Did Net Neutrality Kill Broadband Investment Like Comcast, AT&T, Verizon Said It Would? Image courtesy of DCvision2006

Last year, when the FCC was preparing to vote on the new Open Internet Order (aka “net neutrality”) and its reclassification of broadband Internet as a vital utility, virtually the entire telecom and cable industry claimed this change would ruin investment and slow innovation. But a look at the year-end financial figures for the biggest naysayers casts a lot of doubt on these dire predictions.

One Issue, Two Stories

From changes in market share, competition levels, innovation, to buzzworthy marketing, brand awareness, and public image, there are many ways to measure the success of a business. To stockholders, investors, C-suite executives, and board presidents, though, there’s one that matters more than all the others: money.

Those good old American dollars have, in one way or another, been at the center of most of the rhetoric about net neutrality… but they aren’t always saying the same thing. In order to give themselves the best possible positioning, telecoms and cable companies tell two competing stories about their money.

One is the story they tell regulators. In both filing with the FCC and in astroturfing campaigns aimed at realigning public perception, the most common story told by the telecom/cable industry was this: reclassifying broadband as a more heavily regulated Title II utility will hurt investment, hurt innovation, and generally spoil all the fun everyone is having.

But while regulators and the public were getting the doom-and-gloom version of things, investors were hearing a much sunnier story.

In that sphere, everything is always as great as possible — growth is continuing and inevitable, and sticking around means you too can make buckets full of money from your investment.

As you might guess, those two stories can come into conflict.

Time To Check The Figures

Despite businesses’ strenuous objections, the Open Internet Order did pass, and — against even further challenges from the industry — it went into effect on June 12, 2015.

That means by the end of calendar year 2015, all of the ISPs had two full quarters — half the year — in which to either suffer under the new regime, thrive under it, or generally maintain the status quo.

The earnings calls are all now in, the SEC forms all filed, and the stockholder presentations all made. That means we can look at the data that companies give to investors and ask: how’s that all shakin’ out?

As we go through each company, we’ve got three key questions in mind:

1: How is performance, generally?

2: How much are they investing in their business, as compared to last year?

3: Does that track with what they told the FCC would happen?

AT&T

Image courtesy of Mike MozartWHAT AT&T TOLD THE FCC THEN:

AT&T, currently suing to overturn the new neutrality rules, has always stridently opposed the Title II approach. Months before the issue even came to vote at the FCC, AT&T was already trying out its legal arguments for an eventual lawsuit against.

Some highlights from comments AT&T made to the FCC (PDF) during the rulemaking process:

• “Reclassification would mire the industry in years of uncertainty and litigation, and it would abruptly stall the virtuous circle of investment and innovation that has propelled the United States to the forefront of the broadband revolution.”

• “There is no justification for adopting the new and intrusive net neutrality rules… that would drain investment, stifle innovations, and roll back the impressive gains that the Commission’s measured approach to Internet regulation has helped to secure.”

• “Achieving the next phase of broadband deployment … will require far more investment — according to the Commission’s own estimates, hundreds of billions more. And such sums will not be sunk into broadband infrastructure if providers fear that their multi-billion-dollar investments will be subject to 1930s-style public utility regulation. Moreover, reclassification also would unleash a flood of litigation and regulatory disputes, further undermining stability in the marketplace and compounding the investment-chilling effects of Title II regulation.”

• “Continued investment is not assured. Indeed, a range of market analysts, stakeholders, and others have cautioned that broadband deployment and innovation would be stifled if the Commission were to break from the Title I framework in place today.”

As recently as Nov. 2015 AT&T was still calling FCC actions “a war on infrastructure investment,” and in December it said the company had delayed, and we quote, “a bunch of stuff.”

WHAT AT&T TELLS INVESTORS NOW:

AT&T, which held its 2015 earnings call on Jan. 26, 2016, is in a bit of an unusual position this year: the acquisition of DirecTV was approved in 2015, so the back half of the year (and the front half of this year) has been all about the process of bringing those operations in-house.

That means AT&T’s financials look a little different than they would in most years. The timeline of that merger also complicates our analysis a bit; it was announced in May, 2014, a full year before net neutrality went into effect — but it wasn’t approved until July of 2015.

(Although one could argue that buying an entire company for $49 billion is a pretty strong sign of ability to continue investing in one’s own business.)

