A survey released last week by Wells Fargo found that a majority of small business owners aren’t prepared for the October deadline to switch from traditional swipe-and-sign credit card transactions to the supposedly more secure chip-and-PIN card system. Now, one mobile payment company says it wants to take some of the burden off the shoulders of these companies by offering to pay for any charges incurred from a breach — as long as the business owner has ordered its new card reader. [More]

apple pay

Square Trying To Help Small Businesses Meet October Deadline For New Chip & PIN Credit Cards

Rite Aid Changes Its Tune, Will Now Accept Apple Pay

In a reversal from its sudden decision in October last year to stop accepting Apple Pay at its stores after just a week of offering that option to shoppers, Rite Aid has announced it’s going back, and will allow it as a form of payment starting Aug. 15. [More]

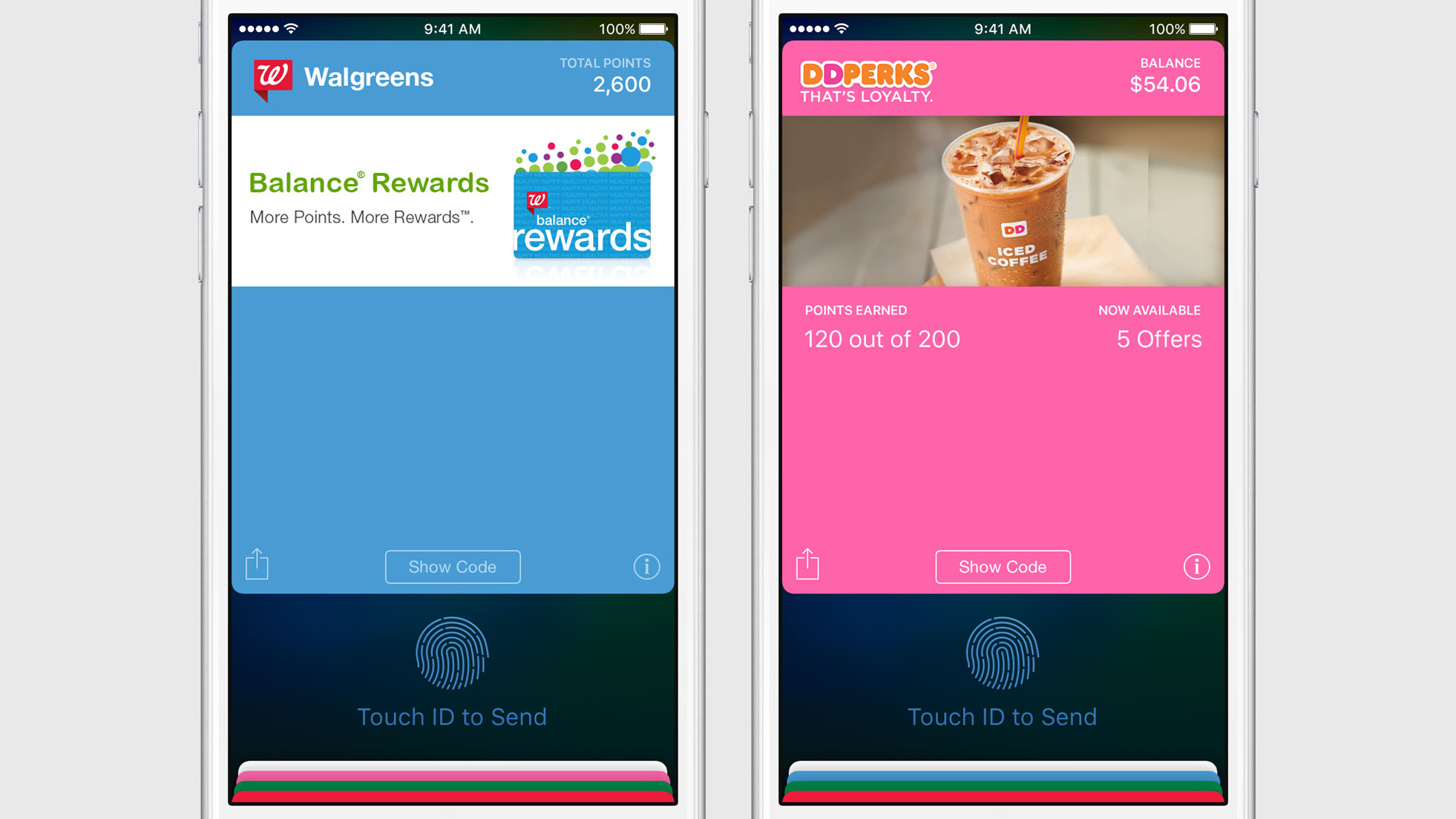

Apple Pay To Include Store Credit, Rewards Cards

Apple Pay is expanding its usability beyond just your bank-issued debit and credit cards. Today, the company announced that the payment platform will soon include the ability to pay with some store-branded credit cards and for users to access certain store rewards cards. [More]

