Having one of your online accounts hacked is like having a reality show on Bravo — it’ll happen to all of us at some point. Given how commonplace hacks are, you might assume that multibillion-dollar online operations would have a process in place for dealing with compromised accounts. You’d be mistaken. [More]

account

Four Executives Fired Over Wells Fargo Fake Account Fiasco

The Wells Fargo fake account fiasco has already resulted in the “retirement” of the bank’s CEO, John Stumpf, and Carrie Tolstedt, Wells’ head of retail banking, for allowing employees to open millions of unauthorized accounts in customers’ names. But the bloodletting isn’t done yet, as Wells has dismissed four additional executives without the PR-friendly spin of “retirement.” [More]

Are Cardless ATMs Safe? $3,000 Goes Missing From Man’s Chase Account

Last year, Chase began installing cardless ATMs that allowed users to withdraw cash and perform other tasks by inputting a code sent to their banking app at the machine. While the system can be convenient and might relieve some of the worry of using ATMs compromised with a skimmer, the new machines pose other threats as one man learned when $3,000 disappeared from his account. [More]

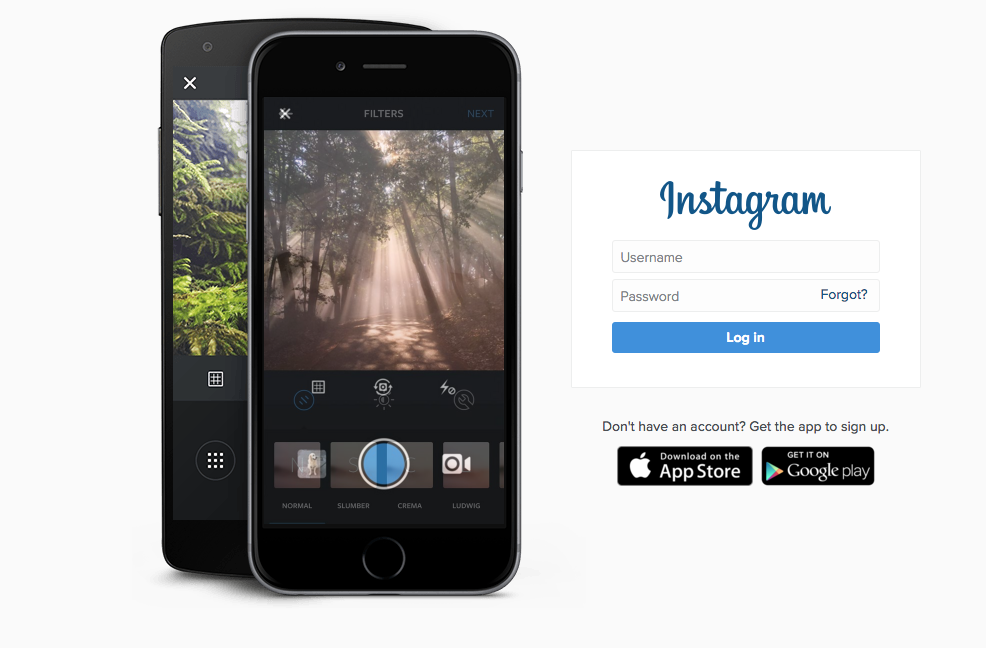

Instagram Adding Two-Factor Authentication To Better Protect User Accounts

While Instagram may not have endured the same high-profile, embarrassing hacks that Twitter experienced in the past, the photo-sharing site is taking a page from the social media service — and other tech, networking, and retail companies — by enabling two-factor authentication for user accounts. [More]

Is Your Free Checking Account Really Free?

Not all free checking accounts are free. Many come laden with fees that surprise consumers who don’t carefully read the fine print. FreeMoneyFinance snagged an except from the book Banking Secrets Revealed that lists many of the charges to ask about before opening an ostensibly free account: