Bloomberg is reporting that the Federal Reserve will probably transfer record earnings exceeding $70 billion into the US Treasury. The income is coming from assets that include mortgage-backed securities, says the Congressional Budget Office. [More]

federal reserve

Low Interest Rate Party To Continue For An Extended Period

Fed Chairman and former South Of The Border employee, Ben Bernanke, says these historically low interest rates will continue… but not forever. [More]

Consent-Only Overdraft Protection: Maybe Not So Great

Starting on July 1st, the Federal Reserve has required banks to get consent from customers before enrolling them in overdraft protection programs so they can experience the excitement of cascading overdrafts. The problem is that consumers may be trading overdraft fees for insufficient funds fees and good old-fashioned bounced checks…and end up worse off in the long run. [More]

Should Retailers Verify Customer Income Before Extending Credit?

One provision of the CARD Act requires credit issuers to verify income and debt load before issuing new credit, and the Federal Reserve is now looking at how to enforce that. That’s scaring retailers, who have come to enjoy the benefits of pushing “instant credit” offers at the register. [More]

Federal Reserve Proposes Rules On Gift Cards

Here’s your chance to sound off on another consumer protection issue. In accordance with the CARD Act, today the Federal Reserve proposed new rules that would protect consumers from fees and expiration dates on gift cards, and they’ll soon be accepting comments on the rules.

Starting July 1, 2010 Overdraft Fees Will Require Consumer Consent

The Federal Reserve has announced a new rule requiring overdraft fees on one-time debit card transactions and ATM withdrawals to be “opt-in.” The new rule will take effect July 1, 2010. “The final overdraft rules represent an important step forward in consumer protection,” said Federal Reserve Chairman Ben S. Bernanke in a prepared statement. “Both new and existing account holders will be able to make informed decisions about whether to sign up for an overdraft service.”

Judge Orders Fed To Reveal Stimulated Companies

The Federal Reserve tried to hide the identities of companies that received emergency funding as the world economy went to hell, but a federal judge stepped in with a backhand Monday and stopped the practice, saying the Fed had failed to show that naming the businesses would cause “imminent competitive harm.”

Banks To "Earn" $38.5 Billion From Overdrafts This Year

Consumers aren’t the only ones looking to save money and gain a little extra cash on the side. Banks are people too, you know! In the face of toxic assets and credit card delinquencies, they’ve come up with a plan to increase their revenue: New fees! Higher fees! Higher minimum balance requirements! Trickier overdrafts!

Your Visa Gift Card Will Self-Destruct If Used Within 24 Hours

Stephanie bought a $100 Vanilla Visa gift card at her local CVS in Richmond, VA. She went right home and tried to use it to make some purchases online. When the card was declined, she studied the fine print that came with the card: “Funds may not be available for 24 hours after purchase.” So she waited the 24 hours and tried it again the next day. Still no luck. When she called the customer service number she was told to go back to CVS. At CVS, a manager told Stephanie (and apparently many others before her) that by using the card within 24 hours she had rendered her card agreement invalid. Bang, there goes $100.

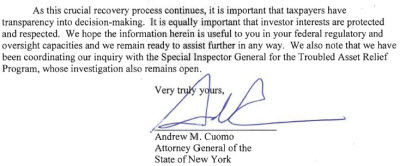

Bank Of America CEO: The Bush Administration Made Me Do It!

New York Attorney General Andrew Cuomo’s office is at it again. They’ve been investigating the circumstances that led to the merger of Bank of America and Merrill Lynch and the subsequent bonus payments to executives. In a letter to Senator Chris Dodd (D-CT), chairman of the Senate Banking Committee, Cuomo quotes Bank of America CEO Ken Lewis as saying that former Treasury Secretary Hank Paulson threatened him with removal from his position and mass firing of the board and senior management if he didn’t allow the merger to go through.

Stop Hungry Hungry Hippo Banks From Gobbling Your Bucks

Oh noes! The Hungry Hungry Hippo Banks are trying to gobble up your happy money fish! You only have 5 days left to get them to stop by writing the Fed and saying NO to banks default stuffing you into an overdraft fee programs. Send an email to regs.comments@federalreserve.gov with “Docket No. R-1343” in the subject line. Or you can use this online form.

Treasury Secretary Wants The Ability To Seize Insurance Companies, Hedge Funds

The Washington Post is reporting that Treasury Secretary Timothy Geithner will testify before the House Financial Services Committee today and argue that his agency needs broad powers to seize companies and “wind them down” without allowing them to enter bankruptcy.

Federal Reserve Chairman Ben Bernanke's Childhood Home Sold After Foreclosure

Federal Reserve Chairman Ben Bernanke is from a small town in South Carolina called Dillon — a town where the impact of the economic meltdown is being felt keenly.

Fed Chairman: A.I.G. Was Essentially Running An Irresponsible Hedge Fund

Fed Chairman Ben Bernanke told the Senate Budget Committee he was “angry” at A.I.G. for exploiting a loophole in the regulatory system in order to run what was essentially a hedge fund tied to an insurance company.

Should Banks Be Required To Ask Permission For Overdrafts?

When you sign up for a checking account, most banks automatically enroll you in a “courtesy overdraft protection” program. This program means that the bank will approve overdrafts from your ATM or debit card — and charge you a $35 fee for each transaction, etc. But what if you don’t want the service? Well, the Federal Reserve has proposed a new regulation that will require banks to ask your permission before they sign you up.

../../../..//2009/01/22/to-fix-the-economy-the/

To fix the economy, the Fed needs to lower interest rates below zero. Trouble is, that’s impossible. [Business Week]

../../../..//2009/01/19/the-credit-card-regulations-that/

The credit card regulations that the Fed enacted last month won’t take effect until summer of 2010, so Congresswoman Carolyn Maloney is reintroducing the Credit Cardholders’ Bill of Rights, which offers the same reforms but would come into effect 90 days after the president signs it.