The retail industry has already politely asked Congress to please not roll back financial reforms involving debit card transactions, but as lawmakers on Capitol Hill inch closer to undoing these protections, retailers are once again voicing their concerns that undoing the 2010 law will lead to higher prices and hurt small businesses. [More]

swipe fees

Is A Restriction On Credit Card Surcharges A Free Speech Violation?

When you think of First Amendment disputes, your mind probably conjures images of protestors, or investigative journalism, or maybe you think of the never-ending debate over where to draw the line between obscenity and protected forms of expression. You probably don’t immediately connect the dots between the First Amendment and a state law about credit card surcharges — but the U.S. Supreme Court has been asked to decide that very issue. [More]

Retailers Tell Fed: Debit Card Swipe Fees Are Still Too Dang High

Even though the Dodd-Frank financial reforms effectively halved the fees that retailers must pay to banks for each debit card transaction, the stores say that amount is still too much. And with all of their legal options exhausted, the retail industry is calling on the Federal Reserve to re-think the cap it put in place nearly five years ago. [More]

Supreme Court Refuses To Hear Retailers’ Complaints About Debit Card Swipe Fees

More than four years after the Dodd-Frank banking reforms directed the Federal Reserve to set a standard for swipe fees — the money charged to retailers by banks for each debit card transaction — the hotly debated issue appears to have hit a dead-end with the U.S. Supreme Court deciding this morning to not hear an appeal from retailers who contend the Fed set the fees too high. [More]

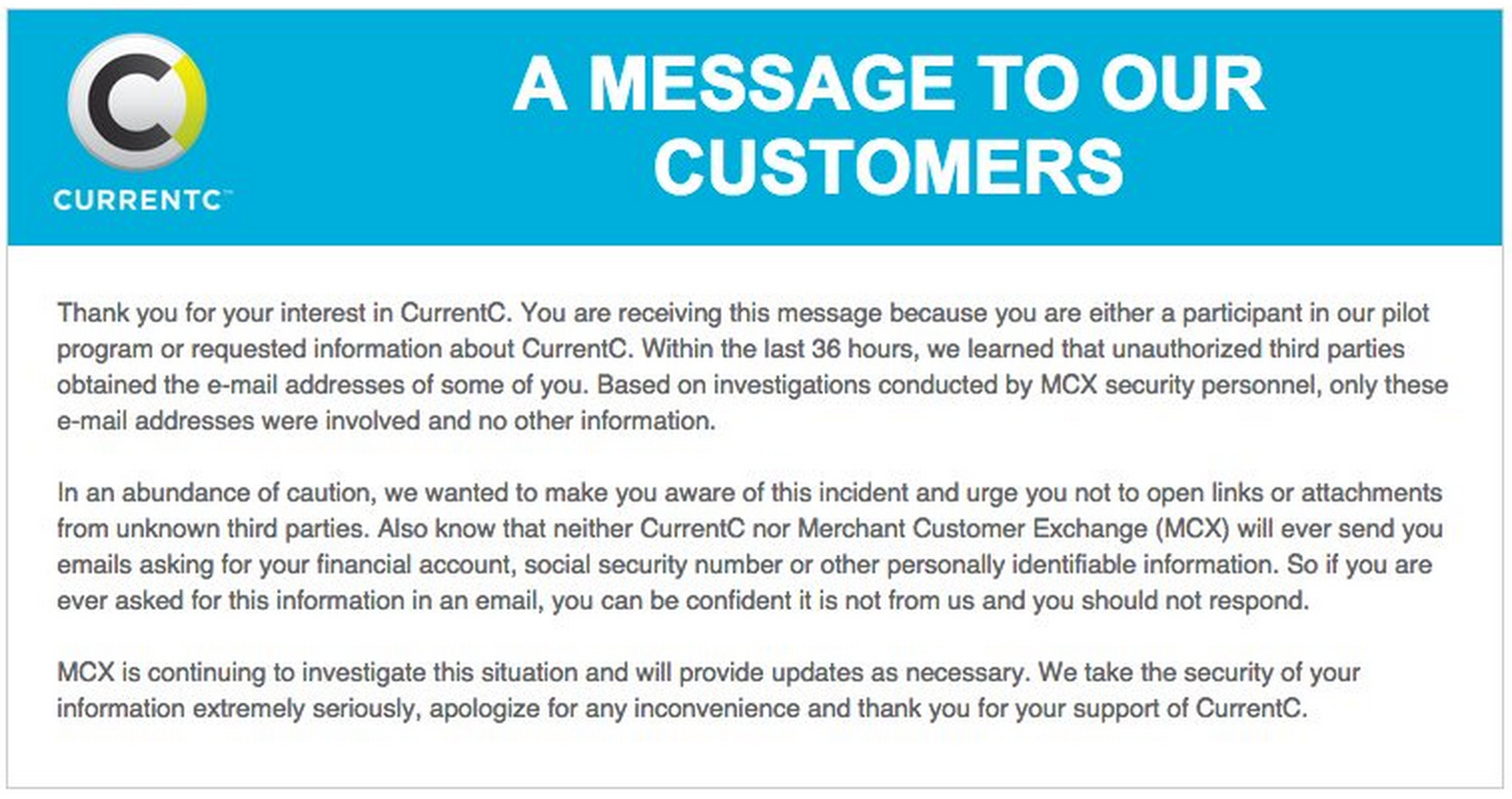

CurrentC, Walmart-Led Competitor To Apple Pay, Has Already Been Hacked

A number of major retailers, most notably Walmart, have yet to allow shoppers to use the recently launched Apple Pay system at checkout, and national drugstore chains Rite-Aid and CVS stopped offering Apple Pay as an option after only a few days. That’s because all of these retailers are part of a consortium working on a competing system called CurrentC, which by the way, has already been hacked. [More]

Why Did CVS & Rite-Aid Stop Taking Apple Pay?