The company’s operating revenues in 2015 were about $42 billion. That’s a significant increase over their 2014 operating revenues of $34.4 billion, but that jump does include the DirecTV acquisition.

Operating expenses over at the Death Star also dropped significantly, from $39.9 billion in 2014 to $34.5 billion over 2015.

Capital expenditures, however, went up significantly year over year. Their total capex for 2015 rang in at about $5.9 billion; in 2014, that number was closer to $4.4 billion.

During the call with investors, CEO Randall Stephenson began by calling 2015 “an eventful year,” before delivering statements about investment like:

• “We’re investing aggressively in the network architecture that is going to give us a competitive advantage in cost … and I have seen few opportunities over my career to drive down the cost to deliver service like this. We’re also on track to deliver at least $2.5 billion in DirecTV synergies by 2018, and we continue to invest in spectrum.”

• “[In 2016] Capital spending will be in the $22 billion range with our focus on cost efficiencies”

During the call, CFO John Stephens also gave many favorable statements about continued investment:

• “For the year, we made capital investments of nearly $21 billion.”

• “We’re going to continue to invest in networks as we’ve said, keep this quality up and keep these product offerings moving out and we feel comfortable about doing that within that $22 billion range.”

• “We are investing at a rapid rate in all of our businesses.”

Charter

Image courtesy of DCvision2006WHAT CHARTER TOLD THE FCC THEN:

Charter was less vocal about their objections to reclassification than the headliners (Verizon and AT&T, in particular), but Charter still agreed nonetheless.

Charter’s comments to the FCC [PDF]were shorter than its peers’ voluminous tomes, but still contain snippets like:

• “Put simply, the growth of investment in U.S. broadband has taken place in the private marketplace without the need for government intervention or regulation.”

• “Trying to fit broadband under the Commission’s Title II authority would upend this climate, creating a prolonged period of legal uncertainty that would dampen investment and ultimately harm consumers.”

• “Changing the rules midstream to classify broadband service as a ‘telecommunications service’ under Title II would inequitably frustrate the expectations that informed these investments, while exposing broadband providers to a substantial range of new legal and regulatory risks that disincentivize further investment.”

• “[S]uch a restrictive regulatory scheme would represent a sea change likely to cause many investors to move their funds to areas offering more certain returns, depriving ISPs of capital needed to improve their networks.”

WHAT CHARTER IS TELLING INVESTORS NOW:

On Feb. 4, Charter held its 2015 earnings call, and like AT&T, some of Charter’s financials are tied up in a large transaction, with the company currently attempting to leapfrog its way into second place by buying both Time Warner Cable and Bright House Networks.

However, Charter’s financial situation otherwise looks to be stable, and possibly improving, year-over-year. Its 2015 revenue came in at about $9.75 billion, up just over 7% from $9.1 billion in 2014.

Total operating costs at Charter did increase this year, due in part to the merger transaction. In 2014, Charter’s operating costs came in at about $5.92 billion, but in 2015 they were $6.35 billion — also roughly a 7% increase.

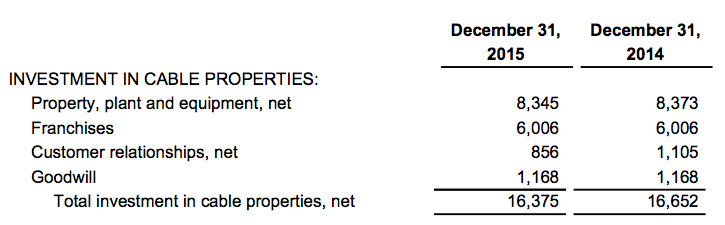

Capital expenditures at Charter were slightly down in 2015, however, as were other internal invevstments. In 2014, Charter spent about $16.6 billion investing in their own networks; in 2015, that number dropped to about $16.4 billion.

During the call with investors, Charter answered very few questions overall about capital expenditures specifically, as most questions dealt with their plan for (1) continuing to make money, while (2) spending oodles of cash on the TWC/Bright House merger.

(Although the point of the transaction is to poise Charter for future growth, the actual action of merging involves a whole lot of costs all at once, and Charter is planning to use debt to finance part of the transaction. That leaves investors and analysts with a lot of questions about those details.)

