Restricting Debt Collection Doesn’t Limit Credit Availability Image courtesy of (khrawlings)

While federal law already prohibits a wide range of unscrupulous debt-collection practices, some states have gone further, enacting laws and regulations to limit collectors’ ability to pursue repayment. The collections industry claims these restrictions hinder consumers’ access to credit, a new report says that just isn’t the case.

In fact, according to the report [PDF] from the Center for Responsible Lending, some regulations may actually improve consumers credit choices.

CRL analyzed the credit environment in North Carolina and Maryland — two states with recent debt-collection reform laws on the books — and found there was no sign of negative impact on consumer credit.

Researchers looked at trends in the extension of new credit card accounts before and after the introduction of the reforms in these two states, then compared the data to information available for economically similar peer states and nationally.

The Reforms

Over the past several years, North Carolina and Maryland have taken steps – through legislation and court rules – to protect consumers from unscrupulous debt collection activities.

Both states’ reforms focus on the way in which these organizations are able to go after borrowers for repayment.

Under a typical debt collection scenario, a debt buyer will purchase overdue defaulted consumer debt from creditors such as credit card companies for pennies on the dollar. Debt buyers then attempt to collect the debt, often by suing borrowers in court.

Because debts are typically sold to debt buyers without fully verifying the accuracy of the borrower’s identity, amount of the debt, or status of repayment, the information used as a basis to collect from consumers may be inaccurate. As a consequence, borrowers can find themselves facing a default judgment on a debt that they do not in fact owe.

North Carolina lawmakers passed the Consumer Economic Protection Act [PDF] in 2009 that aimed to change this pattern after seeing an uptick in lawsuits related to unfair debt collection practices.

The Act requires debt buyers to provide actual documentation of the debts they are attempting to collect.

Additionally, the law requires collectors to provide admissible evidence in order to obtain a judgment against a borrower. This provision was created to disrupt debt buyers’ business models of relying on consumers not appearing in court or otherwise responding to lawsuits to obtain default judgments to then extract payments from consumers.

Maryland took a different approach to its debt buying/collection reform [PDF] by making a change to court rules in 2012. The amended rules outline exactly what documentation is needed for a debt collector to obtain a judgement in certain cases when the consumer does not appear in court or otherwise defend their case.

Specifically, the new rules require debt buyers to provide admissible evidence proving the existence and ownership of the debt, the terms and conditions of the debt, and an itemization of the debt, when filing a debt-collection complaint that is supported by an affidavit.

When these reforms were being crafted and discussed, the debt-buying industry claimed they would result in less credit being made available in those states. CRL’s new analysis found that these debt collection industry claims have no merit.

Then Vs. Now

In fact, CRL found that consumers in North Carolina and Maryland who sought new credit cards generally fared better than those in other states.

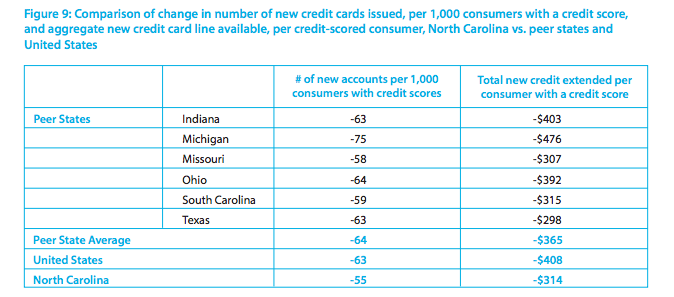

North Carolina out-performed all of its peers for the change in the number of new credit cards opened, and two-thirds of its peer states for the total new credit extended through those credit cards accounts.

When compared to peer states and the U.S. as a whole, North Carolina, on average, extended more new lines of credit to consumers with credit scores following its debt collection reform.

For every 1,000 consumers with credit scores, North Carolina issued 55 fewer new accounts, while the average of the six peer states issued 64 fewer accounts.