After nearly a week of accepting payment via the recently launched Apple Pay system, both CVS and Rite-Aid suddenly stopped offering this option to shoppers over the weekend. And neither retailer is giving a reason why, though it appears to be part of a retail-industry effort to eventually roll out its own payment system. [More]

Walmart Slaps Visa With $5B Lawsuit For Allegedly Fixing Card Swipe Fees

Thought retailers were done fighting credit card companies over those credit and debit card swipe fees? You thought wrong! Or not wrong, because no one can predict the future, but Walmart is steamed up and suing mad at Visa, alleging in a new lawsuit that the card company set ridiculously high card swipe fees. [More]

Appeals Court Resurrects Fed’s Debit Card Swipe Fee Limits

In a move that will please banks and annoy retailers, a federal appeals court has overruled a lower court decision on swipe fees — the amount banks charge retailers for each debit card transaction — and revived the previous controversial standards put in place by the Federal Reserve in 2011. [More]

Court Strikes Down Fed’s Debit Card Swipe-Fee Rules

One of the more contentious aspects of the recent financial reforms was a directive from Congress for the Federal Reserve to set a cap for swipe fees — the amount charged to retailers for each debit card transaction — in order to bring the fees in line with what it actually costs to process the transactions. This morning, a U.S. District Court judge ruled that the Fed disregarded the intention of the reforms by setting that cap much higher than it should have been. [More]

Walmart Comes Out Against Credit Card Swipe Fee Settlement

Earlier this month, when the Visa and MasterCard announced a massive settlement in the legal battle over credit card swipe fees, it looked like the seven-year-old dispute had finally come to an end — and that we’d all soon be seeing credit card surcharges at retailers. But in just the last few days, the nation’s largest retailers have come out in opposition of the settlement. [More]

Visa, MasterCard Agree To Let Merchants Add Surcharges To Credit Card Purchases

Earlier this week, we told you that a settlement in a huge lawsuit between merchants and Visa and MasterCard was in the offing and that it could open the door to retailers tacking on surcharges to credit card customers. Well, that proposed settlement has come to pass, meaning you may soon be paying more for the privilege of using your credit card. [More]

Get Ready To Pay Surcharge Every Time You Pay With Credit Card

Visa and MasterCard know there is nothing that American consumers love more than fees and surcharges. That’s why the credit card companies are reportedly looking to do away with longstanding rules that prohibit merchants from adding on extra costs to customers who pay with credit. [More]

Consumers Getting Mixed Messages On Debit Cards In Wake Of Swipe Reform

Last year, banks and financial regulators on Capitol Hill went head-to-head over swipes fees, the amount of money banks charge businesses each time they accept a debit card purchase. While swipe fees did end up being reduced by only a fraction of what had initially been proposed, banks are still whining about the pennies they are no longer bringing in. Thus, shoppers are receiving mixed messages from retailers and financial institutions about whether to use their debit card, credit card, or cash. [More]

McDonald's Exec: Swipe Fee Reform May End Up Hurting Our Bottom Line

A number of the new or increased banking fees, including Bank of America’s scrapped attempt to charge debit card users $5/month, that have popped up recently have been financial institutions’ reactions to recently enacted regulations that cap swipe fees — the amount banks charge retailers each time a debit card is used to make a purchase. While the goal is to put billions back into retailers’ coffers, some of the nation’s biggest chains say it may end up hurting them. [More]

With Debit Card Fees Disappearing, What Will Banks Try Next?

While today’s announcement that Bank of America is dropping its plan charge a monthly debit card fee, and that other big banks have similarly scrapped their fees, could be dubbed a victory for consumers, it’s only a small triumph, and one that has people wondering what the banks will do next. [More]

BofA Ending $5 Debit Card Fee

Bank of America is calling off its plan to charge debit-card users $5 a month, the WSJ reports. [More]

Fox Business Network Anchor Takes Scissors To Bank Of America Debit Card On Air

The backlash against Bank of America’s decision to charge a $5 monthly fee to some customers who use debit cards to make purchases continues, with Fox Business Network’s Gerri Willis taking a pair of scissors to her BofA debit card in the middle of an on-air report. [More]

Dick Durbin Slams Bank Of America Over $5 Debit Card Fee

Yesterday, Bank Of America announced it would begin charging a $5 monthly fee for some BofA customers who use their debit cards to make purchases. Not surprisingly, this did not go over well with Illinois Senator Dick Durbin, one of the leading proponents of swipe-fee reform. [More]