Under federal law, depository institutions are prohibited from charging overdraft fees on ATM and one-time debit card transactions unless consumers affirmatively opted in. But a new report suggests that those who do opt-in might not know the cost of such a decision, with opted-in frequent overdrafters spending about $450 more in fees each year than non-opted-in frequent overdrafters. [More]

bank accounts

U.S. Bank CEO Warns Employees: Make Fun Of Wells Fargo And You’re Fired

It’s been a (deservedly) bad month for Wells Fargo, what with the bank being ordered to pay $185 million in penalties because employees opened millions of bogus accounts, not to mention the ongoing Justice Department investigation. It would seem like a prime time for the competition to pile on the misery and steal away customers, but the CEO of U.S. Bank is demanding his staff not give into that temptation. [More]

Banks Attract New Customers, New Fee Income With Check-Cashing Services

Instead of imposing new fees on their existing customers, banks have an exciting new idea: attract new customers and charge them fees. Specifically, banks are looking to low-income and lower-middle-income people who might normally use check-cashing stores or check-cashing services in retail stores to gain immediate access to their money. These customers may not make large deposits, but what customers who want access to their cash right away do generate are lots of fees. [More]

Wells Fargo’s High-Pressure Sales Strategy Probed By Federal Regulators

Six months after the Los Angeles City Attorney filed a lawsuit accusing Wells Fargo of a slew of unfair practices — like encouraging employees to open unauthorized consumer accounts and then charging those accounts phony fees to meet sales expectations — two other regulatory agencies have opened investigations into the bank’s behavior. [More]

College-Bound Students Should Shop Around For Bank Accounts

With millions of young adults heading off to college this month, federal regulators are reminding those consumers to do their homework. Okay, not that homework, but the kind related to researching college-sponsored bank accounts. [More]

Telemarketers Took Millions From Senior Citizens In Medicare Card Scam

There’s now one less unsavory, immoral, disrespectful group scamming senior citizens of their savings, as federal regulators took action against the operators of a scheme in which telemarketers pretended to be Medicare representatives in order to bilk millions of dollars from older consumers. [More]

Banks Continue To Improve Consumer Safeguards, But Progress Isn’t Coming Fast Enough

Opening a checking account with a bank is a rite of passage of sorts for many consumers, but the plethora of small-print disclosures, fees and other services are enough to confuse even the most seasoned account holder. While banks attempted to simplify their practices over the years, a new Pew Charitable Trusts report shows that some banks – and regulators – have a long way to go before they’re truly doing everything they can to protect consumers. [More]

The Other Danger Of Online Payday Loans: Identity Theft

Many people who seek online payday loans are already in a very vulnerable position when they take on the added risk of the excessive interest rates and often exorbitant fees associated with these short-term loans. But there’s another danger possibly lurking in the payday shadows: Having all their personal and financial data end up in the hands of cyber criminals. [More]

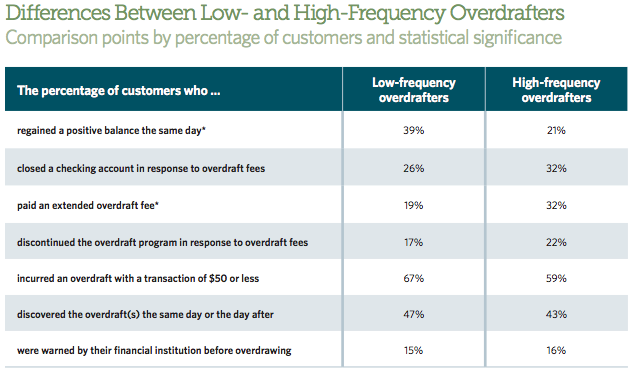

Report: Overdrafting Just A Little Or A Lot Has The Same Negative Consequences For Consumers’ Accounts

