Court Shuts Down Bitcoin Mining Business For Failing To Deliver Paid-For Computers

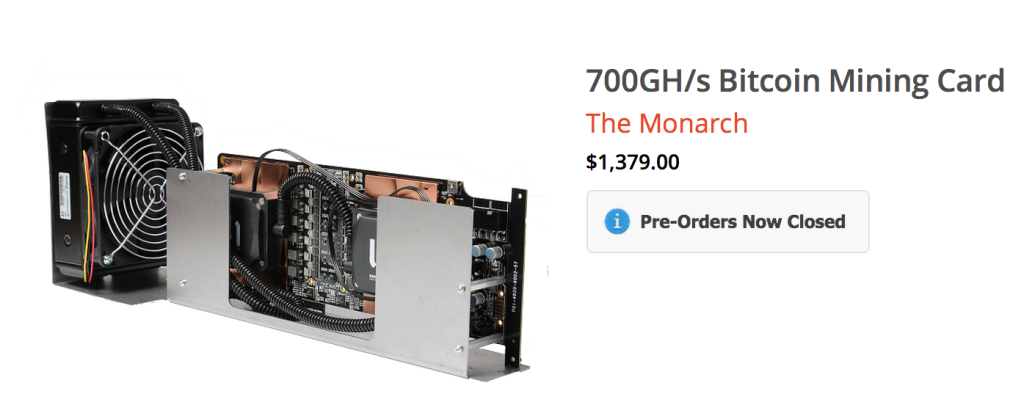

The FTC says that Butterfly Labs took money for Bitcoin mining products like the Monarch, but failed to deliver in a timely fashion, if at all.

You can read more about Bitcoin mining in our Bitcoin 101 article, but it’s the method in which the currency is created. It basically involves computers doing a lot of computing and occasionally spitting out some new Bitcoin.

And given that a single Bitcoin is now worth close to $400 (though that’s down significantly from the recent high of more than $1,000), there’s money to be made in selling machines that can do the computing quickly.

Additionally, because there is a finite limit on the total number of Bitcoin that can ultimately be mined, there are diminishing returns for your efforts. Successfully mining a block resulted in a reward of 50 Bitcoin in 2008, but now only brings in half of that. Additionally, it has gotten significantly more difficult, and takes much longer, to do the mining.

In June 2012, Butterfly Labs began selling BitForce mining machines, ranging in price from $149 to $29,899, telling customers that the devices were “now in final state development” and that delivery was to be expected by Oct. 2012.

But according to a complaint [PDF] filed last week in a U.S. District Court in Missouri by the Federal Trade Commission, not only did Butterfly fail to make that Oct. 2012 delivery date, but also hadn’t delivered a single BitForce machine by April 2013.

And even by Sept. 2013, nearly a year after the originally promised delivery date, some 20,000 BitForce machine buyers — all of whom had paid in full, in advance — were still waiting.

The company claimed in Nov. 2013 that it had shipped all BitForce devices, but the FTC says that customers continued to complain that they had not received their order.

The complaint states there are numerous instances of people who eventually did get their BitForce, but found that it was “either defective, obsolete, or mining far less Bitcoins than it would have had it shipped on the promised shipment dates.”

Also in 2013, Butterfly Labs started selling its newer Monarch machines, ranging in price from $2,499 to $4,680. And just like the BitForce, customers had to pay the full amount in advance. Customers were originally told they would receive their Monarchs by the end of 2013. That then became promises of April 2014 delivery, but the FTC says that as of Aug. 2014 — a full year after taking customers’ money for the devices — Butterfly had yet to ship a single Monarch.

Customers who sought refunds tell the FTC they had trouble reaching the company, and according to the complaint, even if they did get through to Butterfly Labs, there was significant confusion about the actual refund policy.

“At times, Defendants have claimed that they would provide refunds; at other times, they have stated that they have a no-refund policy,” reads the complaint. “Regardless of which purported policy was in place at the time, Defendants have often failed to provide refunds to consumers, even though they have not provided consumers with promised products or services or consumers have not received products or services for many months.”

While one might argue that it’s sometimes difficult to deliver new technology as quickly as promised, the FTC alleges that Butterfly Labs was taking customers’ money and doing lots of things with it other than spending it on manufacturing.

“Records indicate that once consumer funds enter into Defendants’ bank accounts, they are quickly dissipated,” reads a statement from an FTC attorney. “In recent months, despite receiving large sums of money each time consumers place orders, Defendants generally leave no more than approximately $2.5 million in the operating bank account. Instead, funds are depleted shortly after they enter into the bank accounts after consumers place their orders.”

The FTC says there is “substantial evidence” that corporate funds are being used for personal purposes, like shopping at department stores, day care, massages, and home improvement.

“Defendants’ corporate credit cards also reflects numerous non-business expenses, including department stores (including Nordstroms, Bed Bath and Beyond, Restoration Hardware, and Hobby Lobby), auto maintenance, gun stores and hunting stores,” reads the statement.

The FTC alleges that Butterfly Labs violated Section 5(a) of the FTC Act, which prohibits “unfair or deceptive acts or practices in or affecting commerce.”

“We often see that when a new and little-understood opportunity like Bitcoin presents itself, scammers will find ways to capitalize on the public’s excitement and interest,” said Jessica Rich, director of the FTC’s Bureau of Consumer Protection.

UPDATE: Butterfly Labs has released the following statement in response to the FTC announcement —

“Butterfly Labs is disappointed in the heavy-handed actions of the Federal Trade Commission. In a rush to judgment, the FTC has acted as judge, jury and executioner, contrary to our intended system of governmental checks and balances. The FTC’s current actions are negatively impacting our thousands of customers and our dozens of employees. Their current media campaign should only further alarm a knowing citizenry and raise questions as to why the FTC wouldn’t simply let this case play out through the judicial system. That is what Butterfly Labs intends to do.

It appears the FTC has decided to go to war on bitcoin overall, and is starting with Butterfly Labs. Butterfly Labs is being portrayed by the FTC as a bogus and fake company. To the contrary, Butterfly Labs is very real. As pointed out in court filings Butterfly Labs made last night, Butterfly Labs has shipped more than $33 million in products to customers and voluntarily granted refunds approximating $17 million to customers for cancelled orders. Butterfly Labs was literally is in the midst of shipping out completed products to fulfill the remaining millions of dollars of orders on our books and issuing requested refunds, when the FTC effectively closed the doors of Butterfly Labs without any chance to be heard in court.

At this time, Butterfly Labs is cooperating fully with the Temporary Receiver appointed by the Court. A hearing is set for September 29 and Butterfly Labs has asked the Court to allow it to present testimony from key witnesses for the company. Butterfly Labs intends to defend our business and our nascent and promising industry. The government wants to shut Butterfly Labs down, and we are not going away without a fight to vindicate bitcoin, our company, and our employees. Our continued focus is our customers and finding a way to continue to deliver products and processing refunds for those who have requested them.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.