Banks are increasingly charging foreign transaction fees on domestic purchases, a dangerous practice that’s likely to expand as banks look for new ways to generate profit. Tripso tells us the story of Sunil, who bought tickets with Qatar airlines, which sounds ever so expensively foreign. Citi charged a 2% foreign transaction fee, even though the tickets were bought in U.S. dollars and processed by the airline’s central reservation system based in Washington D.C.

citi

Citibank Comes Up With Elaborate Cash Back Offer That Reduces Credit Limit And Temporarily Suspends Card

Compared to what some other banks and card companies are doing to reduce their exposure to debt, we guess Citibank’s cash back offer isn’t that bad—it’s sort of a “let us help you help yourself get rid of your debt” scheme. It’s funny, however, if only because it’s such an elaborate way to get customers to self-select for a reduction in credit.

Citibank Launches iPhone Version Of Mobile App

Okay, all you iPhone dorks, Citi’s just released an easy way for you to keep track of your account balances while you’re running around pinching things bigger and smaller with your heavily patented gestures. Don’t worry, ugly phone owners, they’ve got other mobile versions too.

Citibank Reinstates Credit Limits If You Ask

Like many credit cards, Citibank is cutting people’s credit limits left and right but apparently if you call up and ask to get your credit limit back to where it was, they’ll do it for you. Classic tactic: Conduct adverse action, easily fix it for the small amount of people who complain, profit from the difference. As ever, squeaky wheel gets the grease.

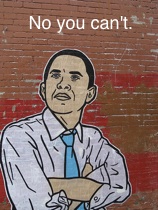

White House To Citi: Don't Even Think About Buying Luxury Jets With Taxpayer Money

Yesterday, we wrote that Citigroup had decided to spend $50 million of its bailout money on a French luxury jet to ferry execs around town. The White House was not pleased about this.

Bailed Out Citigroup Stimulates French Economy By Purchasing $50 Million Corporate Jet

With $45 billion in taxpayer funds burning a hole in its pocket, Citigroup is purchasing a $50 million Dassault Falcon 7X, according to the New York Post. Apparently none of the existing jets that ferried execs to Washington to ask for bailout funds was ironic enough.

Defending Access To Your Credit Cards & Lines

Credit card issuers are panicking, cutting credit lines and entire cards. This can have a negative impact on your credit score, here’s a few ideas on how to defend against it.

20% Of Citigroup Cardholders Can Expect Rate Increases For 2009

If you have a Citigroup-issued credit card and you haven’t had a rate increase over the last two years, expect to be notified of a 2-3% rate increase on your November statement. Congratulations! You’re going to help Citigroup offset its losses in the global credit card division, whether you were directly part of those losses or not. As the New York Times points out, by doing this Citigroup is breaking the promise they made to Congress in 2007 that they would not arbitrarily raise rates on accounts—which may be why they’re offering a fairly lenient opt-out policy.

Citi Credit Card Cautions You Against Spending

Citi’s been burned enough by its cardholders’ profligate spending, apparently. Check out the message on this activation sticker on a new card. We like the inclusion of a sort of Yin-yang background, as if to remind us that debt and repayment are equal elements of the consumer credit world. A balance must be maintained! Just, you know, not so high a balance that you can’t make your monthly payments.(Thanks to Jerry!)

Citigroup Buys Wachovia

Part of Wachovia will remain independent — including its massive brokerage business which ballooned after it purchased AG Edwards in 2007, as well as its Evergreen investment management division.

Forever 21 Aftershocks? Citibank Cancels Cards Due To Retailer Security Breach

We’ve received queries from readers telling us that their Citibank cards have been replaced, and asking whether we’ve heard about any new security breach. Other than Forever 21 we haven’t, so we’re wondering whether they’re responsible for the stories below.

Citibank: Sorry We Illegally Ruined Everything You Own Because Your Landlord Was In Foreclosure

Do you know what your rights are if your landlord is in foreclosure and people show up at your door to try to evict you instead of him? What if they load all your crap onto a truck and lock you out? No? Neither did “Tabitha,” a renter whose landlord was in foreclosure and whose possessions were destroyed as movers kept illegally loading them onto and off trucks over and over again.

Citigroup May Reinstate Universal Default

Last year Citigroup pledged to abandon the customer-screwing policy of universal default, where an unrelated late payment or credit score change can trigger an interest rate increase on your Citibank card. They even used a marketing phrase to promote their promise: “a deal is a deal.” According to the New York Times, Citigroup is “quietly reconsidering its pledge” and may decide to reinstate universal default as early as this week.

Citi CEO Emails To Inform You Of Citi's "Bold Steps," Neglects To Tell You What The "Bold Steps" Are

Reader Ben writes:

Citibank Promises To Credit ATM Fees, But Will Try To Get Out Of It Unless You Badger Them

Tim was pretty sure he met all the conditions of Citibank’s offer to refund ATM fees—he opened his account online and he doesn’t live near a Citi Financial center. When he wasn’t credited, he contacted them to ask why, and was told he had to meet the conditions he’s already met. He had to contact them four times to finally get the $2.00 fee credited as per their advertising. You might be asking yourself, “All that trouble for two dollars?” Well, that’s why he ends his email with this: “Can someone point me in the direction of a better bank that actually provides ‘reimbursement of the fees other banks may charge you for using their ATMs’ without hassle?”

Citigroup Developing Citi-Branded Phone That Can Make Contactless Payments

Do you wish you had a way to spend your money more easily, without all that opening-the-wallet or punching-the-pin-number manual labor? The trade publication Cards & Payments (registration required) says that it’s received a copy of a report filed with the FCC that indicates Citigroup is developing a Near Field Communication, or NFC, mobile phone that would allow its customers to make contactless payments at participating retailers.

Citibank Sends You Letters To Let You Know Your Paperless Statement Is Ready

Corey writes:

I have a lovely Citi Mastercard with lots of rewards. I hate having to deal with paper statements, so I signed up for paperless statements (like I’ve done with all my accounts), available for viewing online at their website.

GoDaddy Hushing Up Customer Credit Card Data Breach?

Did domain name registrar GoDaddy have a credit card security breach that they’re not telling anyone about? That’s what Reader Newcxns thinks. Two weeks ago, one of his Citi cards was replaced. One week later, another. The only thing Citi would tell him is that “a merchant” reported a possible data breach. No merchant has sent any data breach reports to Newcxns. In typical fashion, banks and vendors like to hide it when their security systems fail and compromise your account information.