New York Attorney General Andrew Cuomo has written a letter to House Financial Services Chairman Barney Frank, offering some advice on what topics they might discuss at tomorrow’s AIG hearing. Among them: Giving “retention” bonuses to people who have left the company, making 73 millionaires in “the unit which lost so much money that it brought the firm to its knees” and the fact that without a taxpayer bailout — the “best and brightest” at AIG wouldn’t have jobs from which to collect impressive guaranteed bonuses.

aig

../../../..//2009/03/17/aig-misses-their-400-pm/

“We had given AGI up to 4 o’clock today to provide the information on the latest round of bonuses that they paid out,” Cuomo told reporters. “Four o’clock has come and gone.”

How Do You Solve A Problem Like AIG? Suicide.

Another day, another livid politician. Senator Charles Grassley of Iowa told a Cedar Rapids radio station that the AIG executives who are taking bonuses should, as an alternative, kill themselves.

NY Attorney General To AIG: You Have Until 4:00 PM To Give Us The Names

Andrew Cuomo has written a letter to AIG in which he explains that they will turn over the names of those employees from the Financial Products subsidiary (that’s the division that brought down the company) who are receiving bonuses by 4:00 pm today or they are coming at them with subpoenas. Yes, ladies and gentlemen, it’s another awesome Andrew Cuomo letter after the jump.

Lawmakers, Regulators, Taxpayers Unbelievably Pissed At AIG

There’s no shortage of outrage directed at AIG today as the fallout from the bailed-out insurer’s announcement that they intend to use $165 million in taxpayer money to pay bonuses to the very executives that ruined the company continues.

AIG To Use Bailout Cash To Pay $165 Million In Bonuses. Yes, Seriously

So, those guys at AIG who underwrote trillions of dollars worth of credit default swaps backed by securitized mortgages? The ones the Times says were “at the very heart of A.I.G.’s worldwide conflagration?” They’re taking $165 million of our bailout money for bonuses. Because if we don’t pay them, these people—described by AIG’s government-appointed Chairman Ed Liddy as the “best and brightest talent”—will apparently leave to go ruin some other country’s financial system, and we can’t have that. Liddy acknowledged that the bonuses were “distasteful and difficult” before saying that he had “grave concern about the long-term consequences” of not paying up.

Fed Chairman: A.I.G. Was Essentially Running An Irresponsible Hedge Fund

Fed Chairman Ben Bernanke told the Senate Budget Committee he was “angry” at A.I.G. for exploiting a loophole in the regulatory system in order to run what was essentially a hedge fund tied to an insurance company.

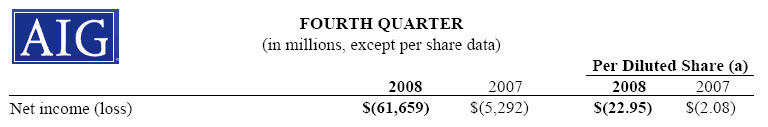

AIG Loses $62 Billion In A Single Quarter

The government is taking steps to revamp the AIG bailout, after the company lost a mindbogglingly huge amount of money, $62 billion, in a single quarter.

Video: Oil Speculators To Blame For Record Gas Prices After All

If you thought oil speculators as the reason behind the historic gas prices spikes of this summer was debunked, think again. From ’07 to when the price of oil collapsed, supply increased and demand dropped. According to basic economic theory, this should’ve meant the price went down. But all of a sudden an influx of capital, an infusion that brought the total at play from $13 billion to $300 billion, brought to market by large investment bankers, exploiting de-regulation and trading in black box private exchanges made possible by Enron, drove the price of oil from $69 to almost $150. A new 60 Minutes report explores the issue. Video inside.

AIG Ad Is Optimistic, Ready To March Down The Field For A Comeback Win

The fall of AIG is old news, but we had to laugh at this ad from the October issue of Money magazine sent in by reader Tom.

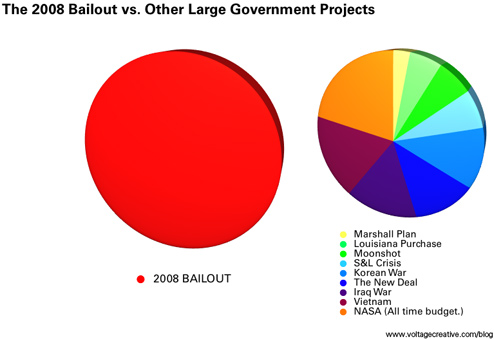

2008 Bailout Costs As Much As Several Large And Famous Government Projects Combined

This graphic demonstrates how the 2008 bailout, so far, costs as much as several large and famous government projects added up together. Yes, these numbers are inflation adjusted.

AIG Swaps "Retention Bonuses" For Annual Bonuses

In order to get a giant honking bailout from Congress, AIG pledged it would give up executives annual bonuses, but guess what? They found a way to give them anyway.

The Tom Hanks Movie "The Money Pit" Is Actually A Documentary About Our Economy

Over at Slate they’ve realized that the Tom Hanks movie from the 80s “The Money Pit” is actually just a documentary about our current financial crisis and the bailout of AIG. Specifically, the scene in which the kitchen catches fire and the bathtub falls through the floor. (Video, inside…)

AIG's CEO Issues Statement About $343,000 Phoenix Seminar

Bothered by news reports about another high-priced junket, AIG’s CEO Edward M. Liddy issued a public statement to correct the innacuracies he saw. AIG Media Relations emailed it to us and wanted to make sure we shared it with our readers, and since we’re all about sharing at The Consumerist, here it is:

AIG Spends $343,000 On Secret Seminar

AIG is hurting so bad that we just gave them another $40 billion, while execs live it up at another luxury junket, this one costing $343,000. KNVX uncovered another high-priced conference taking place at the Pointe Hilton Squaw Peak Resort in Phoenix, AZ. They reported that AIG made efforts to disguise its presence, making sure no AIG iconography was out in the open. One hotel employee said that staff was forbidden from even saying the word AIG. AIG said seminars like this, which was for independent financial advisers who steer customers to AIG, are essential to its business. They also said that most of the seminar’s costs would be picked up by other corporate sponsors. AIG said in a statement, “We take very seriously our commitment to aggressively manage meeting costs.”

AIG Gets Additional $40 Billion From You

Congrats, taxpayers, you’re about to own $40 billion more of A.I.G. [NYT]

AIG Has Already Used Up 3/4 Of $123 Billion Bailiout

It’s only been a month, but AIG has already gone through 75% of its $123 billion government bailout. Those golf trips and sea-side hotels sure add up, don’t they? [Washington Post] (Photo: ChristophrHiestr)