Sketchy Debt Relief Company Accused Of Impersonating Federal Agency

In a sweet case of karma, a debt relief operation that claimed to wipe away consumers’ debt through an affiliation with the Consumer Financial Protection Bureau has been sued by none other than that exact same agency.

The CFPB announced Thursday that it had filed a lawsuit against debt-relief operation Federal Debt Assistance Association and Financial Document Assistance Administration, and affiliated company Clear Solutions, accusing the organizations of engaging in unfair, deceptive, and abusive practices related to debt relief.

Baltimore-based Federal Debt Assistance Association and Financial Document Assistance Administration — doing business as FDAA — claimed to provide advice and assistance to consumers to eliminate all or a portion of their debts and improve their credit scores.

Clear Solutions, also based in Baltimore and owned by the same individuals as FDAA, was in charge of processing payments for the companies and providing other services.

There’s No Affiliation

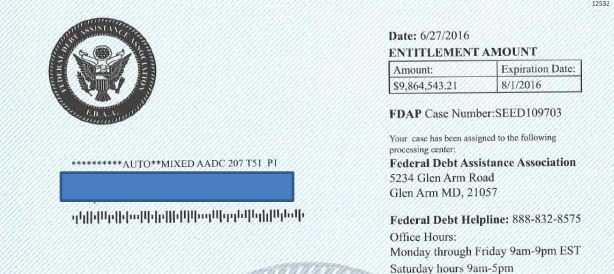

According to the CFPB’s complaint [PDF], in order to appear legitimate the two FDAA operations claimed to be affiliated with or endorsed by the federal government, specifically the CFPB and the Federal Trade Commission.

The companies marketed their so-called debt-validation programs as a way for customers to receive a portion of the fines and restitution the CFPB obtains through enforcement actions against banks and credit-card issuers. These funds would be passed on to the customer in the form of credit card debt reduction.

Federal Debt and Financial Document touted their programs as being approved by the FTC, telling customers that they and their agents were “authorized to review, consult, and prepare consumer protection documents on your behalf.”

In reality, the Bureau claims the companies do not have and never have had any involvement in providing relief or restitution obtained by the CFPB to individuals or working on behalf of the FTC.

Targeting Customers

Federal Debt and Federal Document also targeted financially distressed customers with debt-relief programs, the CFPB alleges.

To do this, the CFPB claims the company purchased consumer information from national list brokers, specifically targeting individuals who were using at least 85% of their available credit on their credit cards, who had at least $30,000 in debt on those cards, and who were current but had a recent delinquency.

The companies would then send these consumers direct mailers or pre-recorded messages that claimed individuals were involved in a class-action lawsuit with millions of dollars in settlements.

The direct mailers included a seal meant to look as if it were from a government agency, sharing several similarities with the Great Seal of the United States.

Inflated Results & High Fees

When promoting their debt-validation program to potential customers, FDAA allegedly claimed the service was the most beneficial debt-relief option available.

The companies claimed that they could reduce a customers’ principal debts by “at least 60%” and improve credit scores within the first year.

In order to achieve these results, however, the company charged upfront fees ranging from $12,000 to $19,000.

Under federal law, companies are prohibited from collecting such fees before a credit-repair or debt-relief company actually achieves results.

Still, these payments were sent to Clear Solutions which processed the funds and maintained accounts for Federal Debt and Financial Document.

The Process

After the fees were paid, the companies instructed customers to stop making payments on all their debts.

However, they failed to disclose that not making payments may result in the consumer being sued by creditors or debt collectors and may increase the amount of money the individual owes due to the accrual of fees and interest.

When a debt collector or service provider contacted the customer, FDAA said they would send a response on the customer’s behalf asking for “Notice and Demand for Verification of Debt.” The CFPB notes that this notification was not tailored to the customer’s dispute or to the facts surrounding the debt.

If within 30 days, the collector failed to provide answers to the request, FDAA would send a “Notice of Insufficient Response” (NOI).

If FDAA did not receive what it considered a sufficient response to the NOI after 15 days, it would deem the debt invalid and produce a “commercial record” stating the debt balance was zero.

In reality, the CFPB contends that Federal Debt and Financial Document’s practices did not eliminate debt balances as a matter of law.

“FDAA and its owners lied to financially vulnerable consumers to line their pockets with cash,” CFPB Director Richard Cordray said in a statement.

With the complaint, the CFPB is seeking monetary relief for affected individuals and civil penalties against the operation.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.