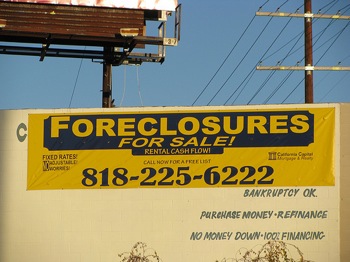

Foreclosures Slow Down An Itsy Little Teensy Bit, But Not For Everyone

Once again looking for anything even vaguely resembling a silver lining in these craptastic economic times, a new report shows that, while foreclosures did increase overall in February, they only increased a little bit… relatively speaking.

According to RealtyTrac, February saw the lowest year-over-year increase in filings in Jan. 2006 and filings were actually down 2% from the month before.

But before everyone gets their hopes up, RealtyTrac cautions, “This leveling of the foreclosure trend is not necessarily evidence that fewer homeowners are in distress and at risk for foreclosure, but rather that foreclosure prevention programs, legislation and other processing delays are, in effect, capping monthly foreclosure activity — albeit at a historically high level that will likely continue for an extended period.”

Though Nevada still ranks highest on the list of states with foreclosures, with one foreclosure for every 102 homes, it did see a decrease in foreclosures of over 30% from last February.

The national average was one foreclosure for every 438 homes. Vermont had the fewest foreclosures, with a ratio of only one foreclosure per 39,077 houses.

Meanwhile, six states – California, Florida, Michigan, Illinois, Arizona and Texas – accounted for 60 percent of all foreclosure filings in February, though only Michigan (59%) and Illinois (21%) showed major year-over-year jumps in foreclosures.

Maryland and Utah had year-over-year foreclosure increases of 80% and 90% respectively.

Feb. foreclosure filings at year-over-year low [Philadelphia Inquirer]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.