It Takes Dozens Of Companies To Make Your iPhone Image courtesy of SirMo76

Where does your mobile phone actually come from? What company makes it? How many people — how many businesses, how many factories, how many hands — were involved in its making? Most of us probably have no idea whatsoever how to answer those questions.

A smartphone comes from Apple or Samsung, sure, from the Verizon store or Best Buy or a website. It comes from China, maybe? Or some other nation that does a lot of manufacturing. It comes in a box and it works, right? That’s all most of us really think about, on any given day.

But the iPhone in your hand is not only a marvel of modern coding… it’s a miracle of modern logistics. Its supply chain is sprawling, and hard to track. Minerals come from some suppliers. Manufacturing, from others. Each screw, lens, solder, chip, and piece of glass has to be designed, manufactured, shipped, and assembled — before we get anywhere close to the 1.4 million people in the U.S. alone that Apple claims make their living from the “app economy.”

The process is pretty opaque. We all know that the phones aren’t simply wished into being by magical elves, but the reality of how they are made is hard to understand — even after years of efforts to increase transparency.

We’re not here to pick on Apple, just to be clear. In fact, Apple is more transparent about their suppliers and process than most of the competition, which is how we can even write this story: The company publishes a list of its 200 largest suppliers every year (PDF) as part of a corporate responsibility initiative, and says that list of suppliers accounts for 97% of its spending.

So, when you look at that list of suppliers, what do you actually find?

Global Means Global

Without even counting where the minerals are mined, where the phones are used, and the shipping logistics of making it all happen… Apple’s supply chain really is global.

The company’s top-200 list of supply partners includes 753 listed office and manufacturing facility locations worldwide. As you’d likely guess, the majority of those addresses are in China, Japan, and the United States. But other nations, large and small, appear. The full list of of countries involves every continent except Australia and Antarctica, including:

- Austria

- Belgium

- Brazil

- China

- Czech Republic

- France

- Germany

- India

- Indonesia

- Ireland

- Israel

- Italy

- Japan

- Malaysia

- Malta

- Mexico

- Morocco

- Netherlands

- Norway

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- United Kingdom

- United States

- Vietnam

Components are manufactured worldwide, but most of the final assembly is done at factories owned by Hon Hai Precision Industry Co. in Zhengzhou, China. Americans usually recognize that company by its other name, Foxconn Technology Group. The company, which also assembles gaming consoles, other smartphones, and a huge number of other electronics, has an estimated 1.3 million employees in dozens of facilities worldwide.

Some Names You Know

While many of the companies Apple does big business with are completely unknown in the U.S., plenty are major global players in their own right. A sample:

Samsung

One of Apple’s biggest, most important suppliers? A company best thought of as competition in the global smartphone market.

Samsung, a South Korean company with roughly 490,000 employees, makes the actual processor chip that makes your phone — a pocket computer — work. And they make it in… Austin, Texas.

The company makes about 75% of the A9 chips included in the Apple iPhone 6S and 6S plus. Samsung also reportedly manufactured a minority of the A8 chips in the iPhone 6, as well as the A7 (iPhone 5S, several iPads), the A6 (iPhone 5 and 5C), and in fact the processor chips for all iPhones models prior.

So yes: the virtual “brain” that makes your iPhone function is brought to you by the company best known for dominating the high-end Android market.

3M

Home consumers know 3M best for their sticky products: Scotch Tape and Post-It Notes. But they also design and make a whole lot of electronics components. And sure, there are a whole lot of fancy adhesives on that list, because of course there are… but the most important part, for an iPhone, is something called a touch sensor film.

What separates an ordinary glass display screen from a functioning smartphone? Its capacity to respond to a touch interface.

Without that film, there’s no pinch, zoom, or tap. 3M has been supplying touch films to Apple for years and regularly announces some new, upgraded, better version every year or two.

Corning

Your first exposure to Corning, if you’re like many Americans, was a casserole dish on Grandma’s Thanksgiving table. The company sells ridiculous amounts of bakeware and home-user kitchenware under the Corning, Corelle, and Pyrex brands (among others).

But it also, famously, makes Gorilla Glass, a strengthened, toughened, durable glass that does not easily scratch or break and can survive living in your pocket or handbag for a year.

The product is used in basically every smartphone you can think of, including all Apple iPhones. In recent years Apple had been researching alternatives, but those plans didn’t work out and so your iPhone’s still using Gorilla Glass.

Corning just recently announced its newest Gorilla Glass version (5), and will likely to continue to appear in your iPhone for some time to come.

Texas Instruments

Texas Instruments has, of course, always been far more than the company that made your high-school graphing calculator… even if the TI-82 (or its younger siblings) is what most of us immediately envision on reading the name.

The company, which employs 31,000 people in 35 countries, does indeed still have its headquarters in, yes, Texas. It is one of the many in the world that make the processors that drive basically all modern electronic goods. Selling those embedded processors and analog chips to the companies that put them into other products account for about 85% of TI’s revenue.

