Abusive Lending Practices Can Lead To Negative Long-Term Consequences For Borrowers, Communities Image courtesy of Scott Cimakosky

Every year, more than 12 million Americans spend $17 billion on payday loans, despite the fact research has shown these costly lines of credit often leave borrowers worse off. Yet abusive lending practices are not relegated to borrowers in need of a couple hundred dollars to stay afloat until their next paycheck; there are mortgages, car loans, and other traditional lines of credit that can leave the borrower in a bind. Even if you never find yourself on the wrong end of a predatory loan, these products can still be a drain on your entire community.

This is according to a new report from the Center for Responsible Lending that explores the universal impact and cumulative costs of predatory lending practices on individuals, households and communities.

The Cumulative Costs of Predatory Practices [PDF] is the final chapter of CRL’s State of Lending series that looks at all types of credit products including mortgages, auto loans, credit cards, student loans, car-title loans, overdrafts, bank payday loans, payday loans, debt settlement, and debt collection to explain how unfair lending practices can jeopardize the economic stability of families and households.

IT’S NEVER JUST ONE THING

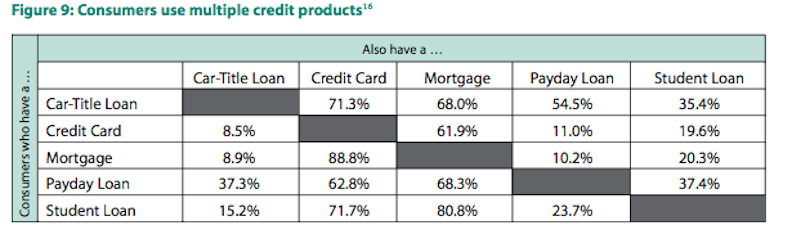

It’s easy to look at an individual borrower and ask “Did this person take out X type of loan?” But the reality is that most people, even those who turn to the most notorious last-option lenders, are tied to multiple lines of credit.

For example, the report found that 55% of car-title loan borrowers also have taken out a payday loan; 63% of payday loan users also have a credit card and 81% of consumers with a student loan also have a mortgage.

“These patterns emphasize the interconnections between consumer credit markets,” Sarah Wolff, CRL senior researcher and author of the report, said in a statement. “Consumers are not simply mortgage holders, credit card users, or payday loan borrowers – they are likely to participate in more than one market, often at the same time.”

This chart shows the overlap of high-risk products like payday and auto-title loans with more traditional financing like mortgages and student loans.

The report found that individuals who utilize a number of loan products concurrently are more likely to face financial risk. Someone having trouble making student loan payments may turn to a high-interest credit card to spread out the cost of their purchases, or someone behind on the mortgage might take out an auto-title loan to keep from losing their house.

“If a borrower has one abusive loan, they may be more likely to struggle with their other debts,” the report states. “This can lead to stressed household finances, more subprime borrowing, and even default.”

REACHING ALL FACETS OF LIFE

Those stresses then have a way of trickling into other aspects of a consumer’s life, and even their community.

According to the report, if a consumer defaults on a loan – a frequent consequence of predatory loan borrowing – they have an increased likelihood of declaring bankruptcy, which in turn can lead to foreclosure or repossession of assets such as a vehicle.

CRL acknowledges that even those borrowers with loans that were properly underwritten can still fall on hard times and have difficulty repaying their debt, but when those traditional products include lending abuses the negative results for consumers are magnified.

![The CRL report uses mortgage lending as an example to show how costly some abuses can be for both the borrower and their community. [Click to Enlarge]](../../../../consumermediallc.files.wordpress.com/2015/06/mortgage.png%3Fw=1060)

The CRL report uses a hypothetical mortgage lending scenario as an example to show how costly some abuses can be for both the borrower and their community. [Click to Enlarge]

As a result of nearby foreclosures, CRL hypothesizes that the value of neighboring homes fell by an average of $23,150 each, which then cost families more than $2.2 trillion nationwide.

