Earlier this month, CNN asked readers to see how far they could stretch $10. A lot of people chose unusual purchases or silly things, but there were some good ideas for tightwads too. [More]

spending

Stay On Budget By Maintaining One Indulgence

Adam Baker at Get Rich Slowly suggests you’ll be able to better stick to a budget if you pick one non-essential hobby or interest instead of cutting them all out. The key to figuring out whether or not it’s something worth “wasting” money on is to identify any hidden benefits, and then to make sure there aren’t hidden drawbacks. [More]

Nine Things That Are Overpriced

CNN Money has put together a slideshow (ugh) of nine of “America’s biggest rip-offs,” and I think we’ve covered all of them at one point or another on Consumerist. [More]

5 Lies You Tell Yourself To Justify Dumb Spending

Blogger Fabulously Broke lists five lies you use to trick yourself into overspending. [More]

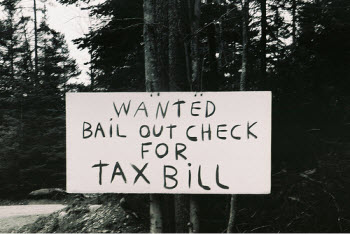

Newly Frugal Behavior Is Permanent, Say Some Consumers

A new study says that 26% of US consumers “have no plans to return to their free-spending ways,” which probably doesn’t sound like good news to retailers. Even worse (for retailers), about a third say they’ve become less loyal.

Layaway Making A Comeback

Sears and Toys R Us are among retailers who have brought back layaway programs to help boost sales, reports Eve Mitchell at the San Jose Mercury News. Not all stores think it’s worth the effort, so you won’t find it at JCPenney, Target, or Walmart. However, if you want to use layaway at retailers that don’t offer it, there are now websites that can help.

Gas Prices Have Jumped $0.20 In The Past Two Weeks

Gas prices have spiked in the last two weeks, reaching levels last seen during the peak of the summer driving season, says the AP. The increase in gas prices has retailers worried that consumers who are putting more money in their gas tanks will buy fewer gifts during the upcoming holiday season.

Christmas This Year Will Be Less Tacky

Because retailers plan their Christmas offerings so far in advance, most were too far along with trendy or ostentatious Christmas merchandise to change course last year, reports the Associated Press. This year they’re prepared to pursue the fiscally conservative consumer, which means everyone is selling the holiday decor equivalent of comfort food.

Financial Advice For College Students

The San Jose Mercury News has compiled a list of financial tips for people just entering college. These are the sorts of things that will help you avoid racking up huge debts or wasting money you don’t have on fees and penalties—and of course they can apply to pretty much anyone, not just college students.

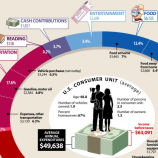

How The Average Consumer Spends His Paycheck

You already have a budget, you just probably haven’t seen it turned into a colorful graphic before. Here’s one that illustrates where all the money goes. Sadly, we spend about three times as much on tobacco as on reading, and yet almost nothing on strippers! (Unless that falls under “entertainment.”)

Everyone Still Shocked That High Unemployment Leads To Low Consumer Confidence

Consumer Confidence is down again. For example, the new score is 46.6. NPR says, “It would take a reading above 90 to signal that the economy is on solid footing.”

Consumers Are Scared To Lose Their Jobs, Still Saving For Their Inevitable Unemployment

The deepest “employment slump of any recession in the last eight decades” has consumers convinced they’re about to lose their jobs — and that’s affecting consumer confidence, says Bloomberg.

Parents May Not Skimp As Much On School Supplies This Year — But They'll Still Skimp

Eiither the economy is improving somewhat or more parents are sacrificing to get their kids geared up for school this year, a survey by Deloitte & Touche LLP says.

Which Parts Of The Country Are Carrying The Most Credit Card Debt?

Forbes wanted to know which states had the highest average balances per household in May, so they took the total amount of debt in 50 major metropolitan areas, divided that by the number of households, then divided that by the median household income for that area for May. Here are some of their results.

Ready To Make A Budget? Here's How To Prepare

So you want to write a budget, but you’re not sure where to start? No Credit Needed has a list of ten simple but necessary steps to take before drafting your first spending plan. Most consumers will already have knocked off the basics like putting their checking and savings accounts in order, but everyone can take advantage of tips like tracking your spending for a full month and making sure you have a detailed list of your irregular expenses. Once you’ve done your homework, check out our guide to writing a beginner’s budget and start mapping out your financial future.