Target Wants To Perfect Chip-and-PIN Before Venturing Into Digital Payment Methods

Consumers and businesses alike are always seeking out ways to streamline the checkout experience, most recently with mobile payment systems like Apple Pay and Android Pay. But there’s one major retailer that won’t be jumping into new payment options just yet. [More]

Apple Pay Unavailable At Home Depot As Retailer Upgrades Payment Terminals

Though Home Depot was never officially a partner with Apple’s Apple Pay mobile payment platform, which allows users to pay using credit card information stored their phones, the home improvement chain’s NFC-enabled checkout terminals worked with Apple Pay — until recently, that is. The retailer has begun the process of upgrading its in-store payment system, meaning that Apple Pay and other mobile payment platforms are now unavailable. [More]

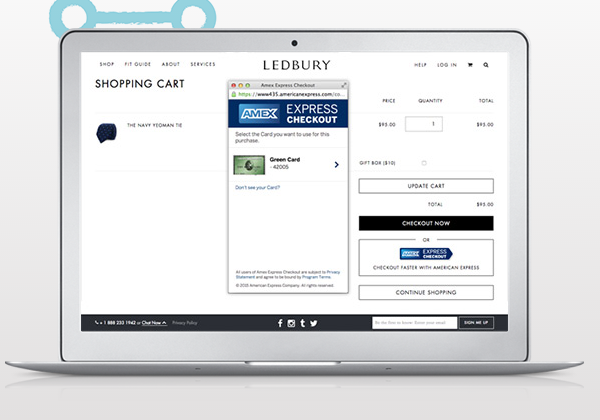

AmEx, Jawbone Partnership Allows Customers To Buy Things Using Fitness Trackers

Using your phone to pay for things at the register is so 2014. With the soon-to-be released Apple Watch allowing payments to be made with a flick of the wrist, other wearable companies are jumping on the bandwagon. Case in point: a new joint venture from Jawbone and American Express. [More]

Study: People Try Apple Pay Once, Don’t Go Back

The prospect of using our phones in place of wallets is exciting to absent-minded people everywhere, but how well is adoption of mobile payments going in the real world? A recent survey looking at adoption of Apple Pay a few months out from its introduction shows that consumers are enthused about it, but are having trouble finding retailers where they can use the service. [More]

Report: Stolen Credit Card Information Used By Fraudsters To Make Purchases With Apple Pay

A rash in data breaches at national retailers may have led fraudsters to use Apple Pay to make big-ticket purchases with credit card information stolen during national data breaches. [More]

Apple Pay Gets More Useful, Coming To 200,000 Vending Machines & Other Self-Serve Devices

Apple Pay is not (yet) available at some of the nation’s largest retailers as they prepare to introduce their own mobile payment system, meaning you can’t use it to buy a week’s worth of groceries at Walmart or a TV at Best Buy, or even pay for your prescriptions at CVS and Rite-Aid. But what about those transactions on the opposite end of the spectrum, the ones with dollar values so small that you may feel odd not paying in cash? One company says it will be bringing Apple Pay to hundreds of thousands of vending machines and other self-serve devices. [More]

Walmart-Led Apple Pay Competitor Requires Months Of Exclusive “Breathing Room”

Even though it hasn’t launched, mobile payment system CurrentC is already making headlines, and not just for being hacked. It’s also the reason iPhone 6 users can’t use Apple Pay at some of the country’s biggest stores, including Walmart, CVS, and Best Buy. But the CEO of the Walmart-led consortium behind CurrentC says that its backers won’t be blacking out Apple Pay forever. [More]