In the iPhone specifically, TI provides chips that help make sure that when you touch the screen, the insides of the phones can process that into the input signal it is. In other words: something pretty dang important to the basic function of the phone.

TI isn’t the only company that has touch screen controllers in the iPhone; another company, Broadcom, has one in there too. It takes a lot of parts to make the iPhone go.

And Names You Don’t

Dozens of the companies on Apple’s supplier list are almost completely unknown to anyone who doesn’t actually make electronics for a living… even when they’re hugely important. Once again, just a small sample:

Largan Precision

This Taiwanese company has, in a sense, made this entire decade — the entire way we use the internet and communicate with each other — possible. Why?

Because they make the camera lenses that you find in almost every iPhone, and most Samsung Android phones too.

That’s it. That’s what they contribute to the iPhone: camera lenses. The lenses are assembled into the camera module elsewhere, and those modules are then later assembled into the phone itself. But without those lenses, there would be no video chat, no recordings of protests, no Facebook livestreaming from your pocket, no “pics or it didn’t happen.”

The company is expected to continue making lenses for the upcoming iPhone 7 at least, if not also later generations.

Cirrus Logic

This company, which is based in Austin, TX, employs 1100 workers in its 15 locations worldwide. And while it makes some industrial parts, the big thing Cirrus is known for is audio.

Your phone is, after all, a phone. You need to be able to hear what comes through it. Likewise, it is also your modern iPod, Spotify streaming device, and TV-watching tool — all of which require functional audio.

And that’s where Cirrus, and its array of converters, amplifiers, and codecs come in. Those are all the parts that take audio signals — from voice to music — and let them be read into sound for your ears to hear.

Cirrus does not by any stretch only make these chips for mobile devices; you’ll find them inside a wide ray of other audio devices (including on some PC sound cards), too.

Apple is, however, Cirrus’s largest customer… which is why investors and crystal-ball readers look at what Cirrus is up to to prognosticate about future Apple products and stock. (Like those increasingly-plausible rumors that the iPhone 7 will kill the common headphone jack.)

Murata Manufacturing

Murata is a 65-year-old Japanese company that makes almost nothing you’ve ever heard of. Their corporate website touts products from “monolithic ceramic capacitors” to “multilayer ceramic devices” and the happily vague “sensors.”

Those tiny parts pack a big punch, though. Although it does make bluetooth connectors and parts that let your phone have a vibrate setting, Murata’s most important product is a line of ceramic capacitors, minuscule parts that regulate where and how electricity moves inside your phone. No electricity, no phone!

As of 2014, Murata commanded half the international smartphone market for the parts it supplies, and in turn those parts comprised a solid 40% of its overall sales.

It seems to be working: right now, Murata’s valued at about $28 billion, and has been on a generally upward trajectory for years.

Vishay Intertechnology

Vishay is actually an American company with its headquarters in Pennsylvania, although it has manufacturing facilities and offices worldwide. (Apple has 19 Vishay locations on its supplier list.) You can be forgiven for never having heard of it anyway, though, unless you work in electrical engineering.

Vishay makes the sort of parts that make a lot of sense to the folks who design and make electronics like smartphones, but that make almost anyone else’s eyes glaze over in confusion.

The company makes different kinds of semiconductors, which at their most basic are the silicon bits that make computer chips work. It also makes passive components, including resistors and capacitors, that help manage and direct the flow of current inside your phone. In other words: the bits that let the signal go from point A to point B, without letting too much signal go from point A to point B.

Exponential Growth

Once you get past the conveniently-alphebatized list that Apple says accounts for 97% of its expenditures, things start to get really murky.

As we know, Apple has roughly 200 suppliers. Let’s then imagine, for the sake of argument, that each of them has just five. That’s already a total of 1,200 businesses involved. Now let’s say each of those suppliers, in turn, has only three. Only two tiers in, we’re up to 5,000 imaginary companies to keep track of.

That’s just a thought exercise, of course. The actual number could easily be at least an order of magnitude larger, if not far more. Or perhaps, theoretically, smaller, if many companies in that second tier out are actually sourcing their parts and materials from the same suppliers.

But investigating that, and coming to actual numbers, is extraordinarily challenging. Not all companies publish a public supplier list. Most don’t, in fact. And even when they do, there may be strategically missing information.

Because it’s worth noting that although it does publish that comprehensive supplier list, Apple remains incredibly tight-lipped about who makes its parts — to the point where those suppliers are often not allowed publicly to say who they supply.

Apple, for example, is nowhere on Corning’s list of products that use Gorilla Glass. Likewise, Cirrus, also on Apple’s supplier list, is “widely understood,” but not explicitly stated, to have Apple as its largest client. Everything exists in a layer of open secrets and hush-hush need-to-know information — which might be good for those who play the stock market, but doesn’t do much for anyone else.

So why does it matter?

First, because it’s important to realize how complicated the modern global economy is. A butterfly flapping its wings in China might not create a literal hurricane, but it can create a disruption that creates another disruption that slows a train that shifts a contract that alters a supply chain that moves a shipment that puts manufacturing in another country that changes a local economy that, well, you get the idea.

