This Is One Of The Scammiest Payday Loans We’ve Ever Seen

Many payday loans have confusing terms and questionable fees that end up costing the borrower a lot more than they’d planned on when they took out the short-term loan. But it’s mind-boggling how one predatory lender managed to squeeze money from borrowers through an automatic opt-in renewal program that turns a $300 loan into $975 worth of payments in only a few months.

Many payday loans have confusing terms and questionable fees that end up costing the borrower a lot more than they’d planned on when they took out the short-term loan. But it’s mind-boggling how one predatory lender managed to squeeze money from borrowers through an automatic opt-in renewal program that turns a $300 loan into $975 worth of payments in only a few months.

In a U.S. District Court order [PDF] in a Federal Trade Commission lawsuit against payday lender AMG Services, there is an example of how the company deceives borrowers — many of whom have little to no experience with the fine print involved in financial transactions — into believing they can easily repay the loan in one payment, when they are actually being opted into an auto-renewal program that will cost them several times the amount of the original loan.

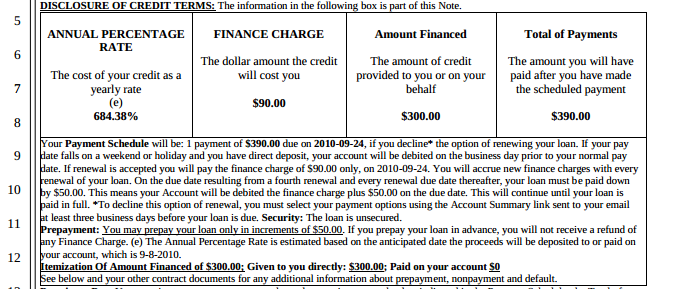

At the top of this post is the Truth In Lending Act info from an AMG payday loan for $300. What’s presented in the large boxes seems to indicate that the borrower will have to pay a $90 fee for a short-term $300 loan. That’s a supersized chunk of a fee, but it’s not outside the norm for payday lenders.

But then, in the fine print underneath those boxes, it reads:

“Your Payment Schedule will be: 1 payment of $390.00 due on 2010-09-24, if you decline* the option of renewing your loan. If your pay date falls on a weekend or holiday and you have direct deposit, your account will be debited on the business day prior to your normal pay date. If renewal is accepted you will pay the finance charge of $90.00 only, on 2010-09-24. You will accrue new finance charges with every renewal of your loan. On the due date resulting from a fourth renewal and every renewal due date thereafter, your loan must be paid down by $50.00. This means your Account will be debited the finance charge plus $50.00 on the due date. This will continue until your loan is paid in full. *To decline this option of renewal, you must select your payment options using the Account Summary link sent to your email at least three business days before your loan is due.”

To break that block of text down, this says your payment schedule is the single payment, but only if you opt out of the renewal program. Otherwise, you will start making $90 weekly payments for four weeks, none of which will go to pay down the loan balance. After the four payments, you then have to start paying an additional $50 that finally goes against the principal.

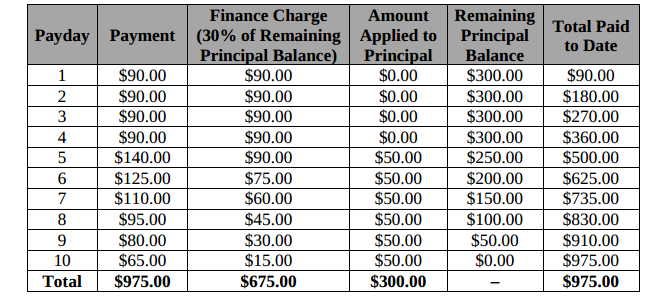

As the below chart shows, within 10 weeks, a $300 loan results in a total of $975 of payments, more than three times the amount originally borrowed:

The District Court judge in this case recently agreed with an earlier magistrate court ruling that AMG’s disclosures were misleading and deceptive.

Additionally, internal AMG documents obtained by the FTC show that employees were instructed to not make it clear to borrowers that they were being automatically added to the renewal program.

After a sales rep expressed concern that the language of the loans was not clear to borrowers, a training manager responded that this was on purpose.

“When we are trying to sell it I think we should leave out terms like renew and pay down,” reads the e-mail presented in the FTC case. “We don’t want to complicate things if we are trying to get them to get a loan. I have heard many times customers ask to withdraw the loan after the explanation and I believe that a lot of it has to do with the way it is explained.”

The judge wrote that these records indicate that “employees were instructed to conceal how the loan repayment plans worked in order to keep potential borrowers in the dark.”

AMG has been in a legal battle with the FTC for two years, when it tried to block a 2012 lawsuit filed by the regulators by claiming tribal affiliation.

In March of this year, the court shot down that notion, ruling that lenders can not shield themselves from U.S. law merely by operating from a base on tribal lands.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.