CFPB: Retailer Allegedly Using Illegal Debt Collection Practices Against Servicemembers Must Refund $2.5M

The CFPB, along with AGs from Virginia and North Carolina took action against Freedom Furniture & Electronics and its related companies for alleged illegal debt collection practices involving servicemembers.

The Consumer Financial Protection Bureau continues its fight against companies that continuously take advantage of members of the military, despite protections afforded to them under federal laws. Regulators’ latest victory? A settlement demanding over $2.5 million in consumer relief from three companies that allegedly used illegal tactics to pilfer money from servicemembers and their families.

The CFPB, in conjunction with the Attorneys General from North Carolina and Virginia, announced today that they have ordered [PDF] Freedom Stores, Inc., Freedom Acceptance Corporation, and Military Credit Services LLC, along with their owners, to provide over $2.5 million in consumer redress and to pay a $100,000 civil penalty for allegedly using illegal tactics to collect debts, including filing illegal lawsuits, debiting consumers’ accounts without authorization, and contacting servicemembers’ commanding officers.

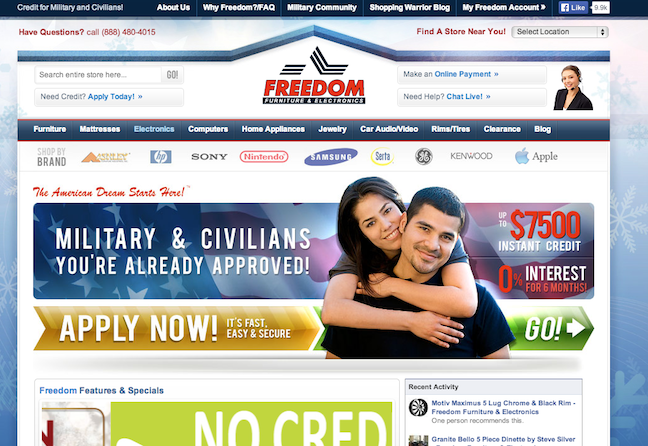

According to the CFPB complaint [PDF] Virginia-based furniture and electronics store, Freedom Stores (also known as Freedom Furniture and Electronics) operated a number of retail locations near military bases across the nation.The company offers credit to buyers but then transfers those contracts to an affiliated company, Freedom Acceptance Corporation.

Its owners, John Melley and Leonard Melley, Jr., also own Military Credit Services, which provides financing for purchases made at over 300 locations of the independent consumer-goods retailer.

Among the accusations against the companies is one particularly egregious bit of misbehavior that could have lead to service members being dismissed from their positions: the company illegally contacted the borrowers’ commanding officers to try to pressure buyers into repayment.

“A clause buried in the fine print of the purchase contracts required servicemembers to allow Freedom Acceptance and Military Credit Services to contact their commanding officers about their debt,” the complaint states. “The companies would contact the officers in writing and by phone to disclose the debts, humiliating the servicemembers and putting their careers at risk.”

Such actions have been known to lead to disciplinary proceedings or revocation of a security clearance for members of the military.

In addition to possibly costing consumers their careers, the CFPB claims that from July 2011 to December 2013, Freedom Acceptance Corporation and Military Credit Services filed thousands of illegal lawsuits in Virginia for out-of-state contracts.

In that time frame, the companies allegedly filed over 3,500 lawsuits in Norfolk, VA, against consumers who had not signed their financing contracts in Virginia and did not live there when the suits were filed.

Almost all of those lawsuits resulted in a default judgment, after which the companies garnished the consumers’ wages or put liens on their bank accounts. CFPB investigators found that some consumers did not even know they had been sued until they discovered their bank accounts had been drained.

The CFPB order accuses the inter-related companies of double-dipping into servicemembers’ funds.

“Most of Freedom Acceptance’s and Military Credit Services’ customers sent their payments via military allotment, but the companies also required consumers to authorize withdrawals from a bank account as a back-up payment method,” the complaint states.

As a result of the requirement, and the companies’ use of often incorrect payment processor reports, many servicemembers’ ended up having payments deducted from their paycheck and their bank accounts in the same month. This often led to unexpected overdraft fees and non-sufficient funds charges.

Finally, the order claims that collectors for the companies illegally debited bank and credit card accounts belonging to consumers’ family and friends.

This particular issue came to life when a parent or other third-party would authorize the companies to take a one-time payment on a consumers’ behalf. Instead of disposing of the account information, the company kept it on file and later used it to take funds without authorization or notification.

“Our nation’s servicemembers deserve better than to be targeted with illegal collections tactics when they are struggling to pay their bills,” CFPB Director Richard Cordray said in a news release. “Today’s action sends a clear message that the Consumer Bureau will continue to aggressively defend the rights of servicemembers and all consumers.”

In addition to providing consumer redress and paying the civil penalty, the defendants are barred from further violations of the law and subject to monitoring by the CFPB.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.