With thousands of former Corinthian Colleges students waiting to find out if their federal student loan debts will be discharged because the now-defunct for-profit college allegedly deceived them with false promises related to their future careers, the Department of Education announced the creation of a special enforcement unit with the goal of being able to respond quickly to allegations that colleges are violating the law. [More]

fraud

A Stop Payment On A Check Only Lasts About Six Months

When you write a check and it’s lost, stolen, or you have some other reason to do so, you call your bank and ask for a “stop payment” on it, usually incurring some kind of fee. Stopping the payment means that no one can ever deposit or cash that check, though, right? No: generally, the order lasts about six months. [More]

Whistleblower Lawsuit Accuses ITT Tech Of Defrauding Government, Using Deceptive Recruitment Practices

A recently unsealed whistleblower lawsuit against for-profit college chain ITT Technical Institute accuses the school of operating a “systematic scheme” to defraud the government by using a litany of abusive, deceptive practices to enroll students. [More]

ID Thieves Also Use Call Centers To Outsource Their Scams

We all know that a lot of businesses outsource customer service work to call centers around the world. But what you may not know is that there are also call centers that specialize — and openly advertise — their services in aiding ID theft and other cyber fraud. [More]

How Fraudsters Can Convert Stolen Goods Into Cash Through Bargain-Hunters

Maybe you’re planning a large purchase or a big shopping trip with a certain retailer, and you seek out gift cards to that store from online gift card marketplaces. Swapping gift cards online is a unique opportunity for savings, but also provides a unique opportunity for fraudsters. [More]

Reminder: There Are No Fees To Claim Your Prize When You Win The Publishers Clearing House Sweepstakes

The day has finally come — you’ve won the Publishers Clearing House sweepstakes! At least, that’s what the guy on the phone is telling you. But don’t send your thanks to the ghost of Ed McMahon just yet: if someone is telling you to fork over huge wads of cash in order to claim your prize from PCH, it’s a scam and you should hang up the phone and start hoping anew. [More]

UPDATE: For-Profit Education Company EDMC Agrees To Pay $95.5M To Settle Fraud, Recruitment Violations

UPDATE: Education Management Corporation, the operator of for-profit college chains such as Brown Mackie College, Argosy University and the Art Institutes, will pay $95.5 million to settle claims it violated state and federal False Claims Act (FCA) provisions regarding its recruiting practices. [More]

Couple Plead Guilty To Scamming Kohl’s Of $600,000 In Rewards Cash

Sure, sometimes that Kohl’s cash you earned goes to waste: you forgot about it or found there simply wasn’t anything in the store you could use it on. One New Jersey couple apparently didn’t have those problems. Instead, police say they created a system to scam the retailer’s rewards program to the tune of $600,000 in products. [More]

Using Only His Phone, Man Scams 217 Macy’s Stores Into Issuing Fraudulent Refunds

If you plan to go on a scamming spree, you probably shouldn’t use your actual email address when completing the transactions. That was ultimately the undoing for a Georgia man who federal authorities say duped more than 200 Macy’s stores in 31 states into issuing fraudulent refunds — and all without having to drive to the mall. [More]

Feds: Green Energy Ponzi Scheme Duped Consumers Out Of $54.5M

When someone makes a promise that seems too good to be true: like saying you’ll be “stinkin’, filthy rich” if you invest in their green energy technology, it’s a good idea to look into that proposition with a little more scrutiny. That kind of attractive, yet ultimately worthless deal cost consumers nearly $54.5 million, federal prosecutors say. [More]

Man Charged With Operating Debt Collection Scheme That Targeted, Defrauded Spanish-Speaking Consumers

Deceiving consumers is a trademark for most unscrupulous operations attempting to collect debts that aren’t actually owed. Shady collectors have been known to lie about debts, misrepresent themselves as officers of the law, threaten lawsuits and, in the case of one operator, threaten Spanish-speaking residents with deportation. [More]

Dept. Of Education Plans To Overhaul Loan Forgiveness Program For Students Defrauded By Schools

As thousands of former Corinthian College students continue to wait to learn whether or not they’re on the hook to repay billions of dollars in student loans they took out to attend the now defunct for-profit college, the Department of Education announced plans to overhaul the loan forgiveness process for students who believe they have been defrauded by their colleges. [More]

Man Charged With Operating American Dream Scheme Sentenced To Jail, Must Refund $6.4M

A man who helped perpetrate a scam that promised consumers they could obtain the “American Dream” by selling coffee and greeting cards at retail establishments across the country will spend 70 months in jail and must repay $6.4 million to victims. [More]

Most Small Business Owners Aren’t Ready For Chip-And-PIN Credit Cards

Following a string of high-profile data breaches last year, Visa and MasterCard handed down a requirement that all merchants transition to the more secure chip-enabled credit card payment system by October of this year. While several major retailers have already made or are in the process of making the switch, a new report finds that many small business owners don’t even know about the deadline – or the potentially costly consequence of not meeting it. [More]

Single Ladies In 50s And 60s Prime Targets For Online Romance Scammers

Single ladies in their fifties and sixties are really in demand on dating websites. Unfortunately, they’re not popular in the way they might prefer. They’re prime targets for scammers, and victims typically lose $40,000 to $100,000. Once they realize what happened, they’re often ashamed to tell their families. That means word about this crime doesn’t get out. [More]

“Incorrect Keystroke” Allows Comcast To Withdraw $500 From Non-Customer’s Bank Account

We’ve told you before about Comcast not really paying attention to the payments it receives — like the woman who accidentally sent them her rent check and found that it had been deposited in the cable company’s account — but here’s a story of a man who isn’t even a Comcast customer but found that $500 had been taken out of his bank account anyway. [More]

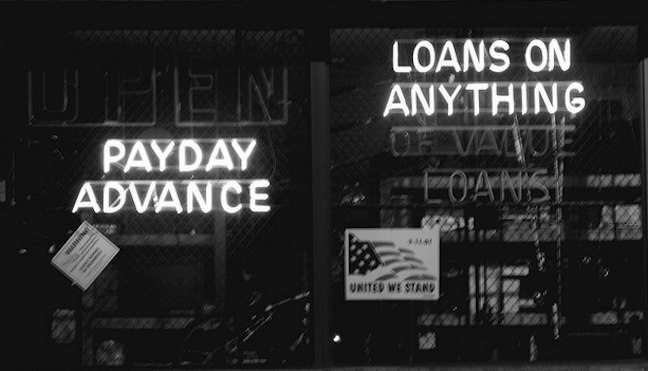

Payment Processor Pleads Guilty After Allowing Fake Payday Lenders To Raid Bank Accounts

If a payment processor — the intermediary between a merchant and the banks — facilitates transactions that it knows aren’t on the up-and-up, it’s not just a no-no; it’s a federal offense. Just ask the California man who pleaded guilty to wire fraud for enabling the operators of fake payday loan sites to steal money from consumers’ bank accounts. [More]

Operators Of Massive Payday Loan Scheme Banned From Industry

The masterminds behind a massive payday loan scheme have agreed to be banned from the consumer lending industry to settle federal regulators’ charges they bilked millions of dollars from customers by trapping them into loans that were never authorized. [More]