With thousands of former Corinthian Colleges students waiting to find out if their federal student loan debts will be discharged because the now-defunct for-profit college allegedly deceived them with false promises related to their future careers, the Department of Education announced the creation of a special enforcement unit with the goal of being able to respond quickly to allegations that colleges are violating the law. [More]

Education

Struggling University Of Phoenix Parent Company To Go Private

Between its sinking stock price, sagging enrollment, and the hot spotlight of federal investigations, the nation’s largest for-profit education chain has decided to go private. [More]

For-Profit Beauty School Chain Shuts Down Just Days After Losing Federal Funding

Just days after losing access to federal student financial aid because it allegedly falsified records and overcharged students, the for-profit Marinello Schools of Beauty has shuttered all of its campuses. [More]

Two For-Profit College Chains Lose Government Funding Over Misrepresentations, Inflated Job Placement Rates

If you hear a for-profit college touting its high job-placement rate, you’ve got good reason to be skeptical. Federal regulators have cut of government funding to two more for-profit education chains caught inflating placement stats.

[More]

Feds Order Debt Relief Schemes To Cease Misleading Use Of Government Logos

Even though it’s incredibly easy to slap a government agency’s logo on your website, that doesn’t make it okay. Just ask the two debt relief companies that have been ordered to stop using Department of Education logos to mislead student loan borrowers. [More]

High School Grads Failed To Claim $2.7B In College Grant Money Last Year

If you’re planning to attend college in the fall but haven’t gone through the not terribly difficult process of filling out a Free Application for Federal Student Aid, you’re potentially giving up your chance to claim thousands of dollars in free money. But you wouldn’t be alone; a new analysis shows that U.S. students failed to claim upwards of $2.7 billion last year because they didn’t take the time to fill out a piece of paper. [More]

Dept. Of Education Working On Rules For Defense Of Repayment Law After Influx Of Claims

Under federal law, student loan borrowers may be eligible to have their debts discharged if they prove the school they attended deceived them with false promises related to their future careers. However, the measure has been used only sparingly in the past and few clear rules outline the forgiveness process. Now, after nearly two decades on the books, federal officials are finally getting around to crafting rules that could remove one roadblock for students seeking relief. [More]

Judge Orders University Of Phoenix Parent Company To Turn Over Documents To Feds

Just because the University of Phoenix may be able to once again recruit on military bases and enroll new students using the military tuition assistance program doesn’t mean the for-profit college behemoth’s problems are behind it. Instead, a court ruled last week that the school’s parent company, Apollo Education Group, must provide records requested by federal investigators nearly six months ago. [More]

University Of Phoenix May Be Up For Sale

Increased government scrutiny and falling enrollment at the University of Phoenix may be too much for Apollo Education Group, the parent company of the for-profit college mega chain. The company is reportedly exploring its options on what to do with the school, including a sale. [More]

New York Program Will Pay For Two Years Of Recent Graduates’ Student Loans

For many recent graduates, repaying their education debt obligations can be a struggle. For some in New York, that struggle just got a little less cumbersome thanks to a recently launched student loan forgiveness program that aims to help the debtors land on their feet after graduation.

Looking Ahead: 5 Big Issues To Follow For 2016

Now that 2015 is done and we finally learned that Luke Skywalker is actually Faye Dunaway’s daughter (and sister!), it’s time to take off the party hats, sweep up the confetti, and do the walk of shame forward into the uncharted territory of the year to come. [More]

How The Federal Government Tries To Keep Financially Troubled Colleges From Failing

Under federal law, colleges that record a student loan default rate of 30% or more for three consecutive years – or 40% in a single year – can lose their access to federal aid. While the rule is meant to weed out bad players and schools that don’t provide students with means for gainful employment, a new report shows that the government often intervenes, propping up schools just before they fail. [More]

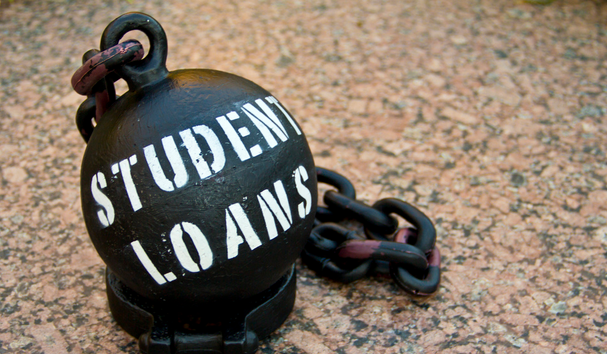

7 Things We Learned About Federal Student Loans & The Companies That Profit From Them

Fifty years ago, Congress created the federal loan program as a way to help Americans realize their dreams of a better life through higher education. While millions of students have no doubt benefited from the program, millions of others have found themselves burdened by mountains of debts, fielding calls from debt collectors and loan servicers, and watching as their paychecks are whittled down by garnishments. Today, seven million former college students are in default with a record $115 billion in federal loans. While those figures may be oppressing borrowers, it’s providing a stream of income – and profit – for companies contracted by the government to collect payments from debtors. [More]

Feds Forgive $103M In Debt For Nearly 7,000 Former Corinthian College Students

Nearly 7,000 additional former students of defunct for-profit chain Corinthian College will have their loan debt erased by the federal government. While the $103 million tab sounds like a lot, it’s only a fraction of the billions of dollars that Wyotech, Heald College and Everest University charged in tuition. [More]

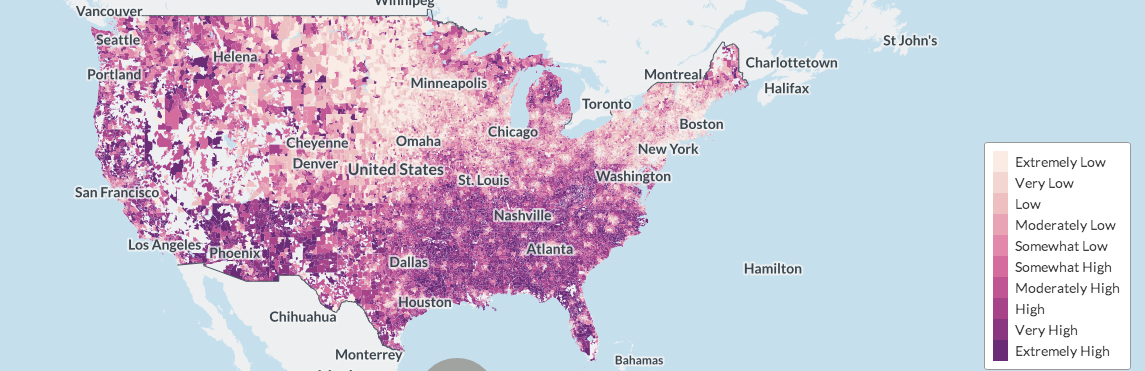

Data Shows Borrowers With Less Student Loan Debt More Likely To Default

When you hear about someone defaulting on their student loans, you might assume this borrower took out several tens of thousands of dollars to pay for their education. But a look at the data shows that those borrowers who are most likely to default are often the ones who owe the least.

[More]

Corinthian College’s Misleading Job-Placement Info Could Result In Faster Debt Relief For Students

Thousands of students affected by the abrupt closure of for-profit college educator Corinthian Colleges’ Wyotech, Heald College and Everest University campuses could soon have more options when it comes to receiving debt relief after a joint investigation by the California Attorney General’s office and the Department of Education found additional evidence that the schools misrepresented job placement rates for several programs in order to enroll students. [More]