Uber Ordered To Pay $20 Million For Allegedly Exaggerating Drivers’ Potential Earnings Image courtesy of Alper Çuğun

Popular ride-hailing service Uber has agreed to pay $20 million to close the book on federal charges that it used misleading and exaggerated earnings figures to attract new drivers to work with the company.

In a civil complaint [PDF], the Federal Trade Commission accused Uber of violating the law by using inflated income figures when marketing to potential drivers.

The FTC points to previous statements by Uber’s CEO that drivers for UberX — the standard level of car service for many Uber users — earned a median income of “more than $90,000/year/driver in New York and more than $74,000/year/driver in San Francisco.” This statement was later revised to say that these figures were “potential” earnings drivers could make in their respective cities.

However, the complaint contends that the real earnings figures, when calculated using a 40-hour work week, were significantly lower. According to the FTC, in 2014 — the year that the above statement was first made — a New York City Uber driver earned a median income closer to $60,000, while in San Francisco the actual median was around $53,000. Fewer than 10% of drivers in these two markets earned the potential income that the company had boasted about.

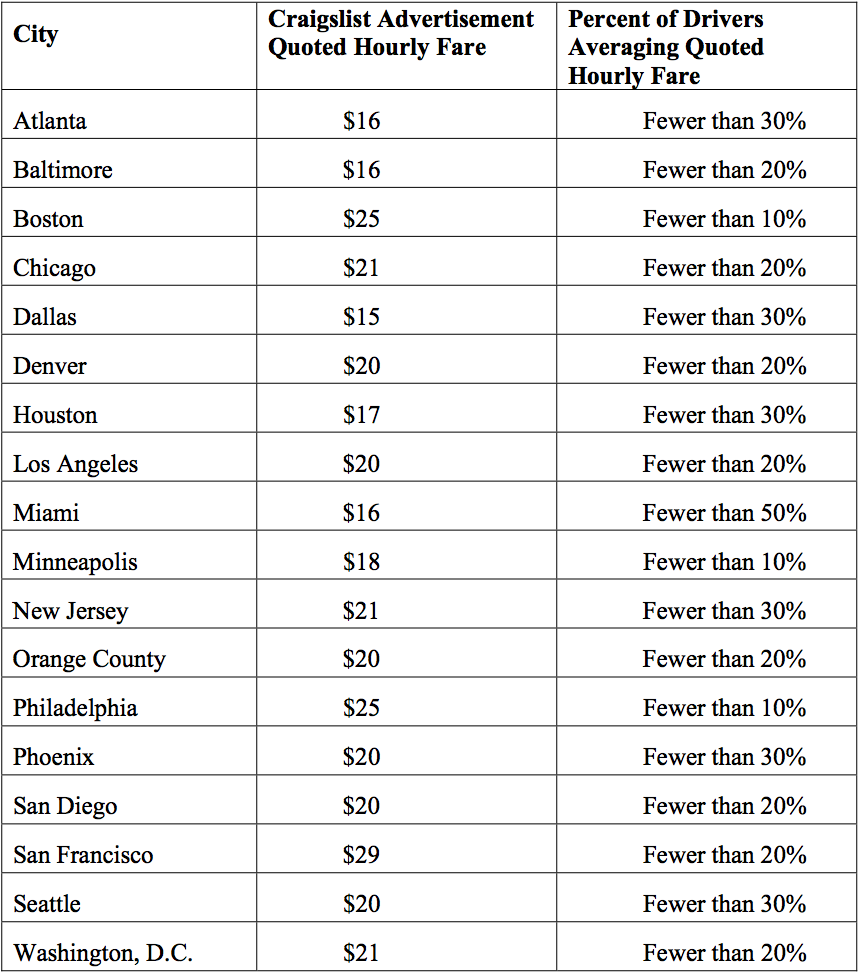

Beyond these statements from the CEO, the FTC also took issue with Craigslist ads posted by Uber in various markets around the country, advertising that Uber drivers could earn anywhere from $16 to $29 per hour, depending on the city.

Yet the FTC claims that actual earnings data from these cities shows that very few Uber drivers average the amounts touted in the ads. According to the following table, in some markets — like Boston, Philadelphia, and Minneapolis — fewer than 10% of drivers earned the advertised hourly average:

The FTC also saw problems with how Uber marketed its Vehicle Solutions Program, which allows people without cars of their own to finance a vehicle purchase while then using that car to drive for Uber.

After this program launched, Uber advertised it to potential drivers as a way to “own a car for as little as $20/day” or that drivers could lease a car with “payments as low as $17 per day.”

Problem is, according to the FTC, Uber had no actual information to base any of these statements on, and the reality of the lease terms has not been in line with what was advertised.

“Despite the claims that Drivers can make low weekly payments, the median weekly payment for Uber Drivers who entered into a lease from late 2013 through at least April 2015 has been over $200, while the median weekly payment for Uber Drivers who opted to purchase their vehicles through Uber’s Vehicle Solutions Program during the same time period has been over $160,” notes the complaint. “Further, information Uber had at the time it made the claims indicate that the claims are false. Uber’s communications with at least one auto company have acknowledged payment terms and conditions that are inconsistent with Uber’s promises to Drivers.”

The FTC also claims that many drivers who entered into the Vehicle Solutions Program thinking they would get a good deal actually ended up with interest rates that were likely higher than they would have received elsewhere.

“Uber’s marketing material to dealers has acknowledged that the lease-to-own option was a ‘one size fits all’ product with an ‘implied APR of 19.5%,’ significantly higher than even the industry average interest rates for consumers with deep subprime credit scores,” notes the FTC. “Additionally, the average rate of the other auto deals for Uber Drivers has been higher than the industry average for consumers with similar credit scores. Numerous Drivers who have purchased cars through Uber’s Vehicle Solutions Program have received interest rates on their retail installment contracts that are more than double the industry average rate for consumers with similar credit scores.”

Additionally, the FTC says that Uber misled drivers in this program into thinking they would not be bound my the typical mileage restrictions you see on many auto leases, by touting “unlimited miles.” In reality, according to the complaint, the leases obtained through the program came with annual mileage limits of between 37,500 and 40,000 miles.

These various allegedly misleading claims are in violation of the FTC Act, which prohibits deceptive business practices.

In addition to the $20 million judgment [PDF] against Uber, the company has agreed to refrain from misrepresenting the facts about drivers’ earnings, and the terms of its auto financing and leasing programs.

“Many consumers sign up to drive for Uber, but they shouldn’t be taken for a ride about their earnings potential or the cost of financing a car through Uber,” says Jessica Rich, Director of the FTC’s Bureau of Consumer Protection. “This settlement will put millions of dollars back in Uber drivers’ pockets.”

When reached for comment, Uber provided the following statement to Consumerist via email:

“We’re pleased to have reached an agreement with the FTC. We’ve made many improvements to the driver experience over the last year and will continue to focus on ensuring that Uber is the best option for anyone looking to earn money on their own schedule.”

Today’s settlement was not unanimously supported by all three sitting FTC commissioners.

Commissioner Maureen Ohlhausen dissented from the decision, voicing concerns about how the Commission came to the $20 million settlement figure, noting that it appears to unrelated to any actual harm that may have been done to consumers as a result of these alleged FTC Act violations.

Ohlhausen contends that the overstated earnings boasts likely only caused “consumer injury that is a small fraction of today’s settlement,” and that the $20 million settlement amount “far exceeds the best estimate of actual consumer harm.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.