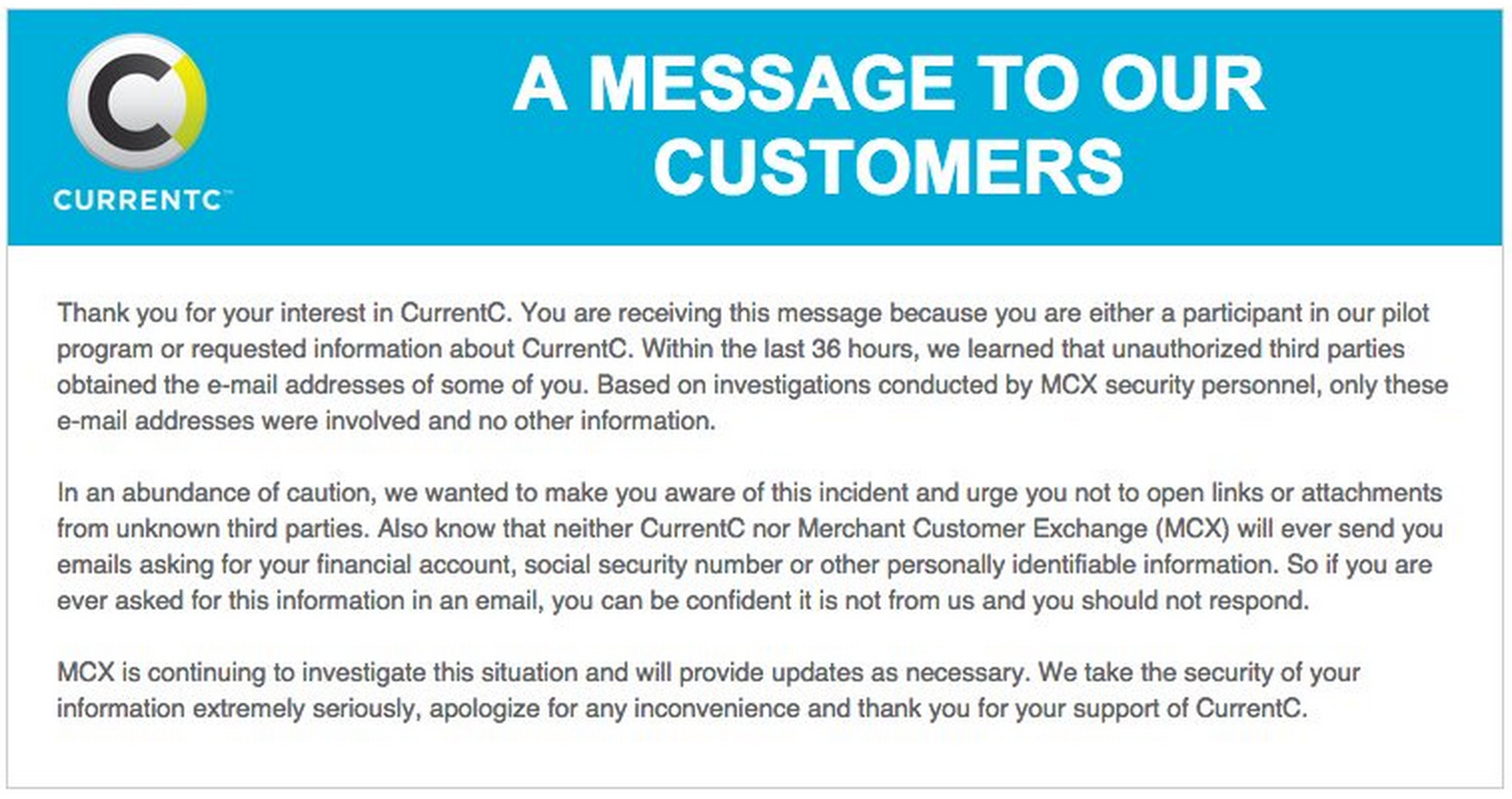

CurrentC, Walmart-Led Competitor To Apple Pay, Has Already Been Hacked

A number of major retailers, most notably Walmart, have yet to allow shoppers to use the recently launched Apple Pay system at checkout, and national drugstore chains Rite-Aid and CVS stopped offering Apple Pay as an option after only a few days. That’s because all of these retailers are part of a consortium working on a competing system called CurrentC, which by the way, has already been hacked. [More]

Why Did CVS & Rite-Aid Stop Taking Apple Pay?

