What do Wachovia customers need to do now that Citigroup owns your ass? Absolutely nothing. You can do all your online and offline banking just like nothing happened. No temporarily held funds, no chained and locked bank branches. Everything is the same. Even your bank’s regulator remains the Office of the Comptroller of Currency. Down the road there will likely be a few alterations, most of them cosmetic. Read our post “Insiders: Probable 1-Year Timeline For Customers In WaMu To Chase Transfer” for some of the changes you can expect.

citigroup

Citigroup Buys Wachovia

Part of Wachovia will remain independent — including its massive brokerage business which ballooned after it purchased AG Edwards in 2007, as well as its Evergreen investment management division.

Citigroup May Reinstate Universal Default

Last year Citigroup pledged to abandon the customer-screwing policy of universal default, where an unrelated late payment or credit score change can trigger an interest rate increase on your Citibank card. They even used a marketing phrase to promote their promise: “a deal is a deal.” According to the New York Times, Citigroup is “quietly reconsidering its pledge” and may decide to reinstate universal default as early as this week.

Blame The Subprime Meltdown On The Repeal Of Glass-Steagall

A lot of blame has sloshed around for the sub-prime meltdown, from greedy borrowers to greedy mortgage brokers to Alan Greenspan, but if you want the real culprit, it was the repeal of the Glass-Stegall Act. On November 12, 1999, the champagne must have been shooting from the walls at Citigroup, which had worked behind the scenes for over 30 years to get the act overturned. After recovering from their hangover, they and their banking buddies went on a sub-prime lending orgy. But what was Glass-Steagall and how did it use to protect us?

Citigroup Developing Citi-Branded Phone That Can Make Contactless Payments

Do you wish you had a way to spend your money more easily, without all that opening-the-wallet or punching-the-pin-number manual labor? The trade publication Cards & Payments (registration required) says that it’s received a copy of a report filed with the FCC that indicates Citigroup is developing a Near Field Communication, or NFC, mobile phone that would allow its customers to make contactless payments at participating retailers.

../../../..//2008/01/15/citigroup-writes-down-181-billion/

Citigroup writes down $18.1 billion due to investments related to subprime debt. Observers and analysts unanimously agree that that is a lot of billions. [Reuters]

Subprime Meltdown Continues: Citigroup To Take $15 Billion Hit?

Goldman Sachs has downgraded Citigroup, the nation’s largest bank, estimating that it will have to take a $15 billion hit due to its exposure to the subprime meltdown. Two weeks ago, Citigroup estimated that its mortgage related write-downs would total from $8-$11 billion as its CEO, Charles Prince “resigned.”

../../../..//2007/11/12/call-it-the-golden-boot/

Call it the “golden boot:” Citigroup’s deposed CEO to get $12.5 million cash bonus. [NYT]

../../../..//2007/11/05/citigroup-said-to-announce-announce/

Citigroup said to announce announce another 8-11 billion in losses due to bad investments based on subprime mortgages tomorrow. Ouch. [CNNMoney]

Citibank CEO Resigns, Additional $11 Billion In Subprime Damage Predicted

Citibank’s chairman and CEO Charles Prince announced his resignation Sunday, citing the subprime meltdown as the reason for his departure.

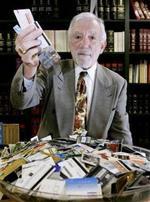

Senate Hearing Attacks Credit Cards' Ridiculous Fees

A Senate hearing today called up executives in the credit card industry to defend their anti-consumer practices, their explanations provoking laughter from the crowd.

Citigroup Stops Using Universal Default

Citigroup announced it will stop using the “Universal Default” clause for credit card borrowers, which should come as a surprising piece of good news for consumers.

Thunder Before The Storm? Another Citibank Account ‘Compromised’

Buckle yourselves in, boys and girls. Is this email we just received from Kate H. the first rumbling of another massive slate of Citibank security breaches?

Citigroup Gets Around to Addressing PIN Compromises

Hey, remember all those debit cards and PINs that got stolen and stuff? Where hackers got into Office Max, made off with debit card accounts and encrypted PIN codes, decrypted the PINs, made counterfeit ATM cards, and withdraw lots of money and large amounts of people were forced to get their ATM card changed without anyone telling them the real reason why? Well, apparently Citigroup remembers too. Eventually.

Citibank’s Statement on the ATM Crisis

Citigroup spokesperson Elizabeth Fogarty released the following statement to us regarding the ATM crisis:

Massive Citibank Alert: UPDATE

EXCLUSIVE: More dirt on the Citibank ATM failures. What happened after we posed as a concerned customer, as well as secret codes for hassling the Citibank public affairs department after the jump…

Massive Citibank Fraud Alert: UPDATE

Citibank may bee trying to keep this huge scandal so under wraps that they haven’t even disclosed it internally, leaving Citibank workers just as clueless as to why many customers can’t access their accounts in Canada, the UK and Russia. Is there a systemic security breach?