One of the nation’s largest providers of automobile financing, Santander Bank, has agreed to pay $26 million to end a two-state investigation into the financial institution’s alleged violation of state consumer protection laws related to its auto loan underwriting practices. [More]

auto loans

Feds Investigate Auto Lender For Its Use Of GPS Device To Remotely Disable Cars

Once upon a time, if you fell behind on your car loan, the repo guy came out in the middle of the night and took your collateral-on-wheels back. These days, there are small GPS devices that can remotely disable the ignition until the borrower pays up. However, one auto lender is currently facing a federal investigation for its use of this technology. [More]

John Oliver, Keegan-Michael Key Explain Why Subprime Car Loans Are So Awful

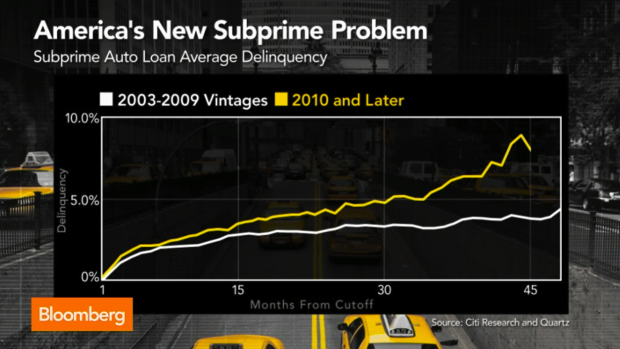

Subprime car loans are pretty much terrible. They’re exploitative of lower-income borrowers, financially risky for lenders, and frankly the only thing that keeps them from being every inch as disastrous for everyone as subprime mortgages — so far — is that their dollar values are lower. [More]

Honda Financial Services Really Sorry They Double-Billed Customers

If you can’t get through to Honda Financial Services, the automaker’s U.S. financing arm, don’t be surprised: they’re currently dealing with a double-debiting fiasco affecting customers who submit payments online. Some customers report that their accounts have overdrafted due to the unexpected double payments. [More]

Toyota Must Pay $22M For Charging Higher Interest To Non-White Borrowers

Under the Equal Credit Opportunity Act, creditors are prohibited from discriminating against loan applicants based on race or national origin. But that was a rule Toyota’s financing unit allegedly violated, resulting in thousands of African-American, Asian and Pacific Islander borrowers paying higher interest rates than their white counterparts. Now, in an effort to resolve charges filed by the Consumer Financial Protection Bureau, Toyota Motor Credit Corporation must pay $21.9 million to wronged consumers. [More]

“Buy Here, Pay Here” Dealer To Return $700K To Consumers Over Deceptive Lending Practices

Federal regulators continued their crackdown on not-so-upfront “buy-here, pay-here” auto dealers today, ordering a Colorado-based dealer to pay nearly $1 million in restitution and fines for operating an abusive financing scheme. [More]

Regulators Take Action Against Fifth Third Bank For Auto-Lending Discrimination, Illegal Credit Card Practices

Federal regulators dished out a double dose of enforcement today by taking action against Fifth Third Bank for allegedly charging higher interest rates to minority borrowers for car loans and deceptively marketing credit card add-on products to bank customers. [More]

Auto Loan Debt Tops $1 Trillion For First Time; All Consumer Debt Nearing $12 Trillion

Now that the Great Recession has gone from “is it really over?” to “remember when?” more Americans are buying cars, pushing auto loan debt beyond the $1 trillion mark for the first time in U.S. history. [More]

Santander’s Auto Loan Business Under Federal Investigation

Each year, Santander writes or services billions of dollars worth of auto loans and leases in the U.S., making it one of the nation’s largest providers of automobile financing. Yesterday, the company revealed that the Consumer Financial Protection Bureau is looking into whether Santander violated federal fair-lending laws. [More]

Honda Finance Unit Must Pay $24 Million For Charging Higher Interest To Non-White Borrowers

Under the Equal Credit Opportunity Act, creditors are prohibited from discriminating against loan applicants based on race or national origin. But that was a rule Honda’s financing unit allegedly violated, resulting in thousands of African-American, Hispanic, and Asian and Pacific Islander borrowers paying higher interest rates than white borrowers for their auto loans. Now, as part of a settlement with federal regulators to resolve allegations that the company allowed discriminatory loan pricing, the company must provide $24 million in restitution to borrowers. [More]

Risk Evaluation Report Finds Mobile Banking Leaves Some Banks More Vulnerable to Cyber Attacks

While mobile banking is no doubt convenient for customers – and banks – there’s a significant downside to the fact that more and more financial institutions are using the technology: an increased risk that your personal information will fall in the hands of a cyber criminal. [More]

CFPB To Oversee Non-Bank Auto Financing Companies

While some folks get their car loans from the bank or credit union, many Americans finance their vehicle purchases through non-bank entities, including auto dealers. But until now, the federal Consumer Financial Protection Bureau only had regulatory authority on car loans issued by financial institutions. A new rule from the CFPB will soon give the agency oversight of the nation’s largest non-bank auto finance operations. [More]

Looking To Finance A New Or Used Vehicle? You’re Likely In For The Long-Haul

Purchasing a new or used vehicle can represent quite a commitment for consumers, especially as the length of an average vehicle loan continue to get longer, now reaching all-time highs. [More]

CFPB Proposes Rule To Oversee Automakers’ Financial Units, Stop Discriminatory Lending

The lending arms for national car dealers, such as Ford and Toyota, may soon have to answer to federal regulators. The Consumer Financial Protection Bureau released a proposed rule that would give the agency oversight of automakers’ financing units in a step to prevent discrimination and other harmful practices – marking a move that was applauded by several consumer advocacy groups. [More]

Banks Can’t Get Away With Horrible Mortgage Practices Anymore, So Now They’re Doing It With Car Loans

Subprime loans: they aren’t just for mortgages anymore. The next big bubble of ill-advised loans to borrowers who can’t pay is coming due. This time, it’s used car dealers reaping the interest and repossessing the cars. [More]

Why Are Some People Having A Harder Time Paying Off Car Loans Post-Recession?

For many of us, things have improved since 2010, when the country finally began clawing its way out of the crater that resulted from the collapse of the housing market. So why are some consumers doing a worse job of making car loan payments than they were during the recession? [More]

Ally Bank To Pay $98 Million For Charging Higher Interest To Non-White Borrowers

Earlier today, the Justice Dept. and the Consumer Financial Protection Bureau announced the largest auto loan discrimination settlement in U.S. history with the news that Ally Bank has agreed to pay $98 million, including $80 million in refunds to settle allegations that it has been charging higher interest rates to minority borrowers of car loans. [More]

How Much More Expensive Is It To Have A Bad Credit Score?

Most people know that having a less-than-perfect credit score makes it more difficult to get a loan. And for those who can manage to be approved for a loan or new credit card, it also means they will end up with higher payments. [More]