After nearly a week of accepting payment via the recently launched Apple Pay system, both CVS and Rite-Aid suddenly stopped offering this option to shoppers over the weekend. And neither retailer is giving a reason why, though it appears to be part of a retail-industry effort to eventually roll out its own payment system. [More]

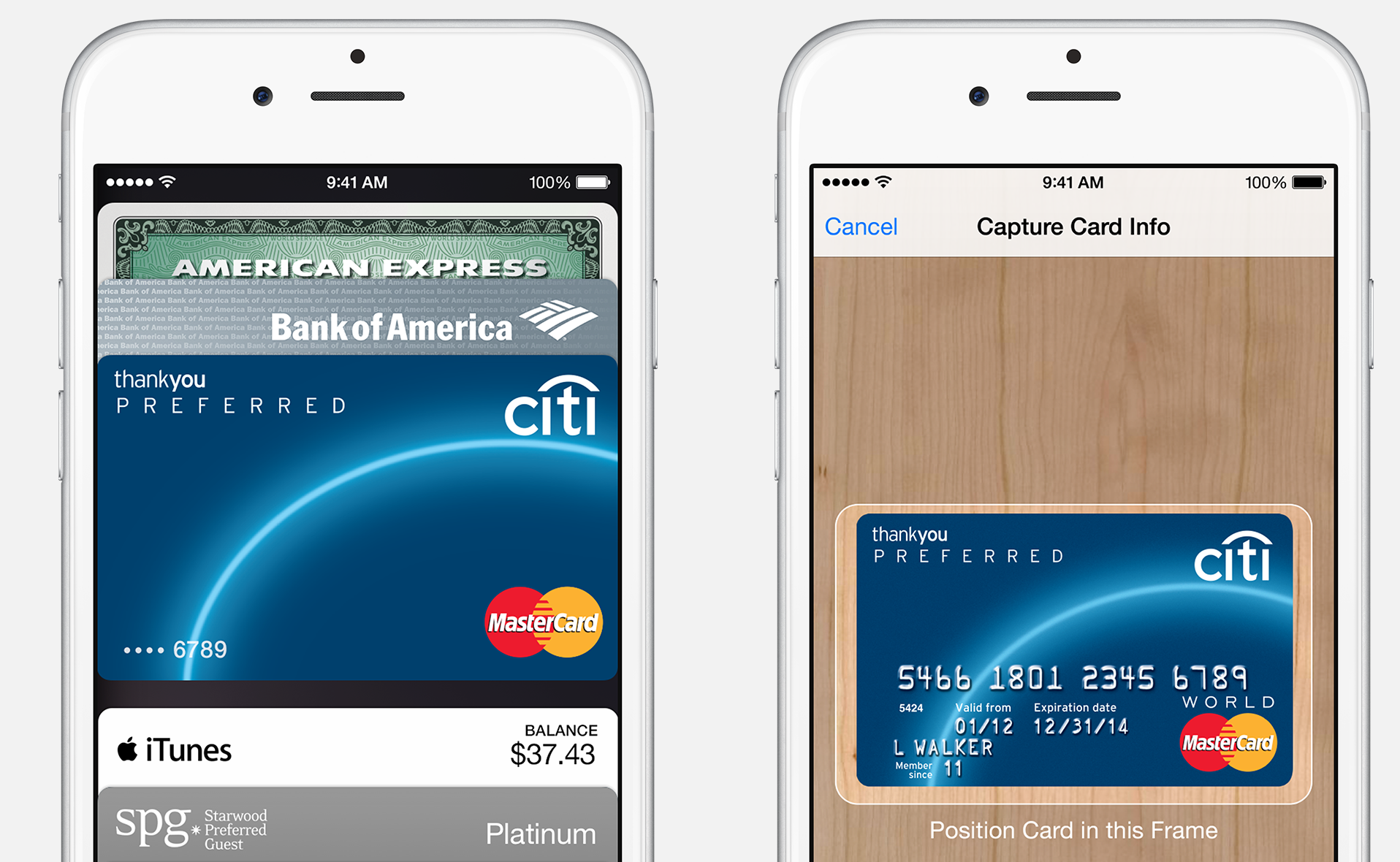

Apple Pay Lets Man Scan, Use Wife’s Citi Credit Card Without Additional Verification

One of the neat features of the new Apple Pay system is that it lets iPhone 6 users quickly scan and verify credit cards into their Passbook so they can use those accounts without ever providing participating businesses with their card numbers. But how easy is it to just scan in someone else’s card and start using it without that person’s permission? [More]