Is Cash America Getting Out Of The Payday Loan Business? Not Exactly

A new piece from Dallas Morning News columnist Mitchell Schnurman suggests that one of the U.S.’s largest payday lenders is expected to spin-off its consumer loan operations to its subsidiary Enova by the end of the year.

The move may come as a surprise considering the majority of the Fort Worth, Texas-based company’s revenue comes from from payday lending. Cash America’s payday revenue exploded from $21 million a decade ago to $878 million last year.

This isn’t the first time Cash America has attempted to distance itself from Enova. The company filed paperwork for an initial public offering back in 2012 but canceled the deal.

Of course the separation of Cash American from Enova isn’t a done deal. The Dallas Morning News reports that officials will consider other options such as a sale. Additionally, if the loan operation does spin-off, Cash America plans to retain a small stake for a few years.

It’s unclear what motivation Cash America has for spinning off its loan operations, but the company was subject to a hefty fine from the Consumer Financial Protection Bureau last fall.

Cash America and Enova were accused of robo-signing court documents related to debt-collection lawsuits, illegally overcharging military servicemembers and their families, and trying to cover these actions up by destroying documents before the CFPB could investigate.

In all, Cash America was required to pay out $14 million in refunds to consumers and pay a $5 million fine for its attempt to destroy evidence and documents.

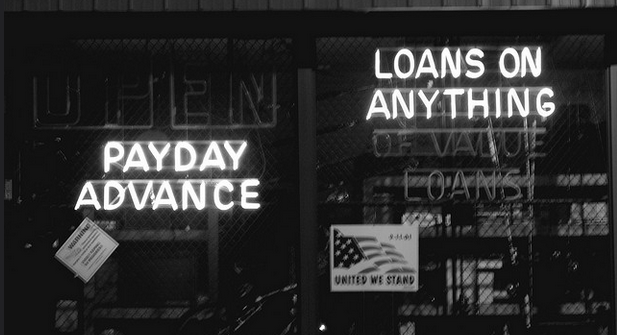

The short-term, high-interest loans – intended to get the borrower through to the next paycheck, but in reality often lead to a revolving cycle of debt – have come under increased scrutiny from lawmakers in recent years.

Stricter restrictions and local laws regulating payday loans may play a part in Cash America’s choice to spin-off its loan operations.

While many states have enacted tougher restrictions and rate caps on payday loans, Texas is home to some of the highest interest and fee costs related to the loans – with the exception of some city restrictions.

Those tough municipal restrictions have resulted in Cash America shutting down 36 stores throughout Texas, The Dallas Morning news reports.

Schnurman: Cash America International ready to exit the payday loan business [The Dallas Morning News]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.