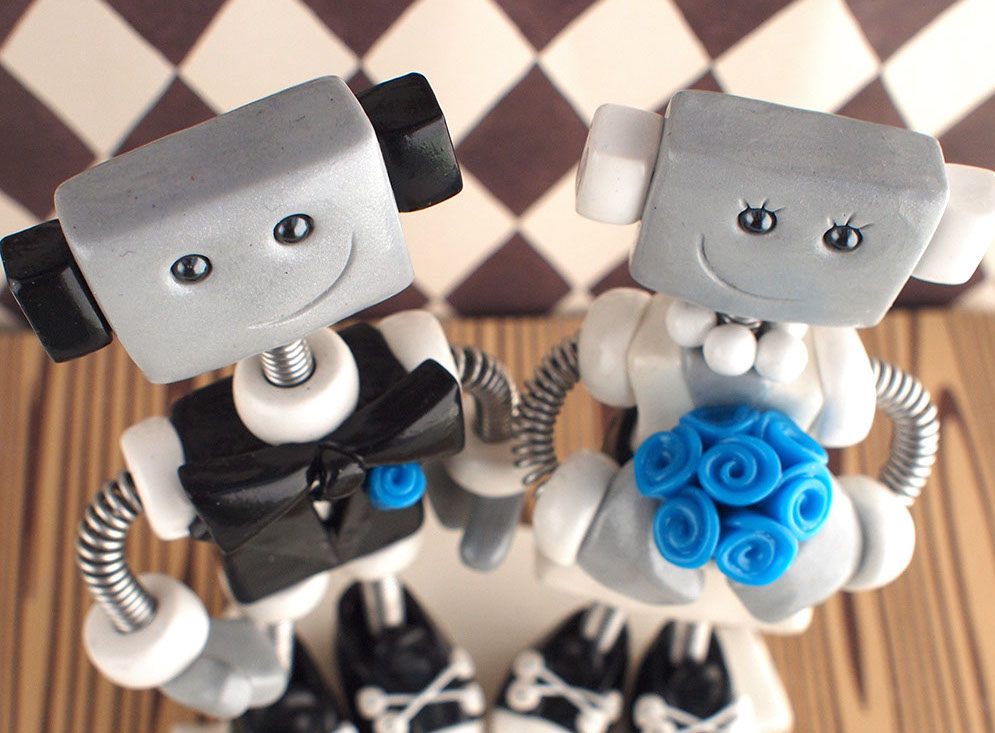

If you’re debating whether or not to cut the odd cousin or two from your wedding invite list, you now have a solid financial justification. A new study claims that the cost of weddings is at a five-year high even though the number of invited guests is shrinking. [More]

planning

6 Steps To Supercharge Your New Year's Resolutions

The routine never changes. A year ends, you take stock of what didn’t go right and vow to change things come Jan. 1. Then life happens and you find yourself making the same vows again as the next year concludes. One reason things go that way is because you fail to give teeth to your New Year’s resolutions. [More]

You've Got A Few Weeks Left To Win The Tax Year

As the holidays usher in the end of the year, it’s easy to overlook the moves you could make to put yourself in a better position come tax time. Come April, you’ll either thank or curse your November and December 2011 self for making either savvy or stupid financial decisions. [More]

Marital Trouble? Consider Divorce Insurance!

You already have home insurance, car insurance, life insurance, and maybe even health insurance—why not insure your marriage, too? For around $16 per month, a North Carolina company called SafeGuard sells “units of protection” that could be worth $1,250 if your marriage implodes in divorce. The company claims that it wants to help defray the costs associated with legal fees and finding a new home, but the insurance, called WedLock, comes with plenty of catches. [More]

Things You Don't Need To Buy For A New Baby

Cameron Huddleston, an editor at Kiplinger and a mom, has some advice on how to make the most of your new baby budget. The money you save on things like play mats, changing tables, and fancy first-year clothes can be used to pay for less pleasant but more important safety-net things, like life and disability insurance, health insurance, and a will. [More]

Do You Talk To Friends About Your Finances?

A recent Huffington Post article wondered if talking about personal finance was “the final taboo.” Talking about money can feel as revealing as a strip-tease with none of the fun, but for something as complex and individual as your financial future, a one-way conversation with the internet or personal finance columnists isn’t enough.

Estate Planning Lessons from Michael Jackson

Let’s face it, Michael Jackson had a spotty record when it came to managing his money. Sure, he earned a gazillion dollars making music and was savvy enough to buy rights to Beatles’ tunes, but in his latter days he also spent lavishly, millions more than his annual income, and he racked up a sizeable debt. In other words, you wouldn’t want him as your financial advisor.

Four Financial Tools All New Parents Need

The baby’s on the way! You’ve got a crib, toys, and a rapidly approaching delivery date. So what else you do need? Kiplinger shares the four must-have financial tools that no new parent should go without…

Daylight Savings Can Save You Money

Congress will sneak into your bedroom tonight and steal a precious hour of sleep, but you don’t need to take the theft lying down. Get up tomorrow and use a few tips from Consumer Reports to steal back some hard-earned cash.

Prepare For A Budget Meltdown By Conducting A Financial Fire Drill

You’re fired! Now what? It’s the nightmare scenario, and you can prepare for it by conducting a financial drill. Take a moment and pretend you have no income. Ask how you would pay pay for rent and food, and what lifestyle changes you could make on two week’s notice. To guide your planning, the New York Times has a few unorthodox and downright scary suggestions that are worth considering in a worst case scenario.

Financial Resolutions for 2009

It’s that time of year again. m The Earth has moved ’round the sun once again, and for a month everyone will screw up when writing the date. What are your 2009 Financial Resolutions?

Don't Let Credit Blocks Eat Up Your Available Balance

Hotels and rental agencies like to carve out the full cost of their services on your credit or debit card before you pay in full. This credit blocking can catch anyone who sticks near their minimum or maximum balance off guard when they try to use their card. Inside, learn how to keep retailers from unexpectedly clogging your credit and debit cards with unwanted blocks.

6 Reasons To Keep More Than One Credit Card

Keeping a second credit card won’t lead to financial ruin, and may prove useful in several situations. Bankrate offers six reasons to stash away a spare card.

Prepaid Funeral Planning: Don't Do It!

Prepaid funeral plans are the “extended service warranties” of the funeral industry—profitable for the funeral home but often useless.

10 Tips For Lowering Your Taxes

This list of ten tips to reduce taxes was published nearly a year ago, but they’re still relevant, and we thought now would be a good time to share them before Kiplinger releases its new “10 Ways” list later this month. Among the tips: make sure you load up your retirement accounts and flexible spending accounts, and remember that the government gives you a 2 ½ month grace period on reimbursing yourself from an over-funded flex account.

Set Up Your Own Funeral Trust

Don’t set up an irrevocable funeral trust through your insurance company, says MarketWatch columnist Chuck Jaffe.

12 Things Women Should Do To Prepare For Retirement

Women live longer than men and don’t participate in the workforce as consistently, which puts them in a tougher position when it comes to living off of retirement funds. But after reading through this list of 12 things women can do to protect themselves from financial ruin in their final days, we’ve decided that old ladies are just goths with even crazier makeup and clothes. It starts off with the basics—”start your own retirement account,” “invest in stocks,” “put your retirement savings before your kids tuition bills”—but then takes a turn for the morbid and becomes all about death, divorce, and more death. Here are the gloomiest tips—enjoy!

Retirement Plans For Those Who Don't Have One

If you’re a freelancer, or work for a small company, or for some other reason don’t have a healthy start on a retirement plan, Smart Money has some suggestions for how to jump-start your investment before you hit your golden years.