And second: because increasingly, consumers are holding giant corporations responsible for their impact on human rights and the environment. And with a corporation the size of Apple, those effects are profound.

The same problems exist in basically every industry. Clothing retailer Patagonia, for example, has been trying hard for years to excise all exploited labor from their supply chain and make it fully sustainable. It’s a core element of their brand and their consumer appeal — and yet they still can’t make a universal guarantee. Their suppliers are good, but their suppliers’ suppliers’ suppliers’ and subcontractors around the world are all but impossible to reach, track or audit.

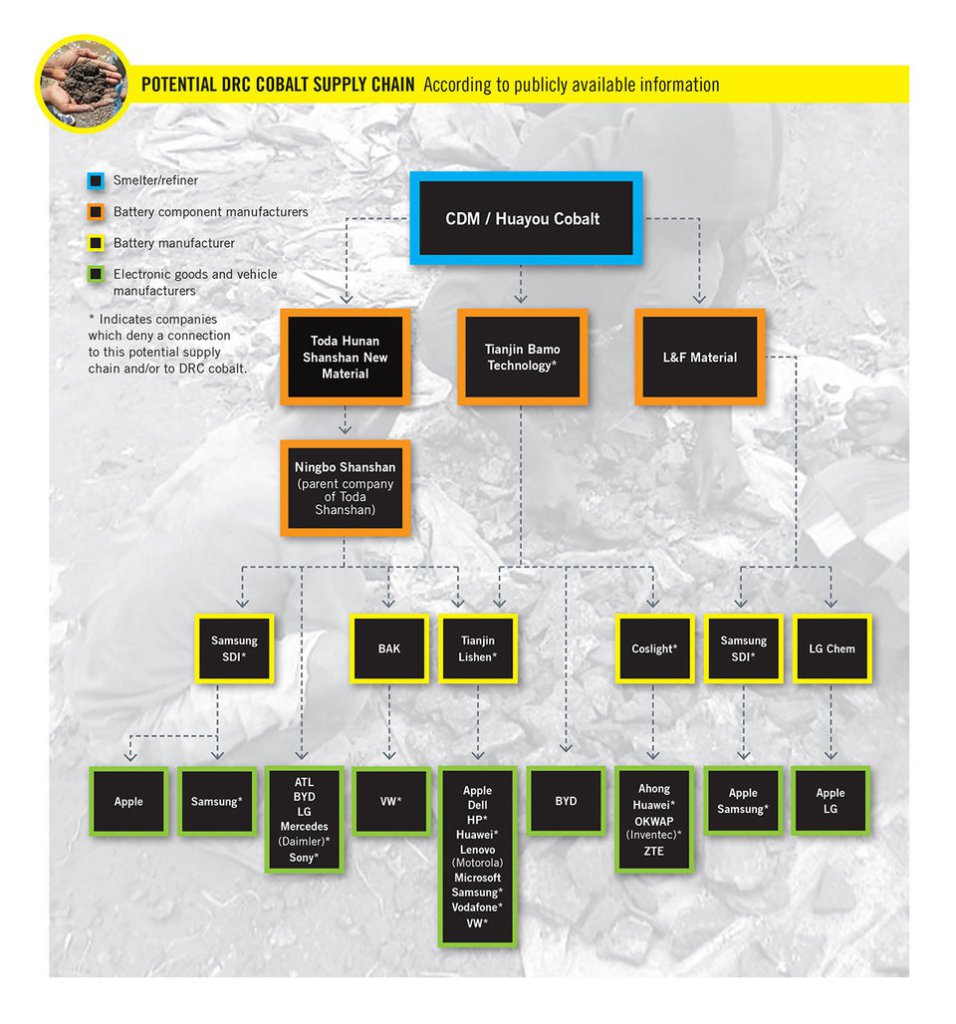

Electronics sourcing is particularly fraught. The delicate components that smartphones need in order to work require elements and minerals — cobalt, tin, tungsten, tantalum, and gold, among others — that are primarily found and extracted in developing, conflict-heavy nations like the Democratic Republic of the Congo.

U.S. law requires publicly owned companies to disclose any use of conflict minerals. (Not to avoid them; just to disclose them.) But to be able to know and accurately disclose that, you have to be able to audit your suppliers. And there’s only so far down the chain most companies can go.

In addition to auditing their own direct suppliers (all 200+ of them), Apple has also explicitly tried to audit for and eliminate suppliers of conflict minerals from the next rung of its supply chain, by going to the smelters. But even then, as experts told Newsweek in 2015: “When you think about the context of these mines being primarily artisanal, very informal, there is no paperwork, so what evidence do any of the audits have to rely on? At the end of the day, we don’t really know what the reality is.”

As for tracking whether or not exploitative child labor is being used in those “artisanal” mines, that’s even harder. Earlier this year Amnesty International released a report showing how hard it is to trace just one component — cobalt — from just one supplier to the companies that end up using it in the end:

From a 2016 report by Amnesty International.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.