Home Renters Pay Up to 47% More For Car Insurance Than Homeowners

Renting a home means that you’re not responsible for fixing the leaky roof or replacing the broken furnace, and you aren’t wedded to a mortgage for the rest of your life. But according to a new analysis of auto insurance rates, it also means you could be paying a lot more to insure your car.

Renting a home means that you’re not responsible for fixing the leaky roof or replacing the broken furnace, and you aren’t wedded to a mortgage for the rest of your life. But according to a new analysis of auto insurance rates, it also means you could be paying a lot more to insure your car.

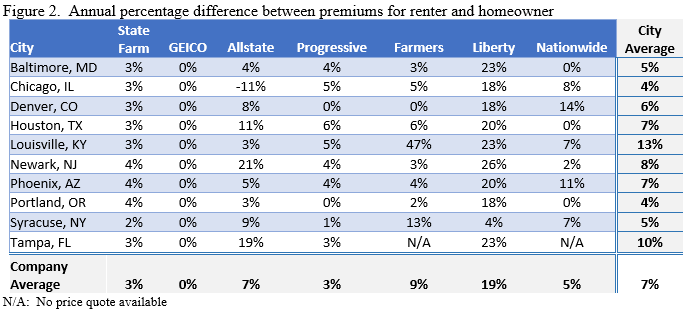

The Consumer Federation of America recently tested auto insurance rates from the nation’s largest providers in ten different cities from coast to coast, and found that some renters are paying upwards of 47% more for basic liability coverage than homeowners.

The CFA analysis used a fictional driver — 30 years old, female, with a 2005 Honda Civic, a high school diploma, a clerical job, and a “Fair” credit rating. This fictional driver has been licensed for 14 years without any lapses in coverage, and without being involved in any accidents, moving violations, or having her license suspended. The only thing that changed in the test was whether she rented or owned her home.

Using this persona, researchers obtained quotes from State Farm, GEICO, Allstate, Progressive, Farmers, Liberty Mutual, and Nationwide in ten different ZIP codes: Baltimore, Tampa, Louisville, Chicago, Newark (NJ), Houston, Phoenix, Syracuse, Portland (OR), and Oakland.

On average, renters paid 6% more than homeowners for basic liability coverage, but that’s including the results from Oakland, where California state law prohibits insurers from considering homeownership in setting auto insurance rates.

Several insurers increase their rates well above that average when the driver is a renter. For example, in the nine non-California cities, Liberty Mutual charged an average of 19% more to renters, with increases ranging from as little as 4% in Syracuse to nearly 26% in Newark.

More perplexing is Allstate, whose insurance rates for renters were often below the national average (in Chicago, Allstate actually charges renters less than homeowners), but which jacked up rates by 19% for renters in Tampa.

The largest overall increase came from Farmers, where Louisville renters will pay 47% more than homeowners.

The only insurer to not account for homeownership in any of the markets was GEICO, which quoted the same rate regardless of whether the driver rents or owns.

The CFA contends that using homeownership as a factor in setting insurance rates unfairly puts lower- and moderate-income Americans at a disadvantage, citing Federal Reserve Board data showing that, in 2013, the median income of renters in the U.S. was $27,800, compared to $63,400 for homeowners.

“To raise people’s auto insurance premium because they can’t afford to buy their homes unfairly discriminates against lower-income drivers,” said J. Robert Hunter, a former Insurance Commissioner for the state of Texas and the CFA’s Insurance Director. “A good driver is a good driver whether she rents or owns her home.”

Additionally, purchasing a home often requires the buyer to save up a significant amount of cash in order to make the down payment on a loan. Moderate-income Americans may be able to afford the monthly payments, but could lack the ability to put together the down-payment.

“Virtually every state requires drivers to buy insurance, but we shouldn’t force them to buy a home in order to get the best price,” said Hunter, who is calling on state insurance commissioners and legislators to put an end to this practice.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.