In a figure modeling a hypothetical borrower who underwent a foreclosure, the credit score damage alone leads to an extra $3,760 paid on a typical auto loan and almost $55,000 more paid on the typical mortgage.

Additionally, the report found that negative outcomes such as default and bankruptcy pose both immediate and long-term costs. For example, the average bankruptcy costs $3,000 in legal fees, while a bankruptcy on a credit report increases the cost of future borrowing.

The report also illustrates that one-in-seven job-seekers with blemished credit reports have been passed over for employment after a credit check.

“For borrowers victimized by predatory practices, the costs are high, compounding, and long-lasting” Wolff said. “And this is especially troubling when considering that predatory lending disproportionately impacts lower-income families – contributing significantly to the widening of this country’s wealth gap.”

SOME HURT MORE THAN OTHERS

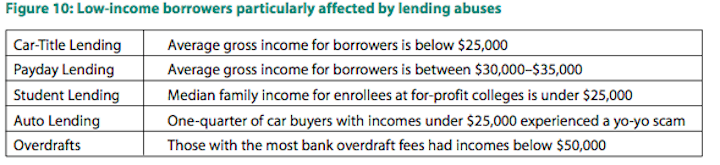

Like previous reports, The Cumulative Costs of Predatory Practices found that across many financial products, low-income borrowers and borrowers of color are disproportionately affected by harmful loan terms and practices.

Families with annual incomes below $25,000 and $35,000 are much more likely to receive an abusive loan product.

In most cases, borrowers of color are two to three times more likely to receive an abusive loan compared with a white counterpart.

“The discriminatory effects of abusive lending clearly contribute to the widening wealth gap between families of color and white families,” the report states.

Lower-income borrowers experience specific abusive lending practices (such as yo-yo scams in auto lending) at greater rates.

Other specific groups – like the elderly and servicemembers – also have been shown to be disproportionately affected, because tight budgets make them less capable of absorbing the added costs of predatory loans.

In addition to the socioeconomic implications of lending abuse, CRL found that these harmful practices are often geographically concentrated.

Prior to the implementation of North Carolina’s payday loan rate limitation, researchers found that African-American neighborhoods had three times as many payday stores per capita compared with white neighborhoods, all else being equal.

Additionally, CRL examined payday lending storefront locations in California and found that these stores were 2.4 times more concentrated in African-American and Latino communities.

“What’s clear is that the impact of financial products on American consumers is much more nuanced – and much more serious – than we ever imagined,” Mike Calhoun, CRL president said in a statement.

WHAT CAN BE DONE?

While consumers’ need to borrow likely won’t change, CRL says that the way in which these products are regulated can put an end to the abusive practices that often accompany some financial products.

“With the costs so high for borrowers, communities, and the economy, it is essential that policymakers make and enforce strong regulations to eliminate abusive financial practices and promote responsible lending,” the report states.

Recent regulations such as the Credit Card Accountability, Responsibility and Disclosure (CARD) Act of 2009 have allowed consumers to continue to gain access to credit while limiting the types of fees issuers could assess.

In all, CRL estimates that the rules have eliminated an estimated $4 billion in abusive fees – translating to an overall savings of $12.6 billion annually.

Additionally, the Dodd-Frank Act put in place important consumer protections for mortgage lending and created CFPB to ensure fairness for consumers in the financial marketplace.

“Consumers and policymakers alike seek to harness the positive potential of lending,” the report states. “Lenders, ultimately concerned most with their bottom line, may be able to succeed both in circumstances where borrowers succeed and when borrowers fail depending on their business model, as we’ve seen throughout the State of Lending in America series.”

While the CARD Act and Dodd-Frank have improved the lending environment for consumers, CRL’s latest report shows that more can be done to promote transparency, fairness, accountability and access of consumer financial products.

“As we have identified throughout the State of Lending series, more work needs to be done,” the report states. “Consumer credit has the power to change household budgets and balance sheets as well as to affect the health of communities and the national economy.

“Regulations that protect consumers at this critical juncture are and will continue to be important for borrowers, communities, and our country.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.