Back in 1985, there were around 18,000 different federally insured banks operating in the U.S. But in the nearly three decades since, numerous failures and mass consolidation has left us with around 38% of that 1985 number, meaning Americans now have the fewest banking options since the federal government began tracking these stats back in 1934. [More]

bank of america

Fulfilling That ‘Banker Bro’ Stereotype In Job-Hunting E-mails Is A Bad Idea

It’s one thing (though still obnoxious) to be a brash, backstabbing alpha male when you’re out on the town with business associates. It’s another for a job applicant to be so dimwitted as to put that same arrogant attitude into an e-mail and assume it’s not going to be forwarded around, and probably end up on the smartphone screen of the very people you’re insulting. [More]

Bank Of America Accused Of Neglecting Foreclosures In Non-White Neighborhoods

In 2012, a National Fair Housing Alliance survey of bank-owned properties in nine metro areas found that those buildings in predominantly white neighborhoods were more likely to be properly maintained by the bank while those homes in non-white parts of town were often being allowed to fall into disrepair, driving property values down for neighbors and causing public health and safety concerns. Since then, the NFHA has filed a federal discrimination complaint against the bank for what it alleges are violations of the Fair Housing Act. [More]

Bank Of America Caught Refusing Mortgages To Women On Maternity Leave

Compared to $40 billion-plus in penalties, settlements, adjustments, and legal fees Bank of America has already racked up because it flat-out stinks at servicing home loans, a $45,000 payment split between two couples is a molecule in a drop of water in the bucket. But this story, in which BofA decided that pregnant homeowners were too big a risk for mortgage refinancing, is a good reminder of consumers’ rights under the law and of BofA’s general incompetence. [More]

Safe Deposit Key Refund Zombifies Bank Of America Account

It’s the end of the day, so let’s all gather around the soft glow of our monitors and tell spooky stories. I’ll start. Not that long ago, an ordinary consumer had a terrifying experience. He laid his Bank of America account to rest last August, never imagining that it would rise from the dead to eat his brains wallet. [More]

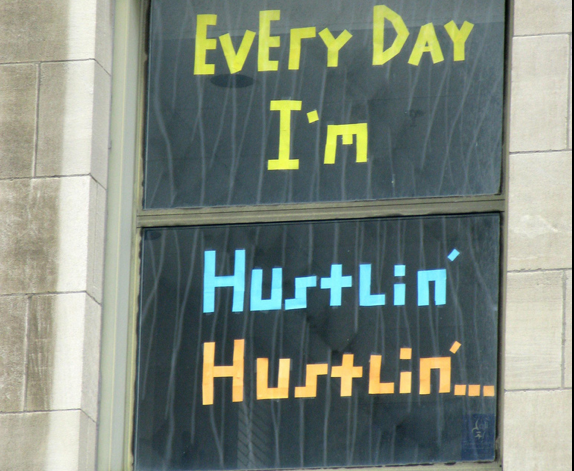

Bank Of America Found Liable For Countrywide’s “Hustle” Scam

A federal jury has found Bank of America (and a current JPMorgan executive) liable for a Countrywide Financial program that knowingly sold piles of cruddy home loans to Fannie Mae and Freddie Mac, meaning the bank could face nearly $850 million more in penalties added to the $40 billion-plus court tab it has tallied since acquiring the cratering mortgage-lender in 2008. [More]

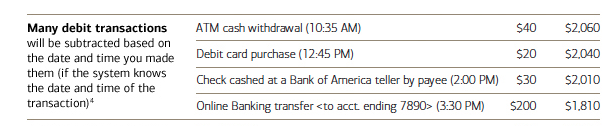

BOfA Stops Overdraft-Friendly Practice Of Re-Ordering Transactions From High To Low

As we’ve noted multiple times over the years, some banks love to lump all transactions made by a customer during a day or weekend together and then process them not in the order they were received, but from largest to smallest. For customers on the brink of overdrafting, this can result in numerous fees that may have been avoided if the charges had been processed chronologically. In a rare bit of positive Bank of America news, the bank has decided to stop this high-to-low transaction processing (for many debit purchases). [More]

Bank Of America Employee Charged With Taking At Least $1M In Bribes To Rig Short Sales