For most consumers, overdrawing their checking account results in a hefty fee. While it’s safe to argue that consumer who have more overdrafts will pay more in fees, a new report from The Pew Charitable Trusts finds that both high-frequency and low-frequency overdrafters often face the same devastating financial ramifications from banks’ overdraft penalties. [More]

Survey Says: Financial Cheating Common In American Couples

Have you been keeping a close eye on your joint piggy bank? Or perhaps you’ve got your very own credit card you keep separate from your significant other, the one you use to buy the things you don’t want to admit to (season 5 of that awful reality TV show, a giant wheel of cheese, etc.). You aren’t the only financial cheater — a new survey says there are a whole bunch of us taking financial matters to motels that charge by the hour, so to speak. [More]

Woman Receives Home Depot Package With Fire Starter, Tons Of Shredded Checks, Bank Statements

A Colorado woman got more than she bargained for when ordering a fire starter for Home Depot: A box full of other people’s shredded checks and bank statements. [More]

The Bank Of America Account That Refuses To Die

Reader David wants to close his Bank of America account and move on. He was in no hurry: he began the process last spring, and slowly moved regular payments over to an account at a local bank and stopped making deposits in his Bank of America account. He wanted to bring his relationship with the bank to a graceful, amicable close. BoA isn’t interested in an amicable breakup, though. This account simply refuses to close. [More]

How Can I Prevent My Wells Fargo Account From Going Zombie?

Aaron is ditching Wells Fargo. Not out of any animosity toward megabanks or dissatisfaction with their policies, though. He’s just moving to an area where they don’t have any branches. He did what you do when breaking up with a bank: withdrew his money and closed out the account. Well, he tried to. He wanted to. Perhaps he did. But the employee who helped him couldn’t guarantee that a stray old check or a recurring charge he failed to change over wouldn’t bring the closed account back to life, resulting in overdraft charges and a zombie account lumbering around. [More]

Closed BofA Bank Account Mysteriously Reopened With 1 Penny Balance

Chris was one of the many in October who closed their bank accounts with Bank of America, and other similar big retail banks, in protest over planned fees for using their debit card. But last week she found it had been reopened for no apparent reason, with a 1 penny balance out of nowhere. [More]

DirecTV Drains Your Bank Account To Pay Your Sister's Bill

Don’t lend your debit card to friends or family to pay their DirecTV bill if you don’t want to be on the hook if they fail to pay their bill. As we learned during the debacle where the satellite provider drained the bank account of a dead customer’s friend, any debit or credit card that has ever been used for a given account stays on file…pretty much forever. Reader Laura learned this the hard way when the company drained her bank account to pay her sister’s bill. [More]

Why Can't Macy's Reverse This Charge On Their Customer's Debit Card?

Amanda has been having a hard time getting Macy’s to reverse an incorrect charge on her credit card–a charge that was canceled less than five minutes after it was made last week. Her story includes almost all of the things that can go wrong with customer support, including random transfers, rude employees, and broken promises. If she’d just been made to hold for 45 minutes before one of the disconnections, she’d have collected the set! [More]

Citibank To Charge Fees On Checking Accounts

If you’re a Citibank customer who has one of the bank’s two smaller checking account plans—the ones where the monthly fee is waived as long as you use direct deposit or their online bill payment—then maybe it’s time to consider taking your business elsewhere. Starting in February, anyone with an average balance of less than $1500 will be assessed a monthly $7.50 service fee, reports the New York Post.

Target Employee Incompetence Freezes Nearly $800 Of Customer's Money

Erica, who writes Philadelphia Weekly’s Style blog, went to Target this past Saturday to purchase some new tank tops. She and her boyfriend filled their cart with a lot of other stuff too—”Ready to stimulate the economy?” she joked to him on their way to the register—and they agreed to split the cost equally. Now when I worked retail, that was an infrequent but not impossible task. When you ask a Target cashier to do that, get ready to have your debit card debited twice for the full amount of the bill, and then told two days later that the voided transactions will take 72 hours to clear.