If your home sustained damage from Hurricane Irma, you might have to wait just to get the insurance company to look at your property to see what repairs will and won’t be covered. Why? Because there aren’t enough claims adjusters to go around right now. [More]

homeowner’s insurance

Insurance Won’t Cover Damage To 80% Of Homes Flooded By Hurricane Harvey

When the flood waters left behind by Hurricane Harvey eventually recede, they will leave behind billions of dollars in property damage. However, a large majority of homeowners will likely have to spend their own money to make their homes livable again. [More]

There’s Some Weird Stuff In Your Homeowner’s Insurance Policy

Do you sit and read every word of every document that you sign? Probably not. Maybe you should, but it would take up valuable time that could be spent “liking” pictures of your friend’s new puppy on Facebook. Jacob Goldstein of NPR’s Planet Money decided to read all 23 pages of his new insurance policy, and he had some questions. Mostly about the likelihood of volcanic eruptions in Brooklyn. [More]

15 Things Everyone (Including Renters) Should Know About Homeowner’s Insurance

This is the second post in a multipart “How To Not Suck…” series on insurance. The first installment looked at the things you need to know about auto insurance, while upcoming installments will cover life, long-term care, and disability insurance.

Unless you’re a financial titan (or got your house on the cheap) your home is probably the biggest investment you’ll ever make, so don’t screw it up by not having the proper insurance. [More]

Travelers: Sorry, The Mold Between Your Window Panes Is Your Problem

A California man noticed weird, fuzzy dirt between the panes his windows. It wasn’t plain old dirt, but mold. Ew, mold! He called his homeowner’s insurance company to report the problem, and learned that not only did they not cover mold removal services, but that he now had twenty days to take care of the problem himself, or get his policy dropped. Oops. [More]

State Farm Reminds Homeowners Filing Multiple Claims: An Insurance Policy Isn’t A Bank Account

While it might feel like paying those insurance premiums every month means you’re amassing funds that can be used later when you need them, as one pair of Denver homeowners found out, there’s no guarantee you’ll see that money again. The couple was shocked to find their insurance policy was terminated when they made multiple claims recently, after paying premiums to State Farm for about 20 years. [More]

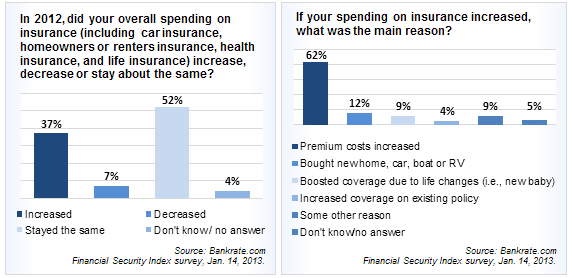

More Than 1/3 Of Americans Paid More For Insurance In 2012

If the amount of money you paid for insurance last year went up, you are not alone. According to a new survey, 37% of Americans paid more for home, health, auto, or life insurance in 2012, while only 7% of people saw their insurance bill shrink. [More]

To Save Homeowners On Insurance Deductibles Governors Insist Sandy Wasn’t A Hurricane

Hurricane? What hurricane? Oh, Sandy? She was just a superstorm, say governors in states impacted by Sandy earlier this week. See, if she was a hurricane, homeowners would have to pay out anywhere from 1% to 5% of their homes’ values before insurance coverage would kick in. But if she wasn’t, as the governors of New York, New Jersey and Connecticut are saying, that deductible doesn’t have to be met. That will likely result in huge savings for homeowners. Nice. [More]

State Farm Pulls My Homeowner’s Policy Because I Was Robbed As A Renter

Just a few weeks ago, Consumerist reader Ben went to close on his new home, complete with documentation from State Farm saying he had a homeowner’s insurance policy for the property. Then the other day, he gets a call from the insurer telling him, sorry, he’s not actually covered because his previous apartment had been robbed a couple years earlier while he had a State Farm renter’s policy. [More]

My Parents’ House Was Struck By Lightning And Burned Down. What’s Next?

When you’ve escaped from a late-night fire and lost your home and all of your belongings with it, what do you do next? That’s what Rudy wants to know, on behalf of his parents. Last week, their house caught fire hours after being hit by lightning. They got out alive, and are about to begin rebuilding their lives. But first: the insurance claim. An adjuster from Allstate is coming today. Rudy wonders whether the Consumerist Hive Mind have experienced this kind of catastrophic loss and massive insurance claim, and have any advice for his family. [More]

Stuck With A Forged Check? Homeowners Insurance To The Rescue

The bad news: Someone passed a bum personal check to you as a payment. The good news: Your homeowners insurance policy might cover you — even if you got stiffed with bogus cash. [More]

Why It Might Make Sense To Insure Your Garden

Money may not grow on trees, but it can take a lot of green to make a garden look good. Vegetation in and around your home may be an afterthought when it comes to insuring your home, but your policy should match the level of care, work and funds you put in to your greenery. [More]

Should Your Driving Record Impact Your Homeowner's Insurance?

You don’t need a driver’s license to own a home. You don’t need to own a home to drive a car. But Allstate insurance has launched a product in Oklahoma that looks at policyholder’s driving records when determining their homeowner’s insurance rates. [More]

Allstate Won't Cover Bat Infestation Because It Thinks Bats Are Rodents

The words “bat” and “rat” rhyme and some folks have been known to refer to bats as “flying rodents,” but that doesn’t make it so. If only someone would tell this to the folks at Allstate, who have told a California homeowner that it won’t pay to rid her home of bats — something it had previously covered — because the insurance company now believes bats are rodents. [More]

Fungus Devours House, Insurance Company Error Leaves Homeowners Holding The Bill

Like a freeloading cousin who shows up unexpectedly, a rare fungus moved in and quickly took over a California house. The homeowners say they got it in writing from its insurance company, Safeco, that it would pay for the hundreds of thousands of dollars in damage and fungus removal, but the insurer says that was a mistake and is only offering to foot a fraction of the bill. [More]

6 Things Your Insurance Agent Doesn't Need To Hear

MSN Money Central posted a list of five things not to tell your insurer.

Insurers Drop Homeowners With Stinky Chinese Drywall

If you own a house made with poisonous Chinese drywall, you may soon have one fewer thing to worry about: paying your homeowner’s insurance premiums.

How To Save On Homeowners Insurance

With the economy in the dumper, it seems like everyone is looking for ways to save on everything. Not wanting to stand in the way of this lovefest for saving, we’re proud to bring you six ways to save on homeowners insurance from Smart Money: