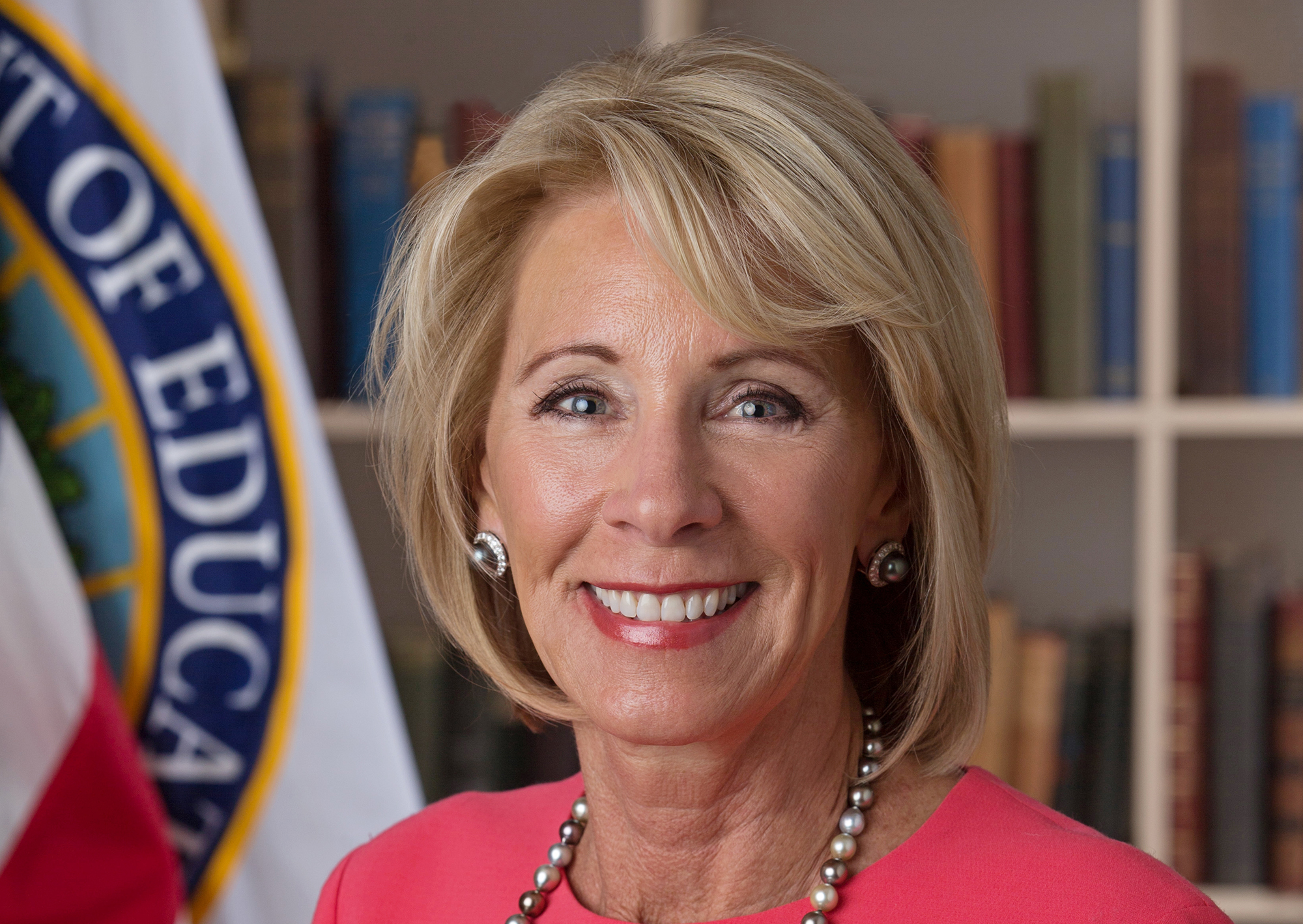

Education Secretary and champion of for-profit colleges Betsy DeVos is once again siding with this controversial industry and against students who were defrauded by schools that tricked them into paying top dollar for a bottom-dollar education. [More]