Charter’s executives also told investors that they were not planning a rate increase for their customers in 2016, and so had to answer questions about where the money was going to come from. (Answer: making the company bigger.)

However, Charter CFO Christopher Winfrey did reference the merger’s abilities to increase Charter’s investments in the future, saying that New Charter “will have the transaction synergies to help fund those types of investments” in personnel and customer service going forward.

Comcast

Image courtesy of Mr.TinDCWHAT COMCAST TOLD THE FCC THEN:

Because it was attempting to buy Time Warner Cable at the time, Comcast was less outwardly antagonistic about net neutrality than they might otherwise have been. However, the company’s comments on the matter did repeatedly prioritize “protecting investment” as its major concern [PDF]:

• “[Title II] also would be unwise in that it would stifle capital investment and dynamic innovation at the very time the Commission is seeking to encourage the deployment of higher speed services.”

• “Such interference would also have serious and inevitably unintended consequences, including hindering innovation and investment in broadband infrastructure.”

• “The sheer uncertainty surrounding such a regulatory environment would produce ‘a profoundly negative impact on capital investment.’ By itself, reduced investment would inhibit job creation, hinder the deployment of broadband infrastructure, and undermine the ‘virtuous circle’ of innovation that the open Internet rules are designed to advance.”

• “Reclassification alone would impose a bevy of common carrier duties on broadband providers, deterring network investment and innovation and fostering tremendous uncertainty.”

WHAT COMCAST TELLS INVESTORS NOW:

On Feb. 3, Comcast held its 2015 earnings call, and, in spite of not being able to acquire TWC or scuttle net neutrality, the company continues do to very well. Its 2015 revenue clocked in at about $74.5 billion, a greater than 8% increase over 2014’s revenue figure of approximately $68.8 billion.

Capital expenditures at Comcast also increased significantly year-over-year. In 2014 it spent about $7.4 billion investing on its business; in 2015, however, that number jumped 14.5% to just shy of $8.5 billion.

Because Comcast — a cable company, a broadcast and cable TV mega-network, a theme park operator –operates a wider variety of businesses than its competitors, it also broke down the expenditures a bit, showing that $7 billion of the $8.5 billion they spent on capex in 2015 related to its cable and Internet business (another $1.4 billion was filed under NBCU, for building out theme parks).

According to Comcast, that money reflects “increased spending on customer premise equipment related to the deployment of the X1 platform and wireless gateways.” The percentage of cable arm revenue going back into investments has gone up, too: “For the year,” Comcast said, “Cable capital expenditures represented 15.0% of Cable revenue compared to 13.9% in 2014.”

Several Comcast executives spoke to the company’s success with investments and capital expenditures during the call. Company CEO Brian Roberts said:

• “We continue to be entrepreneurial and look for ways to invest and grow.”

CFO Mike Cavanagh similarly added:

• “This growth [in non-programming expenses] reflects increased spending to improve the customer experience as we’ve added technicians and service personnel to strengthen our dispatch teams and operations and invested in training, tools and technology.”

• “This [capital expenditure] growth reflects higher spending on our customer premises equipment, including X1 and wireless gateways, increased investment in network infrastructure to increase network capacity, as well as the continued investment to expand Business Services. In 2016, we will continue to invest in each of these areas as they are driving positive results in our business. As a result, cable capex as a percent of cable revenue [in 2016] is expected to remain flat to 2015 at approximately 15%.”

Time Warner Cable

Image courtesy of Photo Nut 2011WHAT TIME WARNER CABLE TOLD THE FCC THEN:

Because of the then-pending Comcast deal, Time Warner Cable tempered much of its anti-neutrality rhetoric at the time, mostly because many of the justifications the two gave for that (ultimately doomed) merger involved Comcast being able to up its network investment game in TWC’s territories.

However, despite being less vocal than others, TWC was still very clear [PDF] that continued investment, under Title II, was a major concern:

• “TWC continues to believe that … over broad regulation — especially in its most extreme form, fashioned under Title II — would pose particular risks to the Internet’s vitality that far outweigh any benefits.”

• “The specter of Title II regulation would risk undermining the private investment that has made the Internet such an extraordinary success and that remains necessary to fulfill the core objectives of the National Broadband Plan.”

