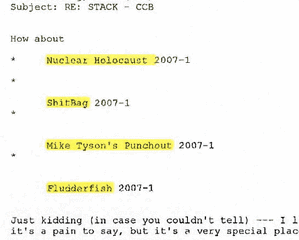

Federal prosecutor Lanny Breuer insists he has yet to find enough evidence to bring an indictment against a single Wall Street executive over the 2008 mortgage meltdown, yet lawyers in private lawsuits against the banks continue to turn up some gems — like this one from the Morgan Stanley e-mail vault. [More]

mortgages

‘Nuclear Holocaust’ & ‘Sh!tBag’ Among Clever Names Morgan Stanley Bankers Gave To Toxic Mortgage-Backed Security

CFPB Rules Aim To Protect Homeowners From Inept & Foreclosure-Happy Mortgage Servicers

One week after it announced a new set of rules that require mortgage lenders to prove that borrowers will actually be able to pay back their loans, the Consumer Financial Protection Bureau is unveiling a slew of new rules for mortgage servicers intended to curb some questionable practices and provide more safeguards for all borrowers. [More]

Professor Tries, Fails To Defend Payday Lending As Legitimate Form Of Credit

Most regular readers of Consumerist know that we’re not exactly fans of payday loans, which charge upwards of 25 times the interest of a high-interest credit card and hundreds of times the interest on a standard loan. And yet, there are people — well-educated people at that — who stick with the argument that payday loans are a good thing. [More]

New Rule Means Banks Will Have To Make Sure Borrowers Can Actually Repay Mortgages

When the housing market collapsed five years ago, it was due in no small part to mortgage lenders who handed out loans without really considering whether or not the borrower could ultimately pay that money back. Hoping to minimize the chances of this happening again, regulators have introduced a new rule today. [More]

Study: There Are Plenty Of People Who Would Take Out A Walmart Or PayPal Mortgage

What’s an average citizen to do when getting a mortgage from a big bank or other financial institution isn’t an option? Perhaps you might consider taking out mortgages from a retailer like Walmart, or even PayPal? A new financial services study says there are plenty of people out there who would be down with a situation like that. [More]

Botched Foreclosure Shines Spotlight On Banks’ Ignorance Of The Rules

In Georgia, there is a program called HomeSafe, intended to prevent homeowners who have just lost their jobs and are only a little behind on their mortgage from losing their homes. When someone is accepted into the program, lenders are required to pause foreclosure actions, but that didn’t stop Citi and Freddie Mac from trying to evict one woman. [More]

Is The End Near For Mortgage-Interest Deductions?

One of the benefits to homeownership has long been the ability to deduct any interest paid on your mortgage on your federal tax return. But with the so-called fiscal cliff looming in the new year, some folks in Washington are considering putting the deduction on the chopping block — or at least on a diet. [More]

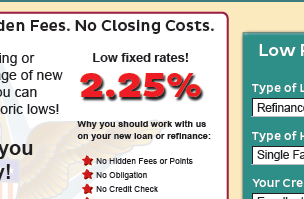

Regulators Ask Mortgage Marketers To Please Cut Down On The Lying In Their Ads

The 2011 Mortgage Acts and Practices Advertising Rule prohibit mortgage lenders and brokers from making misleading claims about government affiliation, interest rates, fees, costs, associated payments, and the amount of cash or credit available to the consumer. Shockingly, some folks just didn’t listen. [More]

Homeowners Impacted By Hurricane Sandy Could Get Some Mortgage Relief Soon

While one major problem facing many homeowners is dealing with insurance claims in the aftermath of Superstorm/Hurricane Sandy, there’s another long-term issue causing trouble for people whose homes have been damaged by the natural disaster — simply paying the mortgage. Relief is in sight for some borrowers as government agencies and other major lenders begin implementing programs to offer breaks on mortgage payments, among other forms of assistance. [More]

Bank Of America Endorses Insurance Check, Won’t Let Me Pay Contractor For 8 Days

Andrew had a contractor literally sitting in his driveway, ready to fix the damage from a fire in his home. The contract was drawn up, everything was ready. Everything except Bank of America, his mortgage holder, which needed to endorse the check. That was fine. The problem was that they refused to let him pay the contractor per his contract, insisting that they had to disburse the funds themselves (okay) with an 8-day delay. Wait, crap! [More]

U.S. Sues Wells Fargo, Accuses It Of Being A Loan Factory Pumping Out Deficient Mortgages

United States prosecutors leveled charges against Wells Fargo yesterday, claiming the bank lied about the quality of mortgages it was working with under a federal housing program. Prosecutors say Wells Fargo defrauded the government for more than a decade, issued mortgages willy nilly and then lied about their condition to the Federal Housing Administration. [More]

Majority Of U.S. Homeowners Paying At Least 5% Interest On Mortgages

While interest rates for 30-year fixed-rate mortgages have been hovering around the 4% mark for around a year — and 15-year fixed loans have dipped below 3% in recent months — nearly 7 out of 10 American homeowners are still paying at least 5% interest on their home loans. [More]

Participating In HAMP Cut Down On Principal Amount Owed For 77% Of Eligible Homeowners

The latest numbers on the government-backed Home Affordable Modification Program are in, and there’s some good news in there for most of the homeowners who participated. About 77% of those who went through modification (and didn’t have a mortgage tied to Fannie Mae or Freddie Mac) in July enjoyed a nice little cut to the principal amount they owe. [More]

Chase Is Now Surprising People With Mortgage Adjustments

While we’ve seen many a story during the last few years of people stuck chasing their tail in an attempt to get a mortgage modification from their lender, some Chase customers are now finding out they’ve gotten a loan adjustment without ever having to lift a finger. [More]

Wells Fargo Working With Daughter To Make Her An Authorized Party On Late Mother's Loan

We’ve been closely following the case of a woman who was trying to save the home she inherited from her late mother, only to be confounded when Wells Fargo refused to deal with anyone but the dead woman. Earlier this week, Wells Fargo announced that they’d placed the foreclosure on hold and had reached out to the woman. In the latest update, both the woman and Wells Fargo have confirmed that negotiations are underway. [More]

New Guidelines Aim To Make Short Sales Less Of A Pain In The Butt To Everyone

Short sales now account for nearly 1-in-11 home sales in the U.S., so there’s a decent chance that anyone who has been house-shopping recently has visited a for-sale property only to have the realtor say, “Now I have to warn you, it is a short sale.” At this point, many of you would go running for the hills rather than be stuck in bank-approval muck for months. But new guidelines issued by the Federal Housing Finance Agency are aimed at speeding up the process. [More]

Why Do So Many Servicemembers Not Receive Mortgage Protections They Have Legal Right To?

The Servicemembers Civil Relief Act (SCRA) includes a number of protections for members of the armed forces who took out a mortgage before going on active duty. But as we have learned in recent years, there are at least 15,000 instances where banks failed to follow those guidelines — and hundreds — perhaps thousands of times where lenders have illegally foreclosed on servicemembers’ homes. [More]

Wells Fargo Receives $175 Million Slap On Wrist Over Discriminatory Loan Allegations

Three years after it began looking into allegations that Wells Fargo had systematically discriminated against minority loan applicants by pushing them into risky, high-cost subprime loans — regardless of their qualifications — the U.S. Dept. of Justice has come to a $175 million settlement with the bank. [More]