Since the Dow made it look so fun, the S&P today dipped into its first official bear market since 2002. A bear market is usually defined as a 20% drop in securities prices from their high (Not a hard feat when the financials were hyped up on imaginary money from worthless mortgages). Is it time to sell, sell, sell? Not unless you’re retiring tomorrow, tomorrow, tomorrow. Investopedia says the best thing to do when you see a bear in the market is the same as when you see one in the woods: “Tuck in your arms and play dead!” In other words, don’t go crazy selling stocks at a loss. In both cases, fighting back can leave you bleeding, although toughing it out won’t be a pleasant experience either. And if you have money leftover after filling up your car, it’s actually a buying opportunity. Which I guess is like playing dead in front of the momma bear while your buddy gathers up all the cubs while mamma is occupied and then later you and your buddy train them to harvest honeycombs for you.

bear markets

Dow Enters Bear Market

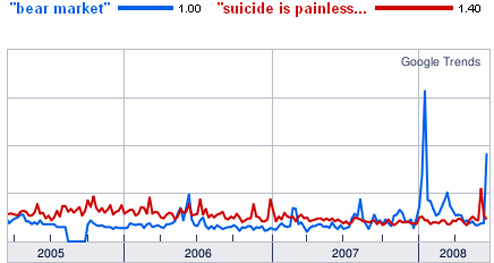

Finally having lost over 20% from its October high, the Dow has entered into a bear market. An unrelated story about an investor-fleecing hedge fund manager who tried to make his disappearance prior to his incarceration look like he took his own life provides context in a Google Trends graph.