In January, federal regulators announced they had put a stop to an apartment rental scam in which homes (that may not exist) are listed online with the sole purpose of tricking prospective renters into paying for “credit checks” that will never be done. Now, the operators of the scheme must pay $762,000 to put an end to the Federal Trade Commission’s allegations. [More]

Tesla Ends $1,000 Referral Credit Program

Sure, saving $1,000 on a car that may cost you far in excess of $70,000 might seem like a minor victory, but it’s still better than nothing. But now that Tesla is becoming more of a household name and hoping to reach a more mass-market car-buying audience, it’s getting rid of even this relatively small savings program. [More]

Betsy DeVos May Only Offer Partial Loan Refunds To Defrauded College Students

Education Secretary and champion of for-profit colleges Betsy DeVos is once again siding with this controversial industry and against students who were defrauded by schools that tricked them into paying top dollar for a bottom-dollar education. [More]

Dunkin’ Donuts Ramping Up Discounts To Bring In Customers

Dunkin’ Donuts, faced with slipping sales, has undergone a bit of a revamp in recent months, such as dropping the “Donuts” portion of its name at a California store to paring down its menu. Now, the company is focusing on deals, as in, giving customers more of them. [More]

Borrowers In Student Loan Forgiveness Program Shocked To Learn Loans Won’t Be Forgiven

This month is the first in which student loan borrowers enrolled in the Department of Education’s Public Service Loan Forgiveness program were expecting to see their student loan tab cleared. But that’s not happening for some borrowers after learning they were never actually enrolled in the programs, despite assurances from the companies servicing their debts. [More]

Amazon’s Bookstores Apparently Aren’t Bringing In Many Sales

Are Amazon’s bookstores headed for the same future as struggling chains like Barnes & Noble? It’s possible, according to the company’s latest financials, which suggest the company’s physical bookstores aren’t doing so hot. [More]

FAO Schwarz Is Back — With Piano Mat — At Bon-Ton Department Stores

It’s been nearly two years since customers have been able to shop at an FAO Schwarz store. That’s about to change… kind of: Department store chain Bon-Ton will open nearly 200 FAO Schwarz toy departments at stores this holiday season. [More]

841,000 Ford Fusion Vehicles Under Investigation Because Steering Wheels Shouldn’t Fall Off

There are a lot of things you’d rather not have happen when driving your car. “Steering wheel falling off and into your lap” likely ranks pretty high on that list. For that reason, federal safety regulators have opened an investigation into more than 841,000 Ford Fusion vehicles. [More]

Researcher Claims Equifax Systems Contained Second Breach-Vulnerable Flaw

Could Equifax have suffered a second data breach following the massive hack exposing the personal information of more than 145.5 million consumers? It’s possible, according to a security researcher who claims to have found a second, separate security vulnerability within the company. [More]

Illinois Sues Payday Lender For Forcing Employees To Sign Non-Compete Agreements

The state of Illinois has filed a lawsuit against payday lender Check Into Cash, but not for its short-term lending practices. Instead, the company is accused of exploiting its low-wage employees by forcing them to sign non-compete agreements that restrict their ability to find jobs elsewhere. [More]

Amazon Selling Discounted LG Phones, But You Have To See Ads All Day

Is a $50 discount on a new LG phone enough to offset having to look at ads everytime the device locks? That’s the question some Amazon customer are debating, as the company is offering to knock $50 off LG smartphones that show ads on the phone’s lock screen. [More]

Stolen Backpack Leads To $52,310 Surprise Medical Bill

Sadly, it’s not uncommon for people to face sudden, unexpected and expensive medical bills. It’s also becoming increasingly normal to find out that your identity has been stolen. These two worlds collide in the story of a California man who recently found out he was being charged gobs of money by a hospital for a medical procedure someone had performed using his identity. [More]

Verizon Finally Lets Unlimited Data Customers Watch HD Video… For $10/Month

Two months after Verizon revamped its unlimited data plans to severely throttle video, the wireless provider is once again tweaking the system, announcing that customers with “unlimited” data plans can finally watch all their videos in high-definition… if they’re willing to pay an additional $10/month for the privilege. [More]

Sears Brings Back Holiday “Wishbook” In Search Of Nostalgic Customers

Sears might be selling off brands, taking loans from its CEO, and ending relationships with long-standing partners, but that doesn’t mean it’s giving up just yet. In an apparent effort to strike a nostalgic chord with customers who remember flipping through the Sears catalog and flagging the things they wanted as gifts, the struggling department store chain is resurrecting its once-popular holiday Wish Book. [More]

More Than 342,000 Kia Souls Recalled Over Steering Issue — For Second Time

When you bring in your recalled car to get a safety defect fixed, you might assume that the problem has been remedied. Yet owners of more than 342,000 previously recalled Kia Soul vehicles are finding out that their cars need to have the same issue repaired again. [More]

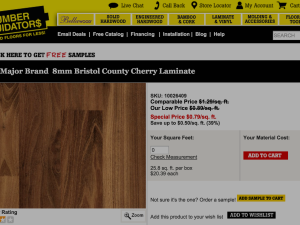

Lumber Liquidators To Pay $36M To Settle Formaldehyde-Filled Flooring Suit

More than two years after an investigative report alleged that laminate flooring sold at Lumber Liquidators contained high — and potentially dangerous — levels of formaldehyde, the flooring retailer has agreed to pay $36 million to close the books on class-action lawsuits brought by customers. [More]

Burger King Definitely Won’t Regret Offering Free Food To Customers Who Dress Up Like Clowns

In a move that absolutely will not backfire and result in viral videos of terrifying clowns menacing the customers of their local fast food franchises, Burger King has come up with the brilliant idea of offering free food to customers who slather on the clown greasepaint this Halloween. [More]

If You’re Flying To The U.S. This Week, Be Prepared For Delays, New Security Measures

In June, the Department of Homeland Security gave an ultimatum to airports around the world: Beef up your security or face a ban on carry-on electronics on flights heading to America. Tomorrow is the deadline for those advanced security measures to be in place, so U.S.-bound travelers should prepare themselves accordingly. [More]