Capital One CEO’s email address is rich.fairbank@capitalone.com.

banks

No, You Should Not Launch An E.E.C.B. Against Your Own Employer

Do not launch an Executive Email Carpet Bomb against your own company or it will explode in your face. Reader E discovered this the hard way when he tried to use an E.E.C.B. to convince the bank where he worked to reverse $300 worth of overdraft fees.

See The Bank Failure And Foreclosure Rates In Your State

CNN Money has put together a couple of quick interactive maps of the U.S. that let you see the bank failure rates and foreclosure rates for each state. According to these two maps, Wyoming is the place to be.

Meet The Savings & Loan That Destroyed Wachovia

60 Minutes recently took a look at World Savings Bank, the acquisition that ultimately wounded Wachovia so badly that it had to be acquired by Wells Fargo. What was wrong with an institution for which Wachovia was willing to pay $25 billion? Well, one whistleblower claims that World Savings was engaged in fraud and predatory lending — tricking its customers into signing up for dangerous “option-arm” or (as they cheerfully called them) “pick-a-payment” loans.

US Bancorp Blasts TARP As Giant Bait And Switch On America

U.S. Bancorp CEO Richard Davis took shotgun blasts to the TARP program for being a fat big lie. “We were told to take it so that we could help Darwin synthesize the weaker banks and acquire those and put them under different leadership,” Davis said. OMG – truth alert!

Laid Off? Get Ready To Pay Bank Fees On Your "Unemployment Debit Card"

The Associate Press says that 30 states have cut deals with bailed out banks like JP Morgan Chase, Citigroup, and Bank of America to distribute unemployment benefits on debit cards instead of paper checks. The catch? All of these programs have fees — and in some states the cards are mandatory.

Market Convinced Banks Will Be Nationalized, Freaks Out

Shares of banking stocks are dragging down the markets as investors become increasingly convinced that the banks will be nationalized, says Reuters. Investors are shunning the companies, worried that shareholders will be wiped out in a government takeover, and are fleeing to U.S. Government bonds and gold, which rose to above $1,000 an ounce.

UBS Will Release Names Of Americans Hiding Money From IRS

Swiss bank UBS, which has “admitted conspiring to defraud the Internal Revenue Service and agreed to pay $780 million to settle a sweeping federal investigation into its activities,” has agreed to release the names of Americans who have been secreting away cash in UBS’ fabled Swiss bank accounts. The U.S. Justice Department has been investigating about 19,000 accounts, but the New York Times says the bank may only release a couple hundred names. Update: Now the IRS has asked a judge to demand that UBS turn over the names of around 52,000 clients. UBS says it will “vigorously challenge” the new request.

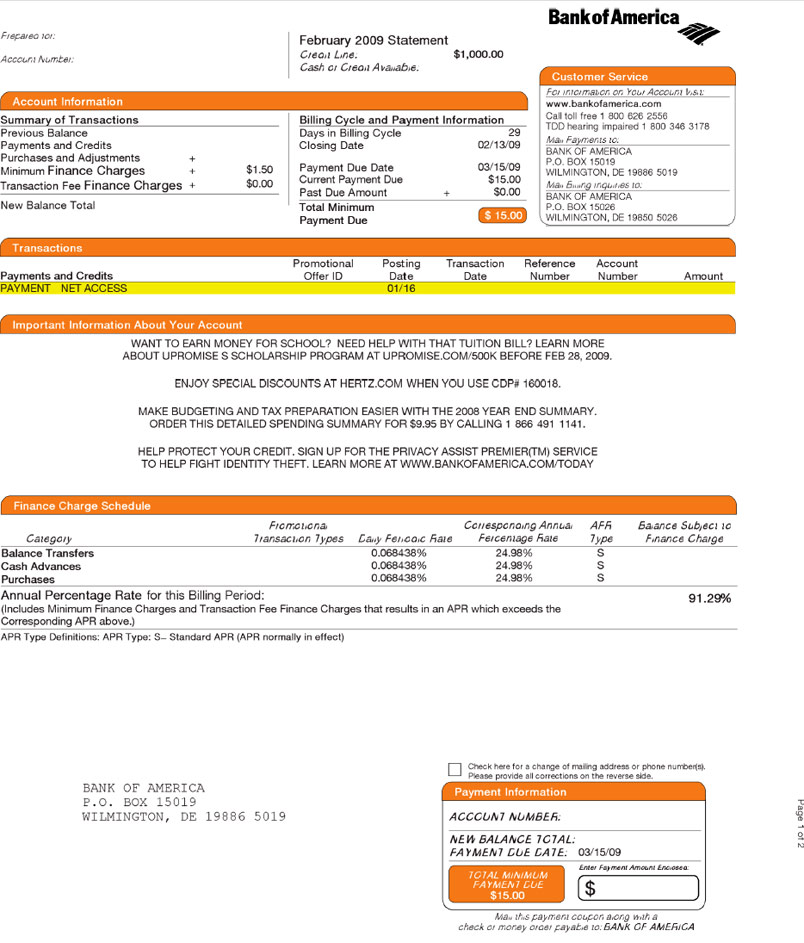

Your APR Is Now 91.29% – Yours Truly, Bank Of America

David’s effective APR on his Bank of America credit card is now 91.29%. It’s not a typo or a scam, it’s math.

Trouble Saving Money? Harness Robots!

Sometimes when people have trouble saving at least 10% of their income on a regular basis, it’s because it hurts too much. After you pay the bills, set aside money for groceries, booze and guns, it seems you don’t have enough left over to save with. So, what you can do is exploit “out of sight, out of mind,”

Qchex Shut Down, Scammers Everywhere Weep

ArsTechnica reports that a judge has ordered Neovi, the company behind Qchex, to immediately stop offering their service, which allowed people to create and send checks drawn on any bank so long as they provided the account info. As you can imagine, this led to abuse by scammers who would use Qchex to create fraudulent checks.

Pre-Loaded Benefit Cards Nickle And Dime Unemployed

Pennysylvania’s unemployed are getting nickled-and-dimed by pre-loaded unemployment benefit debit cards that come come pre-loaded with hidden fees.

Before Traveling, Make Sure AmEx Hasn't Canceled Your Card

Ronnie Sue’s recent trip to Germany was a financial nightmare. Though she warned her bank she would be traveling to Germany, when she arrived, she couldn’t withdraw needed cash. The bank gently suggested that Ronnie Sue draw cash from her credit card, and even offered to refund any cash advance fees. It wasn’t until Ronnie Sue whipped out her AmEx that she learned it had been silently canceled two days before she left…

Battle Bank Fees

Banks love fees. Want to wire money? Need to pay a fee. What to stop a check? Need to pay a fee. Need to use the bathroom? Gotcha!

WaMu: No Refund, You "Authorized" Those Muggers

This tourist in Rome got robbed and WaMu won’t reimburse him for the money they stole from his debit account.

Gee, How Much Does A Bailed Out Executive Make, Anyway?

The New York Times is reporting that the Obama administration announced a $500,000 pay cap that prohibits bonuses for any companies that take additional taxpayer assistance.

Should Banks Be Required To Ask Permission For Overdrafts?

When you sign up for a checking account, most banks automatically enroll you in a “courtesy overdraft protection” program. This program means that the bank will approve overdrafts from your ATM or debit card — and charge you a $35 fee for each transaction, etc. But what if you don’t want the service? Well, the Federal Reserve has proposed a new regulation that will require banks to ask your permission before they sign you up.