important change.

Millions Donated by Gareth Morgan, Benevolent Kiwi

A New Zealand investment banker has donated $47 mil to charity.