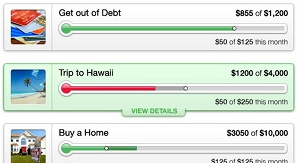

Mint was the cool kid on the financial website block until it cut its hair and went corporate, but the Intuit-owned service can still roll out some nifty features now and then. The latest is a “goals” dashboard, which takes advantage of our natural tendency to try harder if there’s some way to see immediate feedback. Under your account there’s now a goals tab, where you can activate any of the default choices (“get out of debt,” “take a trip,” “buy a home”) or create your own (“laser hair removal,” “pvc bodysuit”). Then you can link your accounts to that goal, and have a quick visual metric you can use to stay focused. [More]

savings

Savings Rate Goes Up, But Spending Doesn't

As a nation, we saved more of our paychecks last month than any time since last September–nearly 4% of income went unspent. That worries economists, because it means we’re not spending at a high enough rate to support an economic recovery. But as the Washington Post notes, since unemployment remains high and most of the recent wage growth came from the government, consumers aren’t exactly comfortable with buying something shiny and new just because it’s on sale. [More]

Skip College, Suggest Some Economists

In a country where the mantra “you can be anything you want” is practically a national prayer, it’s still kind of shocking to see someone suggest that a high school student should skip college. Some economists and professors, however, argue that college has become too expensive to throw money at if the odds are high that either you won’t finish, or you’ll go into an industry that doesn’t require a degree. [More]

Study: Walmart Price Cuts Are Actually Price Hikes

If you’ve turned on a TV recently, you’ve probably seen one of the seemingly countless Walmart ads where the retail behemoth brags about its latest round of price cuts. But a new study says Walmart’s actually been raising its prices on groceries in 2010. [More]

Save Money With These 4 iPhone Apps

Want to update your Facebook status? There’s an app for that. Looking to placate your baby with a dancing Teddy bear? There’s an app for that too. And believe it or not, there are some iPhone apps that will actually help you save a few bucks. [More]

Citibank Freaks Out Customers With Weird 7-Day Rule On Withdrawals, But It's Not As Devious As It Looks

Some Citibank customers recently received notice that the bank reserved the right to require 7 days written notice before authorizing a withdrawal on checking accounts. (It’s also on page 23 of Citi’s Client Manual [PDF].) As you can imagine, this freaked some people out. A Citibank rep quickly moved to clarify the rule, and he pointed out that it’s actually required by federal law for certain types of accounts, and it’s not unique to Citibank, and they don’t intend to enforce it. [More]

"Move Your Money" Profiled On NPR

Last month, the Huffington Post launched a campaign called Move Your Money that urged people to support community banks. The idea is that by moving your money to a community bank, you can help put the “too big to fail” banks on a diet so that they get smaller, while at the same time help a local bank remain competitive. The NPR program All Things Considered took a look at the campaign over the weekend, and talked to some experts about whether it’s worth making the switch. [More]

Experts Answer Credit Questions From Average Americans

Henry Unger at the Atlanta Journal-Constitution has put together a multi-part series of questions and answers from readers. The detailed answers are provided by Consumer Credit Counseling Service of Greater Atlanta, and the questions–which I’ve listed below–cover a broad spectrum of personal finance issues, including credit cards, mortgages, and credit reports. [More]

Here's A Possible Way To Avoid Citibank's New Account Fees

Next month, Citibank will implement its new $7.50 fee on what were formerly free checking and savings accounts. The only way to avoid the fee is to keep a total of $1500 minimum in your linked accounts. John wrote in to tell us that when he went to his branch and asked about the new fee, they found a way to get around it. It may not work for anyone else, but it’s worth sharing. [More]

How To Make Sure Your Marriage Isn't Costing You Money

Liz Davidson at Forbes has an article about ways you and your spouse can fine-tune spending and investment patterns so that your marriage isn’t a financial drain. It’s easy enough to compare financial health before marriage (although lots of couples don’t do it, she notes), but even if your net income increases, your net worth could flatline or drop: [More]

Newly Frugal Behavior Is Permanent, Say Some Consumers

A new study says that 26% of US consumers “have no plans to return to their free-spending ways,” which probably doesn’t sound like good news to retailers. Even worse (for retailers), about a third say they’ve become less loyal.

Don't Let Maintenance Fees Ruin Your Automatic Savings Program

If you participate in an automatic savings program like Bank of America‘s Keep the Change service, where debit card purchases are rounded up and the difference is deposited into your savings account, keep an eye on maintenance fees. James says he was hit with a $5 charge last month because he hadn’t met the minimum monthly deposit requirement of $25: “It turns out that I wasn’t even accruing $5 worth of change per month, so I was losing more money due to the maintenance fee than I was saving via Keep the Change!”

Wachovia's "Way2Save" Account Triggers Over $5,000 In Penalty Fees

Wachovia has a new financial product called Way2Save that automatically moves $1 from your checking account into a high interest personal savings account every time you make an electronic bill payment. Susan tried to maximize her contributions by making a lot of little bill payments, but Wachovia cut off access to her funds without notice and triggered an avalanche of penalty fees. Now she owes over $5,000 to her credit card companies, far more than she would likely have ever earned through Wachovia’s complicated savings program, and of course Wachovia is denying any responsibility.

Build Your Own Extended Warranties

On his personal finance blog Consumerism Commentary, Flexo wisely advocates never falling for the extended warranty trap, instead setting aside the money you might have spent on the warranty and putting it into high-yield savings. The tactic lets you subsidize the cost of a replacement with interest, creating your own extended warranty.

Consumers Pay Down Credit Card Debt For 11th Straight Month

The Federal Reserve has released data on consumer debt for August, and for the 11th month in a row we’ve paid down credit card debt and increased savings. Take that, rate-hiking credit card companies!

"Millionaire By 30" Shares His Saving Secrets

Through a combination of extreme cheapness, hard work, and determination, Alan Corey became a millionaire at an age when most of us are still trying to figure out how to start paying back our student loans. How did he do it? He shared some of his saving secrets with Mainstreet.com, and they’re useful whether you aspire to wealth or just need more money to pay down debts.