Borrower Defense

Dept. Of Education Hasn’t Approved A Loan Forgiveness Claim In Six Months

When Education Secretary Betsy DeVos hit “reset” on revamped Borrower Defense rules that aim to ensure students at troubled schools weren’t left with nothing but debt if their college collapsed, she noted that students who had already submitted claims for loan forgiveness wouldn’t be affected. But that doesn’t appear to be the case, as the Dept. hasn’t approved a single application in nearly six months. [More]

Dozens Of Organizations Come Out In Support Of Gainful Employment, Borrower Defense Rules

A week after two separate lawsuits were filed by 19 state attorneys general and a group representing students accusing Education Secretary Betsy DeVos of breaking the law by delaying protections for student loan borrowers, a coalition of more than 50 consumer groups have stepped forward to join the opposition against a “reset” of regulations put in place to protect students at for-profit colleges. [More]

States Say Education Secretary Betsy DeVos Broke Law By Delaying Protections For Student Loan Borrowers

Following Education Secretary Betsy DeVos’ decision to “reset” new regulations put in place to protect students at for-profit colleges, two separate lawsuits now accuse the Secretary of breaking federal law by running roughshod over the regulatory process when she delayed the so-called Borrower Defense rule, which would have made it easier for defrauded students to get out from under their student loan burdens. [More]

Education Secretary Betsy DeVos “Resets” Rules On For-Profit Colleges

Education Secretary Betsy DeVos has announced plans to “reset” two regulations that were recently put in place to hold for-profit colleges more accountable and prevent students at these schools from being left with nothing but debt if their college collapses. [More]

States To Education Secretary DeVos: Stop Delaying Loan Forgiveness For Students Deceived By Corinthian Colleges

Two months after the Attorneys General from dozens of states sent letters to former students of defunct for-profit college chain Corinthian Colleges reminding them to apply for federal student loan discharges, a number of those same state officials are calling on Education Secretary Betsy DeVos to stop delaying loan forgiveness. [More]