• “The prospect of imposing public utility regulation on cable broadband services for the first time would discourage the substantial investment in broadband networks that the Commission seeks to foster.”

WHAT TWC IS TELLING INVESTORS NOW:

Time Warner Cable held its 2015 earnings call on Jan. 28, and once again the company is in a bit of a funny position: while it needs to look attractive for investors, this is the second year running that TWC is actively trying to be bought out by someone else, and that juxtaposition can create some tension.

On the whole, though, TWC reported positive news. Revenue came in at about $23.7 billion, a 3.9% increase from 2014’s revenue of $22.8 billion.

TWC’s operating costs also went up, however, increasing from $14.6 billion in 2014 to just shy of $15.6 billion in 2015, a 6.7% jump. Those costs were “primarily due to increases in programming, employee, and maintenance costs,” TWC reported.

Capital expenditures, likewise, saw a significant increase between 2014 and 2015. They came in at about $4.4 billion this past year, an 8.5% increase over the $4.1 billion spent in 2014.

During the call with investors, TWC executives repeatedly cited the investments they’ve made in their networks and customer service. Highlights from CEO Robert Marcus include:

• “Once again in 2015, we invested heavily in our network and equipment. Network investments to drive better reliability and greater capacity.”

• “Fueled by our [TWC Maxx] investments, at year end almost 45% of our [internet] customers subscribed to speed tiers of 50 Mbps or greater.”

• “We have an ambitious 2016 financial operating plan marked by continued subscriber growth, better financial performance, and continued investment to improve the customer experience.”

Acting CFO Matthew Siegel added:

• “In Q4, as in recent quarters, we continued to invest aggressively to drive subscriber growth, take care of our expanded customer base, and improve the customer experience.”

• “Full year capital spending … was up 8.5% from 2014 due to customer relationship growth as well as investments to improve network reliability, upgrade older customer premise equipment, and expand our network to additional residences, commercial buildings, and cell towers.”

Verizon

Image courtesy of Alain FerraroWHAT VERIZON TOLD THE FCC THEN:

Verizon is the reason we ended up with Title II reclassification in the first place. The original 2010 Open Internet Order did not rebrand broadband as a utility, but Verizon still sued to overturn it, and eventually succeeded in gutting the comparatively hands-off regulation. The only way to enact neutrality rules that could possibly stand this legal challenge was to reclassify broadband as a utility.

So it’s not surprising that, during the comment and filing periods leading to the current Open Internet rule, Verizon was adamant [PDF] that stricter regulation would harm its ability to invest in innovative solutions for attracting and retaining consumers.

Some highlights include:

• “Further regulation of broadband providers’ behavior is not needed at this time and would threaten the healthy dynamics fueling the growth and continued improvement of the Internet and the many services it enables.”

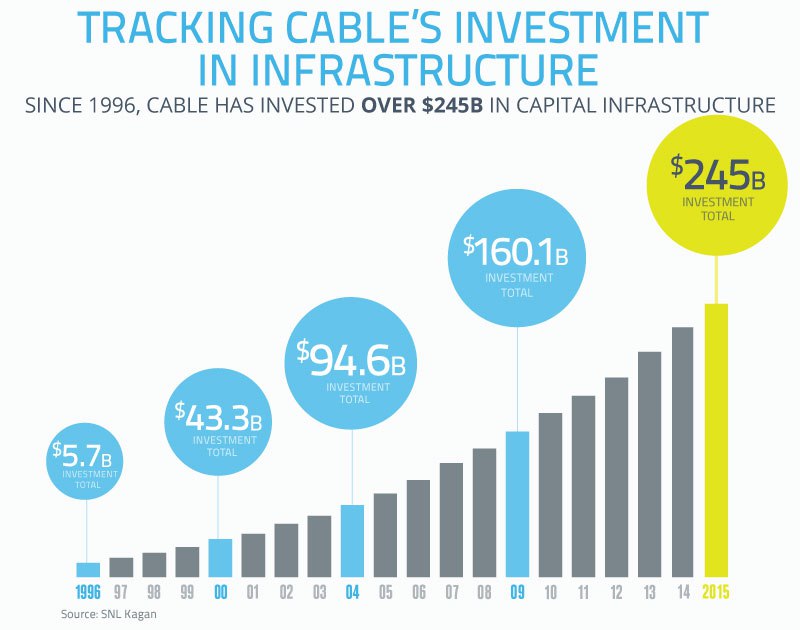

• “This [pre-Title II] flexible approach … has succeeded in unleashing extensive network investment and facilities deployment. For example, in reliance on the Commission’s decisions to refrain from applying utility-style [Title II] regulation to new broadband networks and services, Verizon has invested more than $23 billion deploying [FiOS] … Just since 2009, providers have spent nearly $250 billion to deploy wired and wireless broadband networks.”

