Nursing homes and assisted living facilities in the U.S. have faced increasing criticism for shoddy care and bad business practices. At the same time, many of these facilities have begun using contractual language that explicitly prohibits residents or their loved ones from filing lawsuits when things go wrong. Now dozens of senators are calling on the Trump administration to rethink its decision to let this practice continue. [More]

Search results for: arbitration

31 Senators Ask Trump Administration To Not Strip Nursing Home Residents, Families Of Their Legal Rights

House Votes To Strip Bank & Credit Card Customers Of Constitutional Right To A Day In Court

Because the Sixth and Seventh Amendments of the U.S. Constitution are apparently less important than making sure that banks, credit card companies, student loan companies, and other financial services be allowed to behave badly with impunity, the House of Representatives has voted to overturn a new federal regulation that would have helped American consumers hold these companies accountable through the legal system. [More]

Don’t Strip Consumers Of Their Right To A Day In Court, Say Advocates, Senators

Last week, bank-backed lawmakers revealed their plans to pass fast-track legislation that would undo the Consumer Financial Protection Bureau’s recently finalized rules that prevent banks and other financial institutions from stripping customers of their constitutional right to a day in court. Now, consumer advocates are urging the rejection of the legislation, expected to be voted on this week. [More]

Lawmakers Who Want To Hand ‘Get Out Of Jail Free’ Card To Banks Made Millions From Financial Sector Last Year

As expected, Republican lawmakers in both the House and Senate have introduced legislation that would overturn new rules intended to make sure that bank and credit card customers aren’t stripped of their right to file lawsuits in a court of law. Not surprisingly, many of the politicians pushing this pro-bank bill recently received significant financial support from the financial sector. [More]

GOP Moving Forward With Plan To Block New Legal Protections For Bank, Credit Card Customers

The Consumer Financial Protection Bureau recently finalized new rules that prevent banks and other financial institutions from stripping customers of their constitutional right to a day in court. As expected, bank-backed lawmakers in both the House and Senate are now planning to pass fast-track legislation that would undo these protections and make sure banks retain their “get out of jail free” card. [More]

Federal Court Says Uber Minimum Wage Lawsuit Can Go Ahead, Add More Plaintiffs

There’s been a tiny bit of progress for Uber drivers seeking “employee” status along with reimbursement of vehicle expenses and back pay. While other cases have simply settled for large cash payments, one lawsuit that could cover multiple drivers is working its way through the federal court system in North Carolina, and a judge is letting the case go forward as a conditional action under the Fair Labor Standards Act. [More]

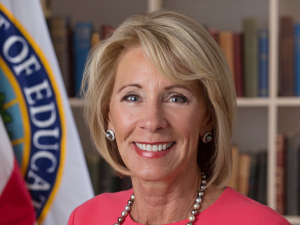

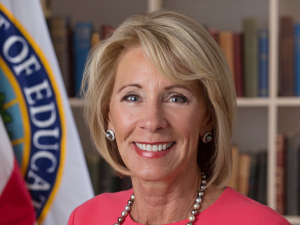

Dozens Of Organizations Come Out In Support Of Gainful Employment, Borrower Defense Rules

A week after two separate lawsuits were filed by 19 state attorneys general and a group representing students accusing Education Secretary Betsy DeVos of breaking the law by delaying protections for student loan borrowers, a coalition of more than 50 consumer groups have stepped forward to join the opposition against a “reset” of regulations put in place to protect students at for-profit colleges. [More]

CFPB’s Finalized Arbitration Rule Takes Away Banks’ ‘Get Out Of Jail Free Card’

Roughly 240 days from now, banks and other financial companies will no longer be allowed to prohibit customers from banding together in class-action lawsuits through the use of binding arbitration clauses, as the Consumer Financial Protection Bureau today released a long-awaited finalized rule on arbitration. [More]

States Say Education Secretary Betsy DeVos Broke Law By Delaying Protections For Student Loan Borrowers

Following Education Secretary Betsy DeVos’ decision to “reset” new regulations put in place to protect students at for-profit colleges, two separate lawsuits now accuse the Secretary of breaking federal law by running roughshod over the regulatory process when she delayed the so-called Borrower Defense rule, which would have made it easier for defrauded students to get out from under their student loan burdens. [More]

With DeVos Unwilling To Defend Rules, States Try To Protect Students Defrauded By For-Profit Colleges

Education Secretary Betsy DeVos has made it clear that she has no intention to defend regulations put in place to protect students at failed for-profit colleges. But a number of states are now attempting to step in to do the job the Department of Education won’t. [More]

Education Secretary Betsy DeVos “Resets” Rules On For-Profit Colleges

Education Secretary Betsy DeVos has announced plans to “reset” two regulations that were recently put in place to hold for-profit colleges more accountable and prevent students at these schools from being left with nothing but debt if their college collapses. [More]

House Passes CHOICE Act In Move To Roll Back Consumer Financial Protections

The House of Representatives voted today to pass the Financial CHOICE Act, a piece of legislation that, if enacted, would strip away a number of consumer protections put in place following the devastating collapse of the housing market. [More]

AGs Blast Financial CHOICE Act, Urge Congress To Reject Proposed Bill

With legislation to roll back consumer protections and gut the Dodd-Frank Wall Street Reform and Consumer Protection Act expected to be discussed by the House as early as this week, several states are urging lawmakers to reject the legislation. [More]

Trump Administration Will Allow Nursing Homes To Strip Residents Of Legal Rights

The Trump administration has proposed revising a rule that hasn’t even gone into effect yet, with the goal of making sure that nursing home residents and their loved ones can not sue these long-term care facilities in the event that something horrible happens. [More]

Report: Financial CHOICE Act Would Harm Servicemembers

Since its creation, the Consumer Financial Protection Bureau has worked to protect servicemembers from ne’er-do-wells that aim to line their own pockets by taking advantage of those who protect us; from fining auto lenders for failing to issue refunds to servicemebers to ordering banks to pay for their bad debt collection practices. But with a bill to gut the agency’s power making its way through the legislature, these types of protections come to a screeching halt. [More]

For-Profit Colleges Sue To Stop Rule That Protects Students Of Failed Schools

Federal regulations that aim to protect and refund student loan borrowers defrauded by their schools could end before they even go into place, thanks to a lawsuit filed by the for-profit college industry. [More]

AT&T, DirecTV Reportedly Overcharged Thousands Of Customers

When you get promised one rate and charged another, it’s frustrating. When it happens to thousands of customers getting service from the same company all at once, it’s probably a sign of a systematic problem. And one report now says thousands of AT&T and DirecTV customers have been complaining about exactly that for years. [More]

Google Avoids Genericide, Will Remain A Protected Trademark

“Google” has delayed experiencing the same fate as kerosene, heroin, laundromat, and a number of other brand names that became so popular they died of genericide. [More]