It is done! The Federal Reserve has given the OK for Bank of America to buy subprime poster child Countrywide Financial Corp.. Bank of America CEO, Ken Lewis, says that even though the mortgage market has deteriorated significantly since the bank offered to buy the mortgage lender, buying Countrywide is still a good deal because the housing market is going to improve “by early next year.”

countrywide

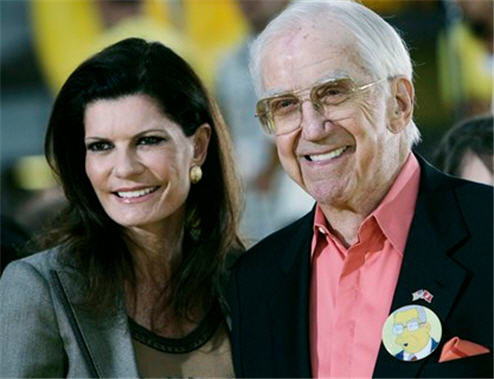

Countrywide Is About To Foreclose On Ed McMahon

Ed McMahon, former sweepstakes pitchman and Johnny Carson sidekick, has defaulted on his multimillion-dollar Beverly Hills home, says the AP. Mr. McMahon’s house has been on the market for two years, but is located so close to Britney Spears’ house that he’s having trouble selling it.

Round 48: United Health Care vs Hallmark/Westland Meat Packing Company

This is Round 48 in our Worst Company in America contest, Countrywide vs Clear Channel!Here’s what readers said in previous rounds about why they hate these two companies…

Round 47: Countrywide vs Clear Channel

This is Round 47 in our Worst Company in America contest, Countrywide vs Clear Channel!Here’s what readers said in previous rounds about why they hate these two companies…

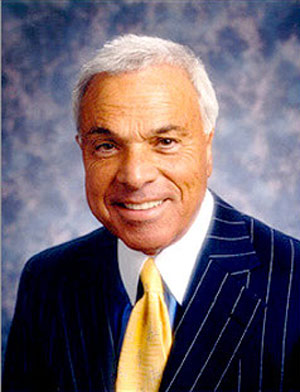

Countrywide CEO Accidentally Emails Homeowner, Calls His Plea For Help "Disgusting"

Apparently Angelo Mozilo, the CEO of Countrywide, has never made a mistake and needed help (from, say, Bank of America,) because he thinks that homeowners who are desperately trying to refinance out of their disastrous home loans and avoid foreclosure are “disgusting” if they look to the internet for help writing letters.

Countrywide Still Asking Consumers To Lie About Their Income

Countrywide would like you to believe that it put all that messy “predatory subprime lending” business behind it and is no longer coaching consumers to lie on their loan applications in order to qualify them for loans they can’t afford… but are they telling the truth about telling the truth? One woman who recently contacted Countrywide about refinancing her home told NPR that sketchy mortgage lending is alive and well at Countrywide.

Round 29: Countrywide Home Loans vs Dish Network

This is Round 29 in our Worst Company in America contest, Countrywide Home Loans vs Dish Network. Vote which sucks more, inside…

../../../..//2008/04/22/bank-of-america-says-it/

Bank of America says it will tighten lending standards at Countrywide. [MarketWatch]

Justice Department Will Investigate Countrywide's Lending Practices

Judge Thomas P. Agresti of the Federal Bankruptcy Court in Pittsburgh on Tuesday approved an inquiry into “the impact of Countrywide’s bankruptcy procedures on the integrity of the bankruptcy process” by the Office of the United States Trustee, a Justice Department arm that polices bankruptcy filings.

../../../..//2008/03/28/bank-of-america-corp-said/

Bank of America Corp said it has agreed to pay $28 million to Countrywide Financial Corp Chief Operating Officer David Sambol to run the company’s mortgage operations. That’s 37% more than Bank of America’s CEO makes. [Reuters]

What Should We Do With 125,000 Out Of Work Mortgage Bankers?

Today CNNMoney profiles an out of work mortgage banker who has been sending out 10 resumes a day since he was laid off in Feburary. He just got his first interview.

FBI Said To Be Investigating Countrywide

The FBI has opened an investigation into Countrywide for suspected securities fraud, reports the New York Times. The Justice Department and FBI “are looking at whether officials at Countrywide, the nation’s largest mortgage lender, misrepresented its financial condition and the soundness of its loans in security filings.” So far everything is unofficial because nobody has been authorized to discuss the case, and a Countrywide spokeswoman says, “”We are not aware of any such investigation.”

Congress To Subprime CEOs: How Come You Got Paid Millions To Wreck The Economy? Hm?

Congress got to ask the subprime CEOs what everyone else is thinking: Why did you get millions and millions of dollars to fail so spectacularly?

../../../..//2008/03/04/dr-housing-bubble-offers-some/

Initially, the lenders gave the impression that the majority of these loans were being given out to sophisticated investors who couldn’t document their $500,000 income and had better places to put their money to work. Clearly this wasn’t the case as we are seeing that 71% of the people are electing for the lowest of the low payments. Of course when the market in California was ripping it up by seeing 20%+ appreciation each year, making the minimum payment made sense because you were going to sell in 1 to 2 years and pocket the change. Heck, it was cheaper than renting!

Countrywide's Risky Mortagages May Be Ballooning Out Of Control

“Pay-option mortgages” are loans in which homeowners can choose to pay the interest or even just part of the interest on their mortgage each month. If they do this, the unpaid interest is added to the principal resulting in a mortgage that actually grows over time.

Get Countrywide To Remove Your PMI With An 80% LTV

Is Countrywide telling you your Loan-to-Value (LTV) ratio needs to have reached 75%, not 80%, in order to get the private mortgage insurance (PMI) removed? Throw the book at them: tell them they’re in violation of the Homeowners Protection Act of 1998. The law clearly states that PMI is to be removed after 80%:

Cancellation date.–The term “cancellation date” means…the date on which the principal balance of the mortgage…is first scheduled to reach 80 percent of the original value of the property securing the loan.

One reader (different from the guy we posted about before) says he was having trouble getting Countrywide to remove the PMI. They twice told him in writing that he needed a LTV of 75%. Then on the phone with them he mentioned the Homeowner’s Protection Act and then all of a sudden they were magically able to remove the PMI.

../../../..//2008/02/11/if-youre-late-on-your/

If you’re late on your mortgage payments, Countrywide may have a new workout program for you. You don’t need to have a ARM. Call them! [MarketWatch]

Countrywide Made Racist Sub-Prime Loans?

Countrywide Home Loans was racist and automatically put African-Americans into exotic and expensive sub-prime loans they didn’t want or need, and couldn’t afford, according to a former employee. This employee worked there for two years up until the sub-prime meltdown. They write:

“…a customer would be qualified for a loan because their credit score and other factors based on the written product description, however, when I went in to put their (this only happened to African-Americans) – they were not qualified for the loan product and had to be referred to Countrywide’s subprime mortgage company Full Spectrum. Full Spectrum offered higher rates and fees. I got wise one day and started not inputing the race so the computer could give me “approval.”