Citibank sent customers a letter informing them that starting in December, they’re raising monthly fees on checking accounts, in some cases by double. [More]

banks

Protesters Take Trash From Foreclosed House To Bank Of America Branch

Protesters chanting, “Bank of America, bad for America” tried to dump ten plump black garbage bags of trash in a BofA branch in Malden, Massachusetts. The bags contained refuse collected from the yard of a house the bank foreclosed on and let fall into disrepair, becoming a blight in the neighborhood and threatening to drag down property values. [More]

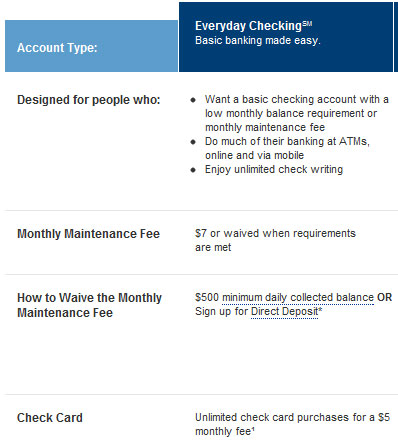

New Dilemma For Some Wells Fargo Customers: Keep $7500 In The Bank Or Pay $15 Fee

As banks look for new and exciting sources of revenue, free checking is slowly fading away at the nation’s large financial institutions. This week, we heard from several Wells Fargo customers who are annoyed that they’ll have to pay $15 per month to keep their current account type if they don’t have an average of $7,500 in the bank, across all of their accounts. Is this impossible? No, but it’s a drastic change from the old requirements. [More]

Banks Must Produce Living Wills To Tell Regulators How To Liquidate Them

No one likes to imagine their own undoing, but that’s what the government has asked the largest American banks to do, mapping out liquidation plans in “living wills” that will help financial regulators pick apart their carcasses if they go under. The banks have until next year to submit their plans, which are mandated by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. [More]

What It's Like For A Blind Man To Use An ATM For The First Time

Have you ever been waiting for the ATM to dispense your monies and seen that little headjack for blind people and wondered, hey, how does a blind person use an ATM? This video shows what happens when Tommy Edison, a blind man, uses the ATM for the first time. It takes him 11 minutes. [More]

More Towns To Withdraw Millions From Chase Over Mortgage Mod Practices

We know the story. Chase and other banks got billions in bailouts that they were encouraged, but not required, to use to help people modify their mortgages. Instead they sat on it and smiled like cheshire cats. Now a movement has sprung up to punish Chase for its intransigence by withdrawing money from their accounts. On the individual account level, that’s not much. But in New York state, entire towns are getting in on the act. [More]

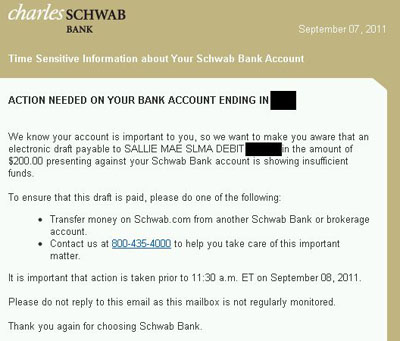

Charles Schwab Bank Helps You Avoid Overdrafts And Pay Your Bills

When Art received an unexpected e-mail about his account at Schwab Bank, he assumed it was some kind of phishing attempt. Aren’t all messages that say “Time Sensitive Information about Your [Bank Name] Bank Account?” But it wasn’t. Schwab wanted to let him know that he didn’t have the funds to cover an impending auto-debit, and he needed to transfer some cash over. [More]

What New Fees Have You Seen Popping Up On Your Bank Statements?

As we’ve reported numerous times during the last year, many banks have been planning to fight new financial regulations and swipe fee reforms by tacking on a host of new fees for everything from getting a paper statement to talking to a human being at the bank to closing an account. Now our corporate cousins at Consumer Reports want to hear from you about which ones have been creeping their way into your bank statements. [More]

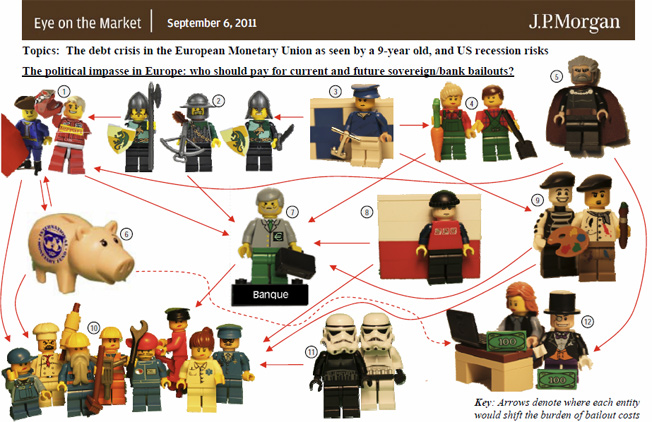

JP Morgan Explains Euro Debt Crisis With Legos. Really.

