Nearly four years after tax refund anticipation loans were all but removed from tax preparation offices, similar costly financial products continue to be offered to many low-income consumers in need of a cash infusion before their tax refund actually hits the bank. This appears to be the case for a loan company accused of providing thousands of refund anticipation-like loans with hidden fees to people living in and around the Navajo Nation. [More]

apr

Lawsuit Claims Lender Targeting Navajo Nation Deceived Customers On True Cost Of Tax Refund Anticipation-Like Loans

Feds Go After Pawnbroker For Misleading Costs On Auto-Title Loans

Pawnbrokers offer cash-strapped consumers an avenue to acquire quick cash in exchange for holding possession of their valuables, sometimes stepping into the world of such things as auto-title loans. One such company is now facing the ire of federal regulators for allegedly deceiving customers about the cost of its loans. [More]

The Average Credit Card Now Comes With An APR Of Over 15 Percent

With credit card interest rates reaching new highs, you might want to try to pay off that card as fast as you can, so you don’t end up paying through the nose if those rates continue to climb. [More]

Even Wells Fargo CEO Powerless To Reduce Your Punitive APR

The APR on Kevin’s Wells Fargo credit card got jacked up from 9.6% to almost 23%. He owes $16,000. At 9.6, he could afford to make double the monthly payments, but now he’s paying $300+ a month in finance charges alone. He’s begged up and down the hierarchy, from the CEO to any exec or VP he could reach, to please reduce his APR so he can carry this debt. Nope. The numbers have spoken. The odds are calculated. Your risk has been assessed, and the verdict has been issued: you lose. [More]

Ending The 0% Balance Transfer Era

Ah, the glory days of American credit cards. When your credit card’s interest rate went too high, you could find a different card with a deliciously low promo balance transfer rate, and revel in your low interest. At least, until you let the card sit idle too long or made a late payment, and then started the cycle over again. But no more.

House To Pass Credit Card Reform, Tell The Senate To, Too

The House is expected to pass the Credit Cardholders’ Bill of Rights Act today, and the Senate is considering similar legislation. The Senate battle will be harder, but you can help!

Capital One Does Not Appreciate You Being Responsible, More Than Doubles Your APR

Beverly, who always pays on time and recently started paying off her balance in full every month, just saw the rate on her Capital One card more than double, from 13.9% to 29.4%. That’ll teach you to not help sink the economy, Beverly!

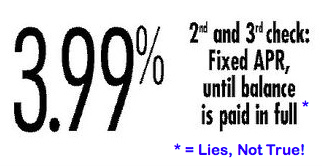

Chase Promises To Honor Promotional APR Until Balance Is Paid Off Or They Change Their Mind—Whichever Comes First

Chase doesn’t want to honor an old promotion promising to lock in a customer’s APR until their balance is paid off, so they’re just ignoring the original terms and jacking up interest rates. The bank wants to hike a promised 3.99% rate to either 7.99%, or 5% of the total balance plus a $10 monthly service charge, terms that are dull enough to put you to sleep until you receive the next month’s bill. Inside, Credit Slips walks us through how this is legal, along with tips for recapturing the stolen promotional rate.

24% APR Crushes Reader To Death

I have a card with one bank (that I am trying my hardest to pay off ASAP) that is 24% APR. It is killing me. A week or two ago, you had an article about a woman who paid off all her credit card debt over the course of 20 months or so. Good for her and it was a good story. One thing about it had me wondering though. She said that she negotiated with her lenders to get lower interest rates on her cards. How do you suggest I do that?

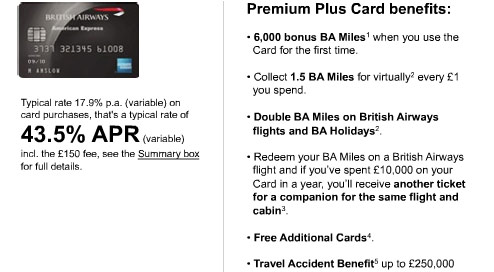

The 43.5% APR Credit Card

Perhaps this British Airways American Express Premium Plus Card’s interest rate is in “metric” APR, but if not, no matter what side of the pond you’re on on, or road you drive on, you must agree that a 43.5% variable interest rate is bollocks. Who cares how many bonus miles you get, they’re just going to get devalued anyway.

BoA Closes Your Credit Cards If You Ask Why They Increased Your APR

It’s evident the pendulum swung too far in terms of giving away too much credit, but now it seems to be swinging back in the opposite direction just as hard, with banks getting too tightfisted, even when it doesn’t make sense. For instance, the APR on James’s BoA credit card jumped from 9.32% to 13.99%, and shortly after he called to see about getting it back, they closed all three of his credit cards. One was a Gold account with a lifetime APR of 7.99%, the other had a 1.99% APR. Just last month, he received an offer to transfer $15,000 to the 1.99% card. Obviously at least one department in Bank of America thinks he’s a good credit risk. It appears some other expressionless faces of the massive dodecahedron that is the entity called Bank of America disagreed.

American Airlines Refuses To Accept American Airlines Credit Card

American Airlines told Justin that they could not accept his American Airlines credit card due to a bug in their spiffy new booking system. Justin wanted to charge a trip to Disney World on the card, which unlike standard credit cards, is supposed to work exclusively for purchasing tickets with American Airlines.

Using Your Chase Credit Card Is Cause For A Rate Increase

Chase likes to raise the rates of cardholders whose only fault is properly using their credit card, according to an ABC 15 investigation. The rate hikes affect cardholders who do not exceed their credit limits or miss payments, with some APRs jumping from 7.99% to over 22%. From ABC 15:

A Big List Of 0% APR Credit Cards

We know how you guys love 0% APR credit cards, so check out this list of 50 of them from Consumerism Commentary. 0% APR credit cards let you do a number of things—you can use someone else’s money for free, help yourself pay off your debt without gaining interest, etc. Each offer is different, however, so you want to make sure you read and understand the conditions of the offer and choose one that fits your needs.

Consumerist's 10 Commandments of Credit

Keeping a balance on a credit card is a sin in the eyes of the Consumerist. If you have a balance, make it your priority to pay it off as quickly as possible.

../..//2007/06/29/money-crashers-shares-some-ideas/

Money Crashers shares some ideas for fighting Universal Default, the practice whereby if you fall behind on your payments with one lender, they alert other lenders, who then use that as an excuse to jack up your rates.