• Verizon even quoted an economist saying, “The current competitive environment, and massive historical and planned investments in deploying broadband networks to meet consumer demands, have been achieved by relying on competitive market forces, not through rigid regulation.”

WHAT VERIZON IS TELLING INVESTORS NOW:

Verizon held its 2015 earnings call on Jan. 21, and in general, the company is performing well.

Its 2015 operating revenues were about $131 billion, as compared to 2014 operating revenues of about $127 billion; a modest but significant 3.6% increase. Meanwhile, Verizon’s operating expenses also dropped by more than 8%, from $107 billion and change in 2014 to $98.5 billion in 2015.

But what about its actual investment in the company? For Verizon, 2015 capital expenditures came in at about $17.8 billion. That’s an increase over both 2014 ($17.2 billion) and 2013 ($16.6 billion).

Verizon also spent significantly more money in 2015 than in the previous years on acquisitions, both of other businesses and of wireless licenses. In other words: their investment in their own business went up, not down, during the first year of the Open Internet rule.

During the investor call, CFO Fran Shammo mentioned his company’s commitment to continued investment several times:

• “We remain committed to consistently investing in our networks for the future. Our 2015 investments have positioned us for growth and allow us to maintain our network leadership position as consistently acknowledged by third parties.”

• “We continue to invest in our 4G LTE network to provide the industry’s highest reliability and position ourselves to capture the efficiencies and capabilities of new technologies.”

• “Look, 2015 was a year of significant change at Verizon. And even with all that change we delivered a strong financial year, continued to invest in growing our customer base, invested in our networks, developed and expanded new businesses, and returned value to our shareholders. … in 2016, we will continue what we started in 2015.”

Indeed, it doesn’t seem like “investment” is going to be a challenge for Verizon going forward, since it’s right there in the #2 position of its strategic goals for this year (after, of course, the one that translates to “make money”).

CONCLUSION

By and large, the half-dozen companies representing the overwhelming majority of cable Internet and wireless broadband customers in the country, are continuing to invest. But is that just puffed-up chest-thumping to cheer up investors?

Those most directly impacted by broadband investment don’t seem terribly concerned. In January, Multichannel News reported that the suppliers who make the stuff that the telecoms spend their money on aren’t losing sleep about a decrease in investment.

More precisely, analysts said they expect to see about a 3% increase in spending over last year, in total, with the wired and wireless phone companies spending 2% more and the cable companies spending 1% more.

Those are small gains, granted — but they are still growth, and not in any way a negative trend. In particular, the analysts said that Comcast is expected to be one of the bigger, earlier movers in spending on network improvements thanks to the arrival (finally) of DOCSIS 3.1 systems, which use existing cable lines to deliver speeds comparable to fiberoptic broadband.

Likewise, the big lobbying group that supports the cable and telecom industries is also happy to keep touting the growth of investments made by its member companies.

In a recent blog post, the National Cable & Telecommunications Association once again sang the praises of its members for keeping the U.S. economy afloat with 20 years of investments in networks:

“Cable operators are investing billions of dollars each year in capital expenditures to stay ahead of consumer needs,” says the NCTA.

If you think that the best way to measure the success of the U.S. broadband market is by the amount of money its biggest private businesses spend on the task of getting people connected, then it looks like we’re still winners, despite Title II.

If you think that the best way to measure the success of the U.S. broadband market is in the number of people connected, the available speeds, the prices, the competition, and the customer service, well… We’ve still got quite a way to go to be as great as the ISPs say we always have been.

[Update: An earlier version of this article incorrectly referred to all of Charter’s $16B of internal investment as capex. Charter’s actual 2015 capex, including transition costs, was $1.8B.]

Did you enjoy this? We’re a non-profit! You can get more stories like this in our twice weekly ad-free newsletter! Click here to sign up.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.