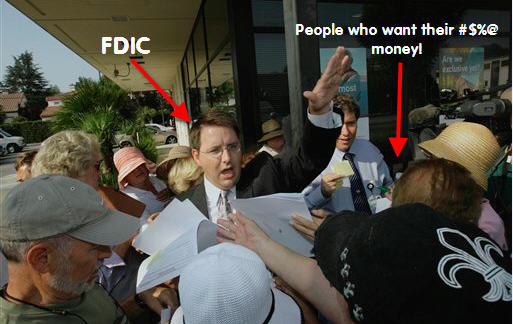

The FDIC was created in 1933 by the Glass-Steagall Act, and provides $100,000 of deposit insurance to checking and savings deposits. “Bank panics” used to be fairly common, and the FDIC was intended to instill confidence in the banking system after the Great Depression. The most recent big failure, that of California bank IndyMac, will cost the FDIC between $4 and $8 billion, and they estimate that about $1 billion of IndyMac’s deposits are “potentially uninsured,” meaning that the depositors had more than $100,000 on deposit. So what does a bank run look like these days?

bank run

IndyMac Failure Demonstrates That The FDIC's Customer Service Skills Could Use Some Work

We’re always told not to worry about our bank failing because our deposits are insured up to $100,000 by the FDIC. Well, in case you were wondering what happens when a bank actually does fail, look no further than the great state of California, where IndyMac has been taken over by federal regulators and its customers are getting a taste of all the FDIC has to offer.