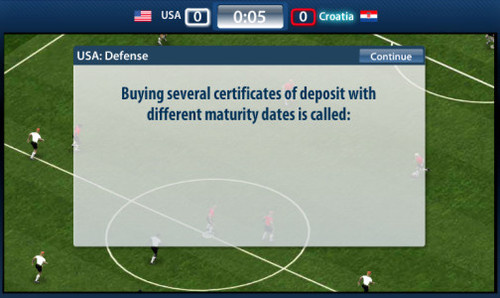

We’re not sure what “soccer” is—it looks like it might be some sort of real-world Quidditch without the brooms—but Visa and a bunch of soccer players have released a fancy-schmancy (for a website, at least) online version that tests your financial literacy. You can try it out at financialsoccer.com instead of working this morning.

financial literacy

How To Teach Children To Manage Money

The “Dollars & Sense” column in the Milwaukee-Wisconsin Journal Sentinel has an interesting list of ideas for how to instill some financial competence in your child. It starts with the basic skill of learning how to delay gratification, then moves on to increasing levels of personal responsibility, so that by the time you’re dealing with a teenager who craves independence, you’re handing out a full year’s allowance in January and tasking him with managing it properly.

High Credit Limits Encourage Consumers To Spend More

The more credulous you are, either because you’re new to the whole line-of-credit experience or because you’re uneducated, the more likely you are to mistake a high line of credit for an indication of your future earnings potential. You can see how this can lead to bad things, as noted by the researchers who studied this unfortunate problem earlier this decade. Luckily, the savvier you get about credit cards, the less influence your credit limit has on you, which is yet another great reason to make financial literacy education mandatory.

../..//2008/09/18/financial-illiteracy-has-reached-epidemic/

“Financial illiteracy has reached epidemic levels.” Author Braun Mincher has an editorial in the Austin American-Statesman on why every school in the U.S. should teach financial literacy. [Statesman]

Tennessee May Soon Require Financial Literacy Classes For High School Students

The Tennessee State Board of Education is expected to pass a bill on January 25th that will make Tennesee the eighth state (after Georgia, Idaho, Illinois, Louisiana, Missouri, South Dakota, and Utah) to require that its high school students take a personal finance class before graduation.

"Checkbook Math" Being Phased Out Of High Schools

We may indeed have a nation of financially illiterate youths, but despite cries for increased financial education in public high schools, the one program that’s historically addressed this—“checkbook math”—has never enjoyed a reputation as a “real” math class because the actual math skills involved are so basic, and it’s being phased out as most students avoid it because, as one student says, it “doesn’t look good for colleges.”

Government Wants To Sneak Financial Info Onto Soaps And Telenovelas

When we posted about “30 Rock” last Friday, a reader SHOUTED IN ALL CAPS that someone—either NBC, or Tina Fey, or maybe The Consumerist, we’re not sure—is a government shill for basically being paid by the gov to write about financial advice. Turns out Mr. Shouty is right, sort of: the U.S. Treasurer, Anna Escobedo Cabral, was on the radio news program “Marketplace” a couple of weeks ago to talk about how she’s been meeting with the creative teams of soap operas and telenovelas to find ways to incorporate financial storylines into their plots.