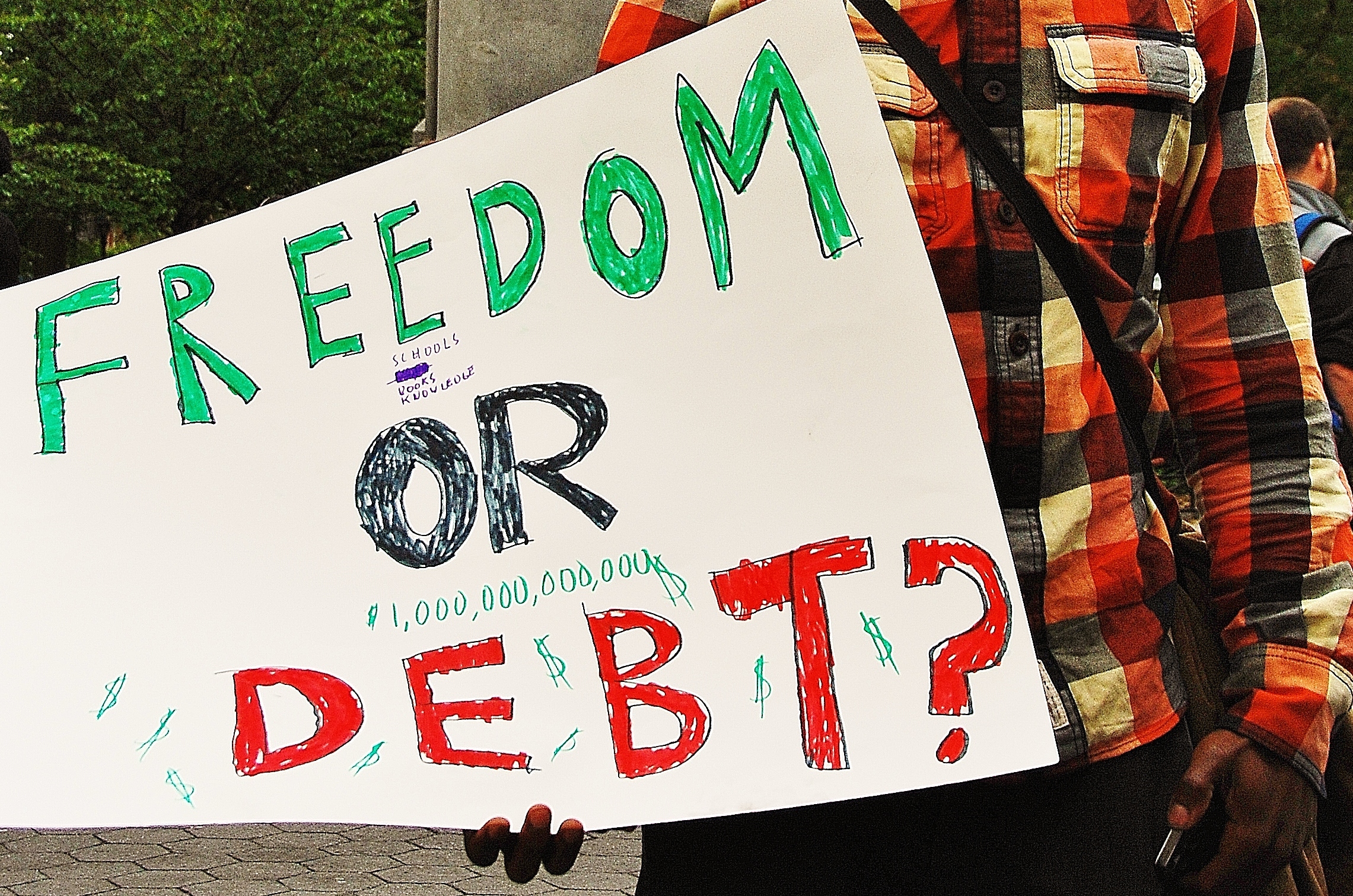

For-Profit Colleges Sue To Stop Rule That Protects Students Of Failed Schools

Federal regulations that aim to protect and refund student loan borrowers defrauded by their schools could end before they even go into place, thanks to a lawsuit filed by the for-profit college industry. [More]

Lawmakers Ask Education Secretary DeVos To Explain Delayed Loan Forgiveness For ITT, Corinthian Students

Thousands of former students at bankrupt for-profit schools run by ITT, Corinthian Colleges, and others are still on the hook for millions of dollars in student loans, even though the Department of Education approved their claims for a refund. Now, lawmakers want Education Secretary Betsy DeVos to explain why. [More]

Not Too Late To Get Federal Loan Forgiveness, States Remind Corinthian Students

Earlier this week, Education Secretary Betsy DeVos rescinded relatively new federal guidelines intended to make the student loan repayment process more accurate and transparent. With the possibility that other federal student loan protections could face the same fate, the Attorneys General from dozens of states are reminding former students of defunct for-profit college chain Corinthian Colleges to apply for federal student loan discharges. [More]

18 Attorneys General Ask Education Secretary DeVos To Not Go Soft On For-Profit Colleges

A number of high-profile for-profit educators shut down or scaled back operations in recent years, among accusations of overcharging and under-educating students, and new rules intended to hold schools accountable. However, these companies’ fortunes began to turn after the election of Donald Trump and his naming of pro-industry Education Secretary Betsy DeVos. That’s why a group of 18 state attorneys general is calling on the administration to not ease up on these controversial schools. [More]

Feds Will Forgive $30M In Federal Loans For Students Of Defunct American Career Institute

Under the “Borrower Defense” program, a student’s federal education loans can be forgiven if they can prove their college used deceptive practices to convince them to enroll. The Department of Education confirmed today that this program will be used to forgive $30 million in federal student loans for thousands of former students from the defunct American Career Institute. [More]

Student Loan Repayment Programs Will Eventually Forgive $108B In Debt

While several recent reports have suggested that many student loan borrowers face needless hurdles when trying to reduce their monthly payments through the Department of Education’s income-driven repayment plans, a new study has found the programs are working and will eventually forgive $108 billion in outstanding student debt. [More]

New Rules Aim To Make It Easier For Students To Seek Financial, Legal Relief From Failed Colleges

In the last few years, multiple for-profit college chains have closed with little or no warning given to their students, while others remain on the brink of closure. And many of the for-profit schools that remain bar wronged students from ever suing the college in a court of law. Today, the Department of Education finalized the massive overhaul of its “Borrower Defense” rules in an effort to make it easier for students to hold colleges financially and legally responsible for their actions. [More]