Between homeowners eager to get out from underwater mortgages and real estate speculators looking to scoop up below-market properties, there are a lot of people out there eager to grease the wheels to make a short sale happen. And federal authorities say one now-former Bank of America employee accepted at least $1 million in bribes to improperly approve short sales and falsify bank records. [More]

Just-Fired NHL Coach Sues Bank Of America For $3 Million

Peter Laviolette is probably still stinging after being given the boot as coach of my Philadelphia Flyers this morning, but perhaps he’s now pinned his hopes not on a Stanley Cup, but on a $3 million lawsuit against Bank of America. [More]

Judge Orders Bank Of America To Pay $10K/Month If It Wants To Keep Hassling Couple

Here’s how inept Bank of America is. Not only did the bank ignore the fact that a couple’s mortgage debt had been discharged in bankruptcy, continuing to harass them for a debt they no longer owed, it also ignored messages from the bankruptcy court judge. That is until after the judge imposed a $10,000/month sanction on the bank. [More]

Bank Of America To Pay $32 Million Over Robocall Allegations

Two of our favorites kinds of stories — big bank badness and robocalling — all wrapped into one breakfast burrito. Earlier this week, Bank of America reached a $32 million deal to settle complaints, filed on behalf of 7.7 million customers, that BofA repeatedly violated federal regulations by robocalling consumers’ mobile phones without permission. [More]

Will Bank Of America Balk At Taking Washington State’s Marijuana Money?

We’ve already written about how owners of legitimate marijuana businesses are being forced to pay their taxes in cash because federally insured banks are unwilling to let them open bank accounts. These payments then pose a problem for the state, which has to worry about finding a place to deposit the tax revenue. [More]

Bank Of America On Trial Over Countrywide’s “Hustle”

There are children in elementary school who were not yet born in 2007, when Countrywide Financial allegedly launched a program dubbed the “Hustle,” which removed virtually all the roadblocks in the mortgage approval process so the lender could write as many loans as possible and quickly sell them off to Fannie Mae and Freddie Mac for billions of dollars. Many of those mortgages proved toxic, and six years later, Bank of America has to answer in court for the bad behavior of the mortgage company it must now regret acquiring. [More]

On 5-Year Anniversary Of Mortgage Meltdown, Those Responsible Are Doing Just Fine

On Sept. 15, 2008, Lehman Brothers became the largest bankruptcy filing in the history of this country. It was the first domino of many to fall, followed by the likes of Bear Stearns, Merrill Lynch, Countrywide, Wachovia, Washington Mutual, and many other banks and investment firms that had bet too much money on the subprime mortgage market, only to have it collapse when people realized many of those bad loans would never be repaid. These events ripped apart the American economy and left people out of work for extended periods of time. But not most of the bankers responsible for the mess. [More]

How A 1¢ Interest Payment Zombified My Bank Of America Account

A few days ago, we shared the hilarious and pitiful one-cent check that a reader received after closing out his Bank of America money-market account and taking the funds elsewhere. This was a silly and annoying waste of paper and postage, but better than the alternative…having the account go zombie and run up a negative balance when it should have been long since dead. [More]

Bank Of America Cuts Me A 1¢ Check I Don’t Want Or Need

Bank of America…scrupulously honest? Hmm. Reader Dave closed his money market account that dated back to the Countrywide era, transferring all of the funds to a local bank. (Yay!) Well, he thought he had transferred all of the funds. Did the company zombify his account years later, charging him maintenance fees on a one-cent balance? No. something unexpected happened. [More]

Judge Denies Class-Action Request In Massive Bank Of America Lawsuit

An effort to consolidate 26 separate homeowner lawsuits against Bank of America hit a huge roadblock yesterday when a federal judge ruled that while the individual cases appear to have merit, they can not be heard as a group in a class action. [More]

U.S. Lawsuit Against Bank Of America Given Go-Ahead For Trial

It’s been nearly a year since the U.S. government sued Bank of America over Countrywide’s sale of billions of dollars worth of toxic loans to Fannie Mae and Freddie Mac. Predictably, BofA has attempted to have the case dismissed, but a federal judge has given the green light for the suit to finally head to trial next month. [More]