Plans are in the works to dismantle Fannie Mae and Freddie Mac, and that could mean that what many Americans had assumed came fourth after “life, liberty and the pursuit of happiness,” the 30-year mortgage, could be on the outs. [More]

mortgage meltdown

Even Nice Cities Not Safe From Housing Meltdown Anymore

NYT reports that the real estate crashdown isn’t just limited to Potemkin-village style build-n-flip hotspots like Vegas and and Florida. That’s just where it started. The giant needle of bubble popping is plunging through Seattle, where prices are down 30% from last year, and is making swift work of Minneapolis and Atlanta. One expert predicts prices could drop another 5 or 7% nationwide. Get out the dramamine, it’s double-dip time. [More]

The Ocean's 11 Of HELOC Fraud

Fortune has a great profile on the “Ocean’s 11” of HELOC fraud. Armed with just laptops and cellphones set to the right area code, he and his crew would drain home-equity lines of credit from unsuspecting homeowners accounts, piecing together enough of a profile on them from publicly available information to break through their account security. At his peak, he was pulling down millions a week, operating out of fancy hotel suites and drinking heavily from an endless stream of high-end liquor, jewelry, and prostitutes. And despite the FBI’s best dragnet efforts, he still remains at large today. [More]

A Miserable Life Inside A Foreclosed Apartment

Living inside an apartment building that has been foreclosed on can become a living hell when the building crumbles into disrepair around you and there’s no landlord to call. Bursting heat pipes, cockroaches, mice, hunks of ceiling falling on you, and black mold seeping up the walls have become the new neighbors to tenants in one low-income apartment building in the Bronx where the landlord has long since checked out. [More]

Wachovia Settles "Pick-a-Payment" Mortgage Loan Class Action

If you got a “Pick-a-Payment” mortgage from Wachovia between Aug 1 2003 and Dec 31 2008, you might be up for claiming some cash in a $50 million settlement. [More]

Banks Lose Foreclosure Case Over Bad Docs, More Could Come

In a potential foreshadowing of things to come, Massachusetts’s Supreme Court upheld the voiding of two home seizures this week because the banks couldn’t prove they owned the mortgages at the time they foreclosed. [More]

Foreclosures Drop 9% Over Fudged Paperwork Fallout

For the first time in a long while, foreclosures actually dropped in October, falling 9%. The big drop came about as several big banks halted foreclosures across the board after news about the robo signers began to emerge. Foreclosures are expected to pick back up again November, albeit at a softened pace. It may be 3-4 months before the rate fully resumes. So take a gasp, homeowners behind on your mortgage, you just caught a temporary break. [More]

"Adversely Possessing" Empty Houses: Robin Hood Or Fraudster?

Citing a law from the 1850’s, Mark is going around Florida looking for foreclosed and abandoned houses and filing paperwork to try to claim their deeds. It’s called “adverse possession.” [More]

Squatters Spoil Dream Home With Fake Deed Claims

A Seattle couple were 10 days from closing on their new house when they discovered squatters had moved in who claimed they had seized “free land.” [More]

Banks Paper Over Robo-Signer Errors, Structural Problems Remain

After the foreclosure fraud scandal broke, banks scrambled to fix what they described as “procedural” errors and “technicalities.” But the lawyer whose deposition of a former robo-signer sparked the uproar says all the banks have done is put bandaids over bandaids. [More]

Walk With A Family Walking Away From Their House

What’s it like to walk away from your house? No, not to go down the street to get some ice cream. Walk away like mailing the keys to your mortgage lender and saying, “Take it. It cost me more than it’s worth.” Immoral? Perilous to future job prospects? Is it “just business?” NPR follows along with one couple grappling with these very questions. [More]

Banks Hired "Burger King Kids" To Process Mortgages

JPMorgan & Chase had a cute name, the “Burger King Kids,” for the workers with little no experience or qualifications it hired to process the reams of mortgages it plowed through at the height of the housing bubble. These walk-in hires “barely knew what a mortgage was,” writes the NYT. The newbies Citigroup and GMAC/Ally Bank outsourced the work to sometimes tossed paperwork into the garbage can. [More]

JPMorgan Chase Suspends 56,000 Foreclosures

JPMorgan became the second major lender after GMAC/Ally Bank to halt pending foreclosures, halting proceedings on 56,000 homes. This follows revelations that “robo-signer” “foreclosure mills” were filing paperwork that would be gracious to call “sloppy,” at the rate of 10,000 a day. [More]

NPR's Pet Toxic Asset, "Toxie," Dies

To see what would happen, reporters for NPR’s Planet Money pooled their money and bought a toxic asset for $1,000. At 99% off, it seemed like a bargain. This week, “Toxie,” as they dubbed their pet, gave up the ghost. Contrary to expectation, she was killed not by foreclosures, but by loan modifications, which reduced the amount of cash flowing into the bond. Planet Money tells the whole story in this awesome and hilarious animation. [More]

Foreclosure Firm Allegedly Forged Bank Execs' Signatures On Affidavits

A foreclosure firm listed “Bogus Assignee” as the mortgage owner on the documents they submitted to the court to process the foreclosure. That’s one of the many oddities surfacing in the investigation of a Florida foreclosure firm for allegedly using improper documentation to speed up foreclosures. Another is an employee “Linda Green” who signed of on thousands of foreclosure affidavits claiming to be executives from Bank of America, Wells Fargo, U.S. Bank and other lenders. [More]

Wells Fargo Says It Won't Foreclose For 30 Days, Then Does So Within A Week

A week after Wells Fargo rejected a couple’s loan mod app and said it wouldn’t start foreclosure proceedings any sooner than 30 days later, a guy showed up on their steps. He said he was with an investment firm that had just bought the house at a real estate auction, and if they would leave within 2 weeks, he would give them $1,500. [More]

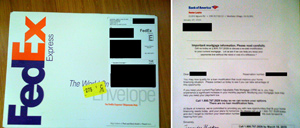

BofA Pays To Fedex You Multiple Loan Mod Opps You Don't Care About

BofA has been Fedexing Eli a loan mod opportunity once every two months for the past eight months. He has no intention of doing a refi, he’s never been late on a payment and likes his 5/1 ARM and low interest late. Wonder how many other homeowners is BofA frittering away their bailout bucks on by FedExing junk mail. Meanwhile, the people who actually want loan mods are stuck in purgatory. [More]

New Trailer For "Inside Job" Financial Crisis Documentary

Get ready to slake your thirst for populist rage. Inside Job is a new documentary coming out in October that aims to expose the truth about the true architects of the financial implosion of 2008. You can probably guess from the title whom they’re fingering. Matt Damon is the narrator and it’s released by Sony Pictures Classics. Here’s the trailer: [More]