Starting Oct 1, AMEX Blue is raising rates on all customers, INCLUDING on OLD balances, AND they are telling customers that you can’t just opt out and cancel the card (like normal). Turns out that opt-out we all took for granted was only by the credit card companies’ good graces.

money meltdown

Why Cash For Clunkers Was Doomed

Cash For Clunkers never had a chance. It was smothered at birth by a pile of paperwork and ever-changing rules, as this dealership worker reveals, using a combination of the words “cluster” and “fudge,” except, of course, not fudge.

Daddy, Is The Recession Over Yet? Handy Chart Holds The Answer

When are we going to pull out of the recession? The Kiplinger Recovery Index thinks it can tell you, using a sophisticated system of red and green colored boxes and checkmarks and X’s.

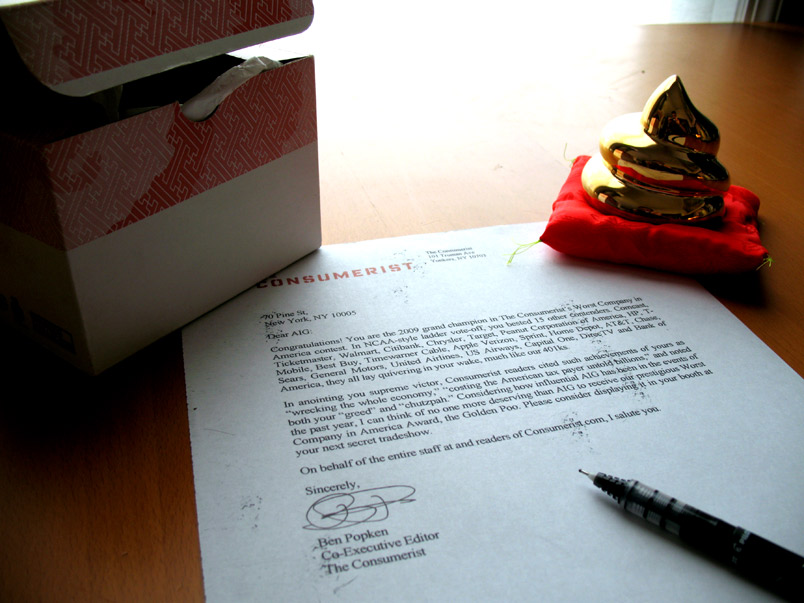

AIG's WCIA 2009 Award Mailed

We put AIG’s Worst Company in American 2009 award in the mail today. Here is the congratulatory letter that accompanied their prize:

How The Recession Destroys Friends

Like a tornado, the recession hits unevenly. One house might get turned into splinters, while another is left untouched. Similarily, one friend can still be afford salads and Starbucks for lunch every day while the other has to brown-bag it. The Double-X blog asks its readers, “how do friends in newly different socioeconomic strata adjust?” Answer: most of the time, they don’t.

../../../..//2009/06/12/so-now-theres-a-compensation/

So now there’s a “Compensation Czar” to oversee the executive pay packages at banks that took TARP money. Here’s an interview with the man behind this thankless job. [Marketplace]

Insiders: Countrywide Made Racist Sub-Prime Loans

The Wells Fargo racist sub-prime mortgage lawsuit reminded me of an old post we did where an ex-Countrywide employee alleged that that loan company had racist practices too. Here’s the insider email we posted back in February, 08:

Judge Slaps Ameriquest Hard For Selling Mortgage, Then Pretending To Still Own It

Ameriquest originated a mortage, securitized it, and sold it. Then pretended it still owned the mortgage to a U.S. Bankruptcy Court judge. Whoops.

65% Of Modified Loans Will Default Again Anyway, Study Predicts

Many homeowners that couldn’t afford their home the first time around, can’t afford it the second or third, a new study finds. Fitch Ratings predicts that 55-65% of home loans getting modified will end up at least 60 days behind within a year. The percentage is even higher for those in subprimes…

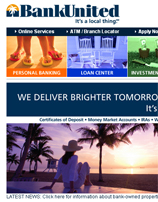

BankUnited Fails, Gets Sold

BankUnited FSB, a Florida-based bank with $12.8 billion in assets and $8.6 billion in deposits, today became the latest bank to fail, thanks to its massive undercapitlization. The Office of Thrift Supervsion closed it, the FDIC was the receiver, and a group of private-equity firms bought its remains. The dour news had no effect on the companies website, which remained a cheerful display of sunny beaches and palm trees. An online poll asked customers, ” Memorial Day is next weekend. What is your favorite way to celebrate? A. Cooking out in the grill B. Going to the beach C. Getting away for the weekend D. Chaining the doors shut and getting a direct flight to Anguilla.” What happens when a bank fails and what do you need to do? 60 Minutes has the answer.

Fund Stole From Clients, Got Lavished In Lap Dances

The SEC is pawing through the records of the collapsed investment firm Sentinel Management Group and getting lap dance remains all over their hands. Bloomberg reports it looks like SMG’s lead trader Charles Mosley sold their clients what now amount to worthless securities (“wallpaper,” says the guy in charge of unwinding the company), and the brokers he bought them from showered him with tickets to sporting events, limousine rides, and even underwrote his lap dances. Musta been fun while it lasted.

About 10 Banks May Need More $ After Gov Stress Test

The number of banks that will need more capital has grown. Now it looks more like 10 banks that underwent the government stress-tests are undercapitalized, possibly among them Wells Fargo, Bank of America, Citigroup and some regional banks, reports WSJ. The good news seems to be that the problems the stress tests are revealing aren’t as bad as analysts had been saying. Clearing out some of that fear contributed to Monday market gains and the S&P 500 entered positive territory for the year for the first time in months.

Oh Noes It's The "Shadow" Banking System

It doesn’t involve ninjas, but the “shadow” banking system is an important part of the US economy, it’s the companies that loan money but aren’t themselves banks. The loans they make aren’t kept on the companies books, they’re securitized and resold as bonds. White whiteboard and magic marker, Marketplace Senior Editor Paddy Hirsch argues this shadow banking system deserves it own bailout.

8.5% Unemployment? More Like 15.6%

Officially, the unemployment rate is 8.5%, but that’s just part of the picture. It doesn’t count those who have given up looking for work, or those who are working part-time when they’d rather be working full-time. The real unemployment rate may be closer to 15.6%, according to the Bureau of Labor Statistics. Yikes.

Banana Republic Lowers Credit Card Limit From $1000 To $100

It’s no surprise that a popular purveyor of work-suitable vestments suck lowered a reader’s friend’s store credit-card limit, but to go from $1000 to $100, that’s cold, Banana Republic. Danielle writes:

What's This "Public-Private Partnership" Mean?

So the latest solution to the problem of these toxic assets on the banks’ books is a “public-private partnership” between the government and the private sector…yawn what is he going on about, I wish I had a pancake…oh wait! Here’s Paddy Hirsch from marketplace drawing stick figures on a whiteboard and explaining it all. Now we’re talking.

What The G-20 Said, And What They Meant

WHAT THEY SAID: “We are undertaking an unprecedented and concerted fiscal expansion, which will save or create millions of jobs which would otherwise have been destroyed, and that will, by the end of next year, amount to $5 trillion, raise output by 4 percent and accelerate the transition to a green economy.”

Fannie And Freddie Can Foreclose Again

Fannie Mae and Freddie Mac can foreclose on people’s houses again. There was much fanfare when they were banned from doing so back in December, but not a peep on March 31st when the moratorium ended. Funny, that. [The Washington Independent] (Photo: Colin Tobin)