In order to explain the Euro debt crisis, Michael Cembalest, the Chief Investment Officer of JP Morgan’s private bank, sent around a research note that used Legos to depict the different players. The Legos were fashioned by his 9-year old son. This really happened. Here’s the legend to explain which parties each figure represents, or you can play a fun game and guess on your own first. [More]

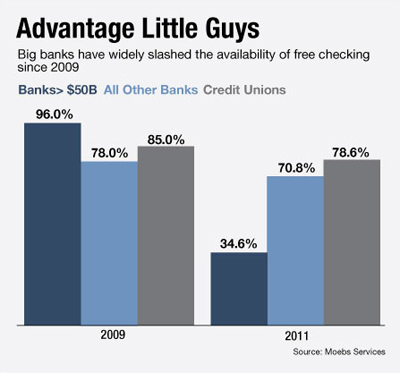

Chart: This Is How Dead Free Checking Is At Big Banks

This chart from American Banker shows just how many nails are in the coffin of free checking at big banks in a post-Durbin amendment world. That is a whopping drop from 96% of large banks offering free checking in 2009 to only 34.6% in 2011. What’s also amazing is just how resilient free checking is at the credit unions and smaller banks, which continue to use it as a marketing tactic to attract customers. [More]

Discover Ends Disposable Credit Card Number Program

Discover sent around an email last night informing customers that it would be ending the “Secure Online Account Numbers” service. This feature helped you mitigate the potential for online fraud by letting you generate unique credit card numbers you could use per online retailer or even per transaction. A few Consumerist readers were bummed to see it go. [More]

Wells Fargo And Chase Waive Fees For Irene-Affected Customers

Wells Fargo and Chase announced that they are waiving some fees for customers in NY, NJ and CT to help them out after Irene. [More]

Wells Fargo And Visa Take A Month To Refund $400 Gift Card Error

It’s a pretty simple error; easy enough to make. When Todd asked for a $100 Visa gift card at Wells Fargo, the teller misheard “for a hundred” as “four hundred.” $400 was promptly taken out of his bank account and placed on the card, and Todd was never asked to authorize the amount in writing. It was only when he checked the receipt after leaving the bank that he found the error. He set off to get his money put back into his account, but it wasn’t so simple even just minutes after the transaction. Adding a credit card company into the mix adds a new and exciting level of bureaucracy when dealing with a large bank. [More]

FDIC: Fewer Banks At Risk Of Failure

According to the Federal Deposit Insurance Corporation, fewer banks were at risk for failure in the second quarter. This marks the first time the number of institution’s on the FDIC’s endangered banks list has fallen since 2006, and is a sign that the finance industry is stabilizing. [More]

How Should Banks Notify Paperless Statement Customers Of Changes?

When a growing number of bank customers go paperless and statement-free, is notifying them of new fees or policy changes only on their statements enough? Becky doesn’t think so. She’s annoyed that Key Bank instituted a $9 per month fee on some accounts recently, but only announced it on the statements that, thanks to online banking, she has no reason to pay attention to. [More]

"I Don't Doubt It" Is BofA's Response To You Saying They Transferred You To Foot Fetish Phone Line

When David tried to report some fraudulent activity on his debit card, Bank of America transferred his call to a 1-900 type phone line that specialized in feet-related activities. [More]

SunTrust Sunsets Free Checking

The next bank to do away with free checking is SunTrust, and they’ve got their own unique twist on it. [More]

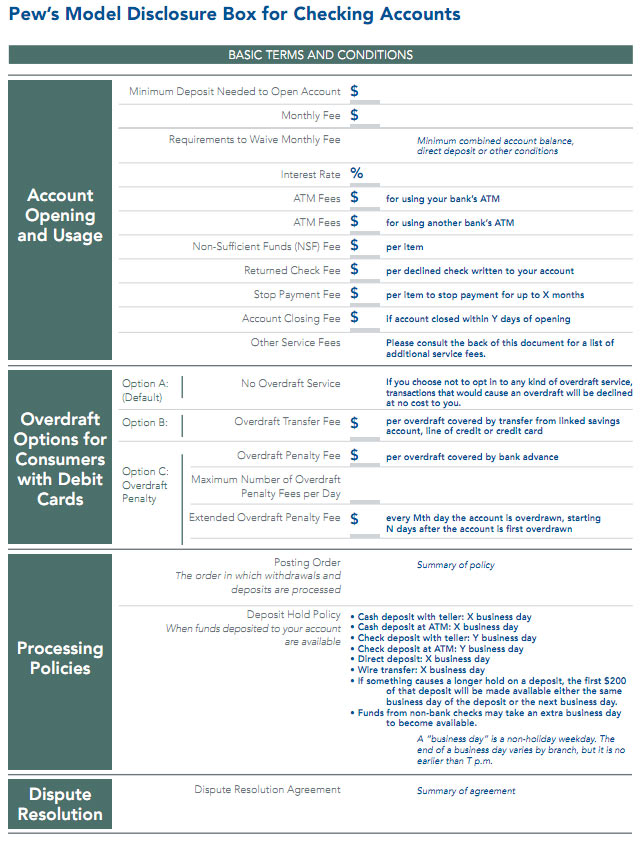

Wouldn't It Be Nice To Find Out Your Checking Fees With A One-Pager Like This?

Wouldn’t it be really cool if your checking account disclosure form looked like this nice one-pager the Pew Research Group mocked up? Naw, just kidding. We know you love reading paragraphs of tiny text that have the important clauses buried in the middle of longer sentences. Playing a scavenger hunt to find out what fees you have to pay is part of the fun of having a checking account! [More]