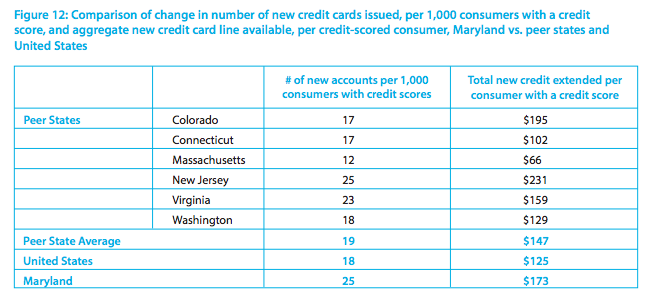

The results were similar in Maryland, where lenders issued the same or more credit cards per 1,000 consumers with a credit score than those in similar states.

Maryland lenders issued, on average, 25 new accounts for every 1,000 consumers with a credit score, while peer states issued on average just 19 new accounts.

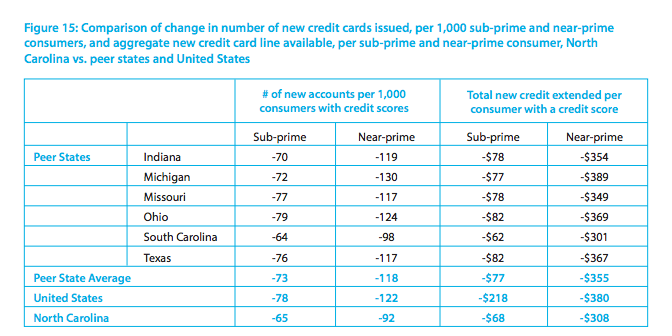

CRL’s analysis found similar results when looking at sub- and near-prime consumers in North Carolina and Maryland.

Sub-prime consumers in North Carolina experienced smaller decreases in credit card openings than in all but one of its six peer states.

Specifically, North Carolina sub-prime consumers experienced a decline of 65 new credit card accounts issued per 1,000 people with credit scores when comparing the time periods before and after the law changed.

The only state with better results was South Carolina, which had a decline of 64 new credit card accounts.

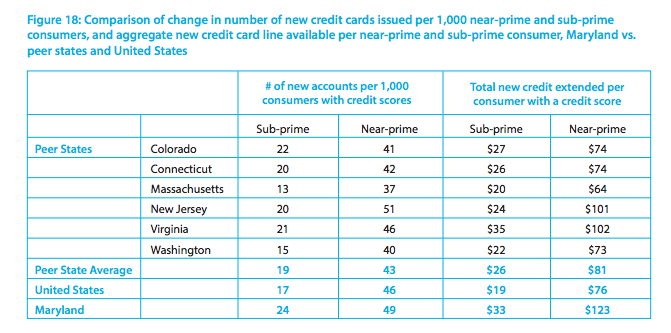

Maryland saw an increase in new credit cards issued and credit extended for sub-prime and near-prime consumers when compared with the time periods before and after the rule change.

Sub-prime Maryland consumers with a credit score had 24 new cards issued per 1,000 consumers, representing an increase of $33 in credit availability per person.

The findings were even better for near-prime borrowers, who received 46 new cards issued per 1,000 consumers with a credit score, representing $123 per person.

CRL found that these new accounts outpaced the experience of consumers nationally, and for many peer states. On average sub-prime consumers nationally were only offered 17 new accounts, while near-prime members were offered 46 new accounts. The changes in credit extended was similar, with national sub-prime borrowers receiving a $19 increase, and near-prime borrowers receive $76 more.

More Protections Needed

According to CRL, the findings of the report show no evidence that additional protections for consumers have a negative effect on credit card availability, even for consumers with non-prime credit scores.

As a result of the findings, CRL urges state and federal officials to continue to strengthen debt-collection and debt-buying rules and laws.

“Sensible reforms, such as those in North Carolina and Maryland, will address predatory debt-collection practices without harming the borrowers’ ability to obtain credit,” Lisa Stifler, Senior Policy Counsel at CRL, said in a statement.

At the state level, CRL believes that officials should require more detailed and accurate evidence when debt buyers file lawsuits. Additionally, the states should rein in the evidentiary requirements for obtaining a judgment, including a default judgment or summary judgment on debt-related cases.

At the federal level, officials should regulate the flow of information in the debt collection market. This could be accomplished by requiring increased and accurate documentation in order for a debt buyer to purchase outstanding debts from lenders in the first place. This would also prohibit debt buyers from initiating collections unless they have all information to verify the debt being sought.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.