Smaller Cable Companies Concerned About AT&T/DirecTV Merger’s Impact On Prices For Regional Sports Networks

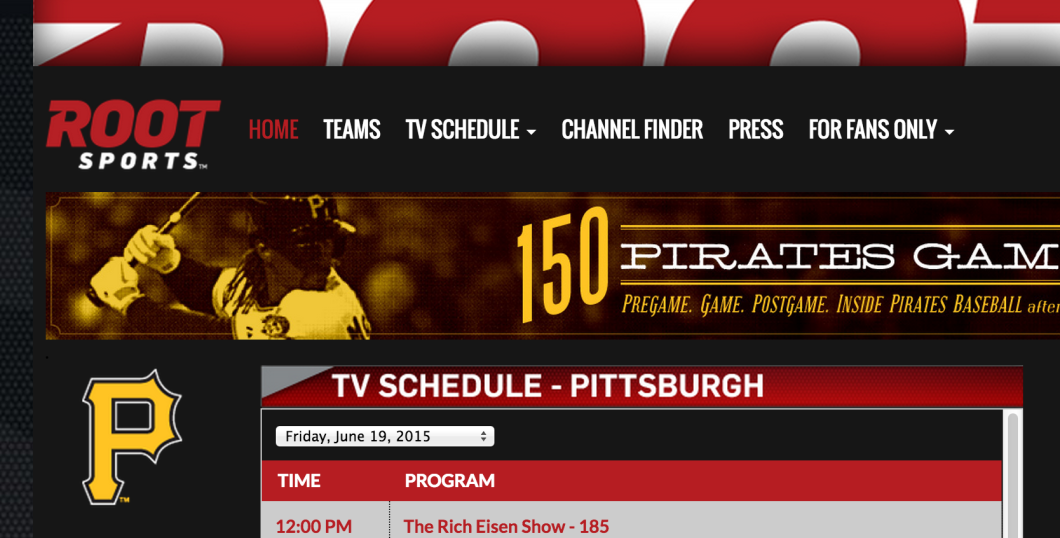

DirecTV currently operates a handful of regional sports networks under the Root Sports banner, including Root Sports Southwest, which it and AT&T jointly bought on the cheap for $1,000 after the controversial forced bankruptcy of Comcast’s CSN Houston. AT&T does not own any other regional sports channels, but it does provide U-Verse pay-TV service to millions of subscribers.

The American Cable Association represents several hundred smaller cable operators around the country, and in a filing [PDF] with the FCC about the AT&T/DirecTV merger, the ACA raises concerns that the merged company would have “an increased incentive to charge greater fees” to pay-TV providers whose biggest — and sometimes only — competition is from satellite providers like AT&T.

The filing contends that DirecTV already has an incentive to charge high prices to competing cable operators for access to its Root Sports content. A merged company would have both DirecTV and AT&T’s interests to protect would, according to the ACA, be even more incentivized to price smaller competitors out of access to these channels.

Since all information about carriage fees — the price paid by a cable company to carry a channel — is confidential, the ACA says that it can’t even enter into arbitration with regional sports networks because there is not enough data to “effectively formulate and make a best and final offer at the outset of the arbitration.” However, DirecTV and AT&T, as both a pay-TV provider and broadcaster, would allegedly have the unfair upper hand of knowing exactly what these costs are.

The ACA also mentions the possible “threat of retaliation” from a merged AT&T/DirecTV in carriage negotiations to come.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.